Chart of the Month – There is life outside the SP500

There is life outside the SP500

The S&P 500 has dominated performance charts for the last decade, with its lead becoming even more pronounced in the past three years, outpacing global indices. This stellar performance is driven by several factors: a robust US economy, healthy corporate profits, and the prominence of megacap stocks benefiting from the artificial intelligence boom. Additionally, the Federal Reserve is expected to cut rates this year and potentially lower them by another 1.00% in 2025.

However, this impressive performance comes at a cost. The chart above compares the Earnings Yield 12-month forward (EY12MF) of the S&P 500 with the yield of a US 10-year government bond. Historically, the average gap between these two yields has been around 3.6%, but it currently stands at just 0.3%. This indicates an extreme or very extreme valuation gap, suggesting that the S&P 500 may be overvalued.

Navigating Market Timing and Seeking Alternatives

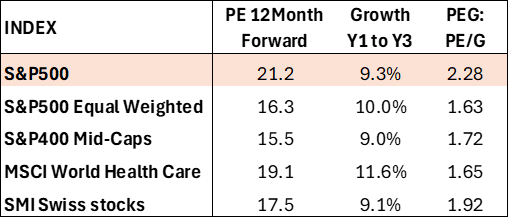

Experienced investors understand that market timing can be challenging and often frustrating. So, what should investors do with this information? Our recommendation is to diversify investments by considering the following alternatives, which offer attractive valuations and growth prospects (See table below).

S&P 500 Equal Weighted Index: Unlike the traditional S&P 500, assigns equal weight to each company, resulting in better performance during periods when smaller companies excel. It offers attractive valuation and similar growth levels, making it a compelling choice.

S&P 400 Midcap Index: This index focuses on medium-sized companies, offering a balance between growth potential and stability. With favorable valuations, it allows investors to acquire stocks at a lower price relative to their earnings growth prospects.

Health Care Sector: This sector stands out for its attractive valuation relative to expected growth and its defensive nature. This sector remains resilient during economic downturns, making it a prudent choice for stability and appreciable returns. It benefits from the ageing population trend.

Swiss Market Index (SMI): This index includes major Swiss stocks known for strong fundamentals and consistent performance. With more attractive valuations than the S&P 500 and a defensive stance, it offers a solid choice for geographic diversification.

CONCLUSION: There is a good a life also outside the S&P500

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group