Chart of the month: US economic consensus 2025 less good than expected

US economic consensus 2025 less good than expected

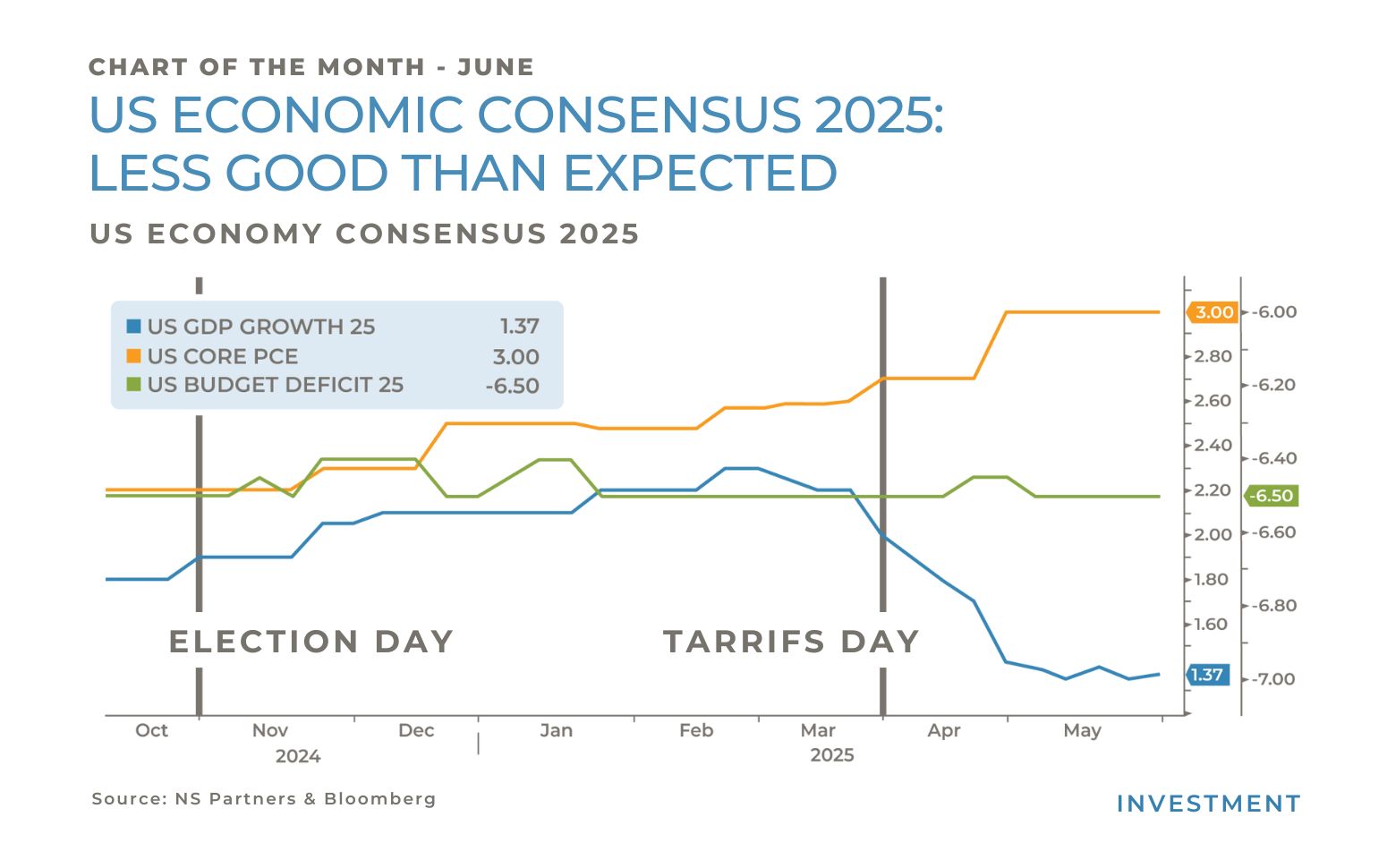

Donald Trump’s November 2024 election victory sparked optimism for a revitalized US economy, with expectations of good GDP growth and a reduction in the hefty budget deficit inherited from the Biden administration. Equity markets soared after Election Day, signaling confidence in Trump’s economic agenda. The initial Bloomberg Consensus for 2025 projected GDP growth at 2.2%, with hopes of fiscal discipline to tackle the long-standing deficit challenge.

Yet, Trump’s tariff obsession, marked by “Tariffs Day” in April 2025, defied David Ricardo’s free trade principles, creating a lose-lose scenario. The updated 2025 consensus reveals a GDP growth drop to 1.4% and a core PCE inflation spike to 3.0%, reflecting expected short-term inflationary pressures. This tariff-driven approach has disrupted global trade, stifled growth, decreased corporate profits and raised consumer costs, undermining the early economic optimism.

The situation deteriorated further with the first draft of Trump’s “Big Beautiful Bill,” which unexpectedly widened the budget deficit disappointing investors who anticipated fiscal restraint. While tariff revenues may partially offset the deficit, the bill has hampered DOGE’s (Department of Government Efficiency) efforts to curb spending. Rising concerns over sustained borrowing have caught the attention of bond vigilantes, pushing US 30-year government bond yields to 5.0%.

The 2025 consensus now paints a less rosy picture: GDP growth at 1.4%, higher inflation (set to ease in 12-18 months), and a persistent -6.5% budget deficit. This has weakened the dollar, driven interest rates higher, left equity markets flat, and fueled uncertainty among consumers and corporations.

However, Trump has shown a willingness to pivot when needed, so we may see tariff reductions and a revised “Big Beautiful Bill” that better aligns with market expectations, potentially easing some of these economic strains.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group