Chart of the month: From Pod-Shop to Quant-Shop – The new El Dorado?

From Pod-Shop to Quant-Shop – The new El Dorado?

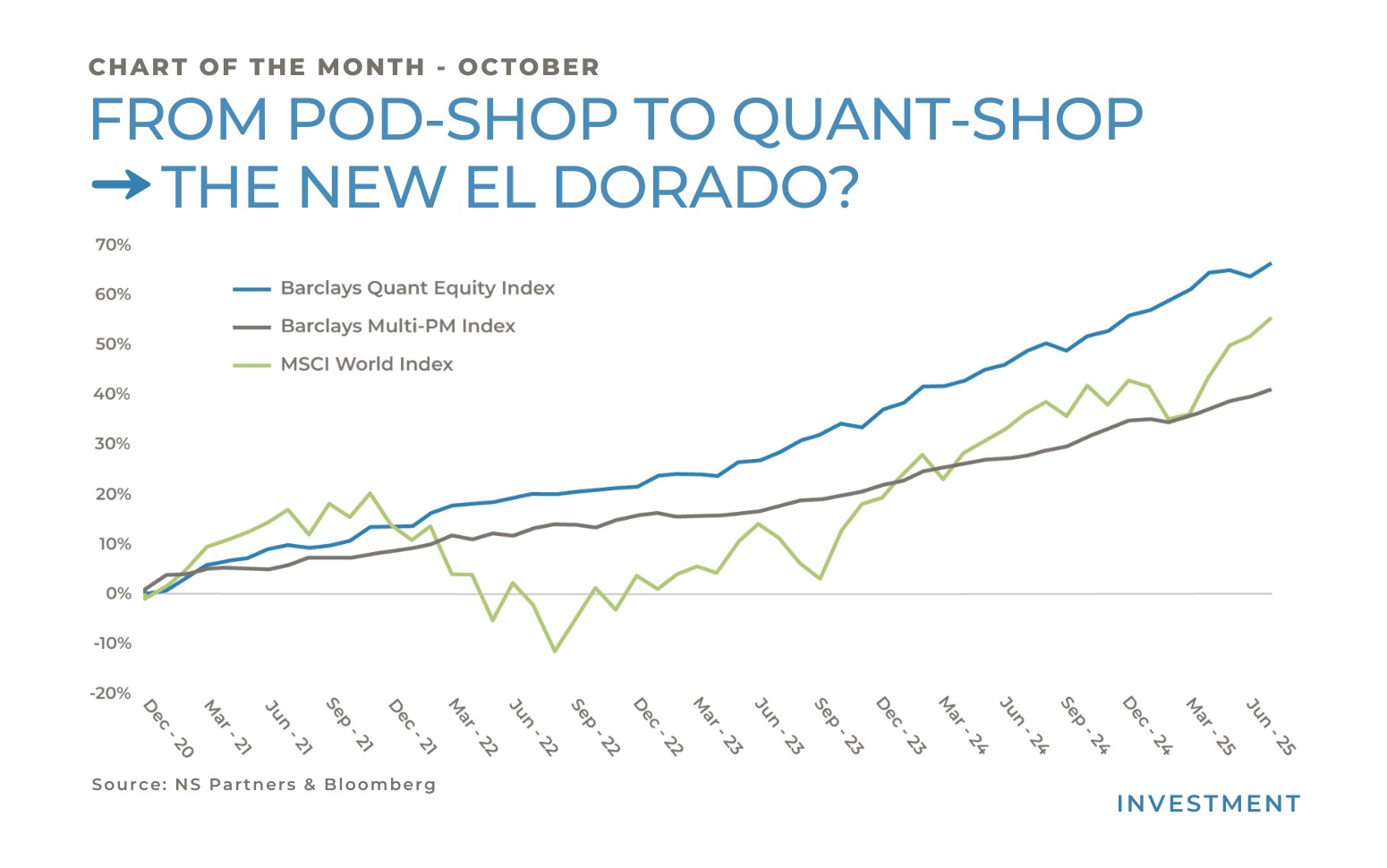

Most of our readers will be familiar with the numerous pieces we have written over the last five years on the pod-shop model which have made both investors and investment managers very happy over the last two decades, with their performance culminating in 2024, one of the best years in recent history besides 2020 (read our piece back in January of this year: Peak Pod Shop – Where to Next?). Fast forward to today and performance in 2025 so far has proved to be challenging for most of them given the current risk-free rate. The Good, the Bad and the Ugly side of the pod-shop model has been increasingly highlighted by the press in recent months and pension funds amongst others are starting to shy away from this model as most still focus on total expense ratios (despite the superior risk adjusted returns of the past). Egregious fees (via the infamous passthrough model), poaching games on star traders (via creative enticement programs), the higher cost of leverage, significant market share of the overall hedge fund industry (and even more so in terms of global market footprint and impact when you include their leverage) and correlation between them are some of the common criticisms. YTD it is fair to say that most pod shops have disappointed investors (particularly in the market neutral US equity long / short space) in a market that has witnessed lots of turmoil during the first quarter and have barely recovered since then. Add to that the reluctance in applying a risk-free rate hurdle to performance fees charged and you will have a backlash on pod-shops that don’t deliver. The subsequent problem with that is where does one redeploy such large amounts of money despite the quarterly investor level gates that are increasingly being raised as assets balloon.

Since the “Quant Winter” between 2018 and 2020, quant funds have been performing with consistency, which has not gone unnoticed. As a result, they have been very successful in significantly raising assets this year, propelling some of the largest quant shops to the top of the Global Billion Dollar Club. They offer lower expense ratios (unlike the high passthrough structures for hiring talented traders), better liquidity (with no investor level gate for the most part), AND the client does not take the netting risk. From fundamental, technical, flow and sentiment driven signals, quant funds come in different garden varieties, and they all work until they don’t, and you never know when or why until after the event. One must not forget August 2007, which was a memorable moment for quant funds where the last one standing in the game of musical chairs was the winner-take-all! We did witness somewhat of a repeat this July, although with less drama (mostly due to short squeezes and factor rotations) but overall, they have demonstrated consistency in outperforming traditional pod shops.

Quantitative strategies take out the emotional factor in investment decisions (more rational and consistent decision making) however there are certain instances where quant shops can get blindsided by unpredictable events. “Liberation Day” was the latest example where many were caught off guard. Quant shops typically do not fare well during macro or geopolitical events. Sentiment is also another important factor to which many have had to adopt. Over the last five years quant shops have been increasing the use of AI and LLMs at an exponential rate and now seeking new ways in achieving machine “superintelligence”. Add to that the increasing availability of a plethora of new data sets and you have models that have become increasingly sophisticated and hard to compete with. The main drawback remains the fact that these models cannot plan for unexpected events or reasons like human beings. Perhaps the combination of quant strategies with a discretionary overlay or vice versa is the optimal solution going forward. DE Shaw, one of the oldest quant shops, just launched its first new multi-strategy fund in 15 years which will be running discretionary strategies instead of the algorithms they are historically known for. This trend is likely to continue.

With the average holding period for US stocks having declined significantly from over 5 years back in the 1970s to less than a few months today, this trend has somewhat been amplified by the pod-shops given the strict drawdown limits imposed on their PMs who typically trade over a quarter trying the anticipate the next earnings miss or beat. Quant shops have an even shorter time horizon ranging from nanoseconds (in the case of co-location) to 20 days or more and have thus further increased this trend. Gone are the traditional hedge funds that buy and hold over a long-time horizon whilst stomaching short term volatility. Perhaps this is one of the reasons why the daily trading volumes on the NYSE have consistently been beating records which have been approaching 5 trillion shares in a single day! Fair to say that today what you see on publicly available data is only the tip of the iceberg as most of the very large (and levered pod/quant shops) have their own internal liquidity provision whereby up to a third of their trades are matched internally therefore avoiding transaction costs and thus don’t appear in the official data. At the end of the day, it is a balance sheet exercise where both pod shop and quant shops manage thousands of underlying positions with a lot of leverage centered around a select number of prime brokers if not one (to offset trades internally when they can).

Whilst it is hard to gauge the total market share of the global hedge fund industry represented by pod shops and quant funds today (from the 25-30% of total AUM in 2024), one thing for sure is that given the leverage involved, the risk of getting run over remains very high given the recent growth in the quant space.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group