Chart of the month: From safe haven to power play: the Swiss market unleashed

From safe haven to power play: the Swiss market unleashed

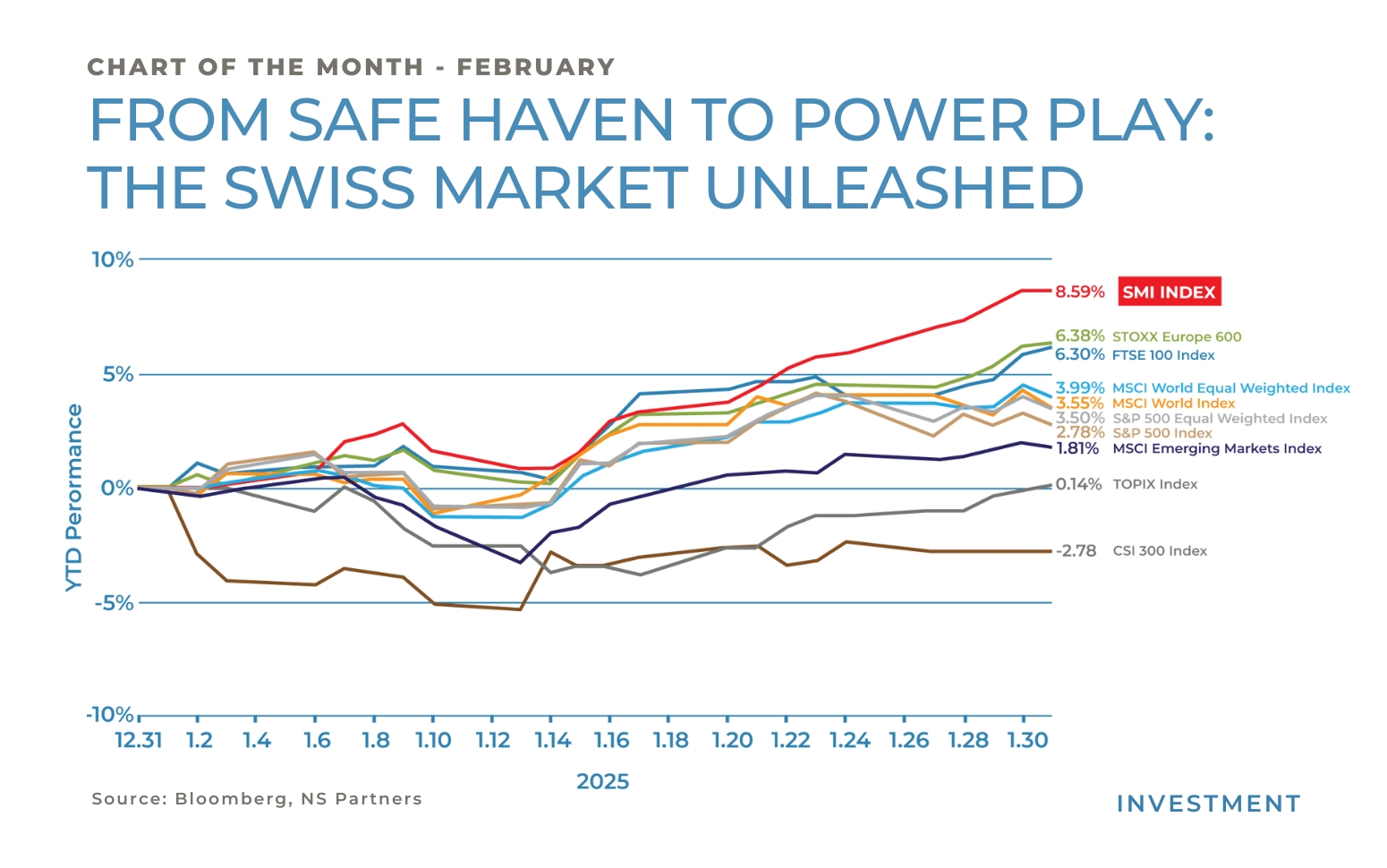

Source: Bloomberg, NS Partners

Switzerland is globally renowned for its breathtaking landscapes, world-class ski resorts, and prestigious watchmaking industry. However, beyond its scenic beauty, Switzerland boasts world-leading companies in niche industries and stands as a safe haven with untapped potential. It offers a compelling opportunity for investors seeking stability and long-term growth, supported by resilient market fundamentals and a strong economic framework.

In recent years, investors have heavily concentrated their portfolios in the U.S. technology sector, particularly in the “Magnificent 7.” However, the recent AI-driven “red wave” has highlighted the risks of overconcentration. The market’s reaction to DeepSeek’s debut served as a stark reminder of how quickly sentiment can shift, underscoring the importance of diversification. In this context, Swiss equities present a compelling opportunity. Known for their strong balance sheets and earnings growth, Swiss companies provide exposure to high-value niche industries. The Swiss market, by nature, has shown a defensive character over time, with key sectors including consumer staples, insurance, utilities, and pharmaceuticals accounting for more than half of its market composition. Post-DeepSeek turbulence, the Swiss market’s defensive qualities shine even brighter.

Since the beginning of the year, Swiss indices have outperformed global peers, with the Swiss Market Index posting impressive gains of 8.59% in January. Demonstrating resilience on January 27th. Adding defensive position remains a time-tested strategy, amid persistent volatility and uncertainty in global markets. Swiss blue chips such as Nestlé, Roche, and Novartis continue to serve as cornerstone holdings for stability-focused portfolios. However, the true opportunity may lie beyond these household names. While large-cap Swiss stocks attract the most attention, mid-cap companies represent a largely untapped growth avenue. Mid-caps, often in their expansion phases, offer significant growth potential backed by strong fundamentals. That said, careful valuation assessments are essential to mitigate risks related to liquidity constraints and premium pricing.

Recent market movements have not disrupted the positive trajectory of several Swiss stocks, with double-digit gains in key names such as Cie Financiere Richemont, Logitech, UBS, Roche, and Partners Group. But also, gems like Galderma, Sandoz Straumann, Swissquote, Comet, Sulzer and Belimo.

Switzerland’s monetary policy remains supportive of economic growth. The Swiss National Bank is likely to maintain a dovish stance, with the potential for lower or even negative interest rates. Such a policy environment provides an additional tailwind for Swiss equities, particularly for export-oriented firms.

For investors seeking a blend of diversification, stability, innovation, and growth, Swiss equities offer a compelling solution. In today’s unpredictable market environment, having a solid Swiss allocation may not just be a luxury—it might be a necessity.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group