Tag: macro

Hedge funds: what positioning for 2024?

L’industria mineraria europea e la transizione green

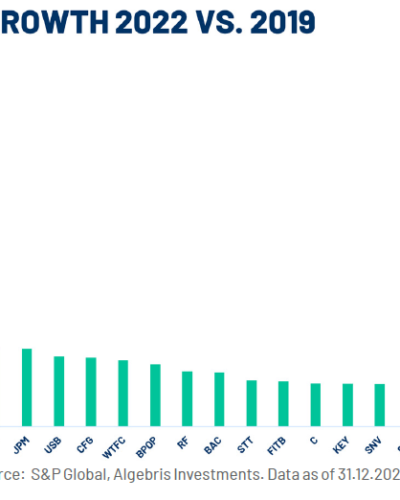

SVB e Credit Suisse: cosa accade nel sistema bancario

L’ascesa del lusso

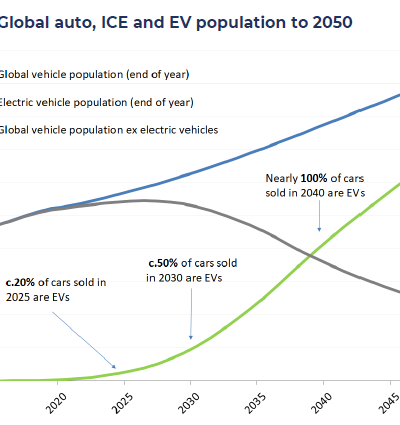

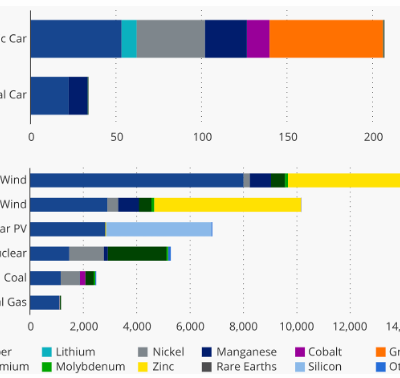

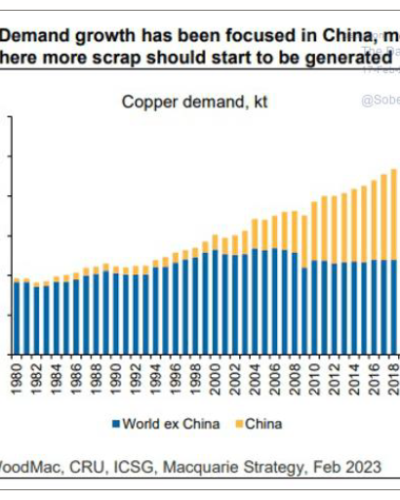

I metalli e la transizione energetica

Il rame, il nuovo futuro?

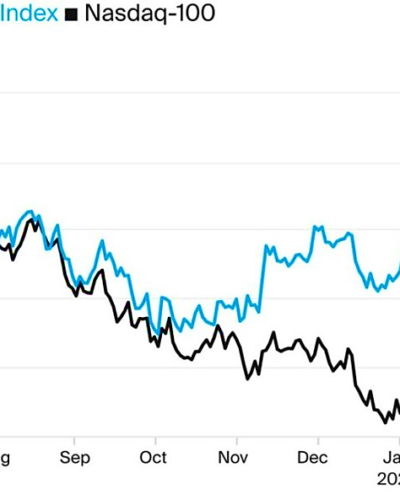

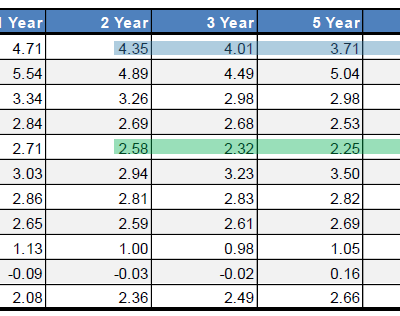

Il mercato obbligazionario: una nuova ascesa nel 2023?

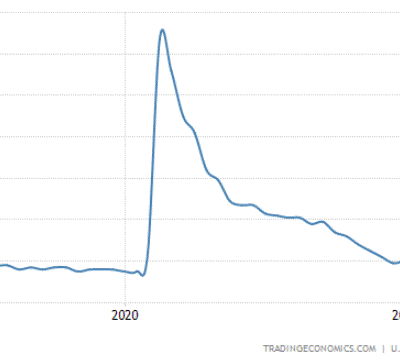

Il ritardo della politica monetaria restrittiva

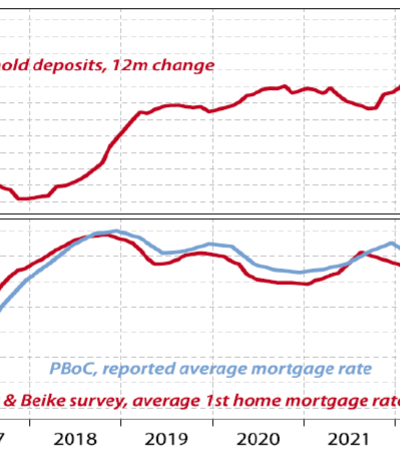

La riapertura cinese e l’inflazione