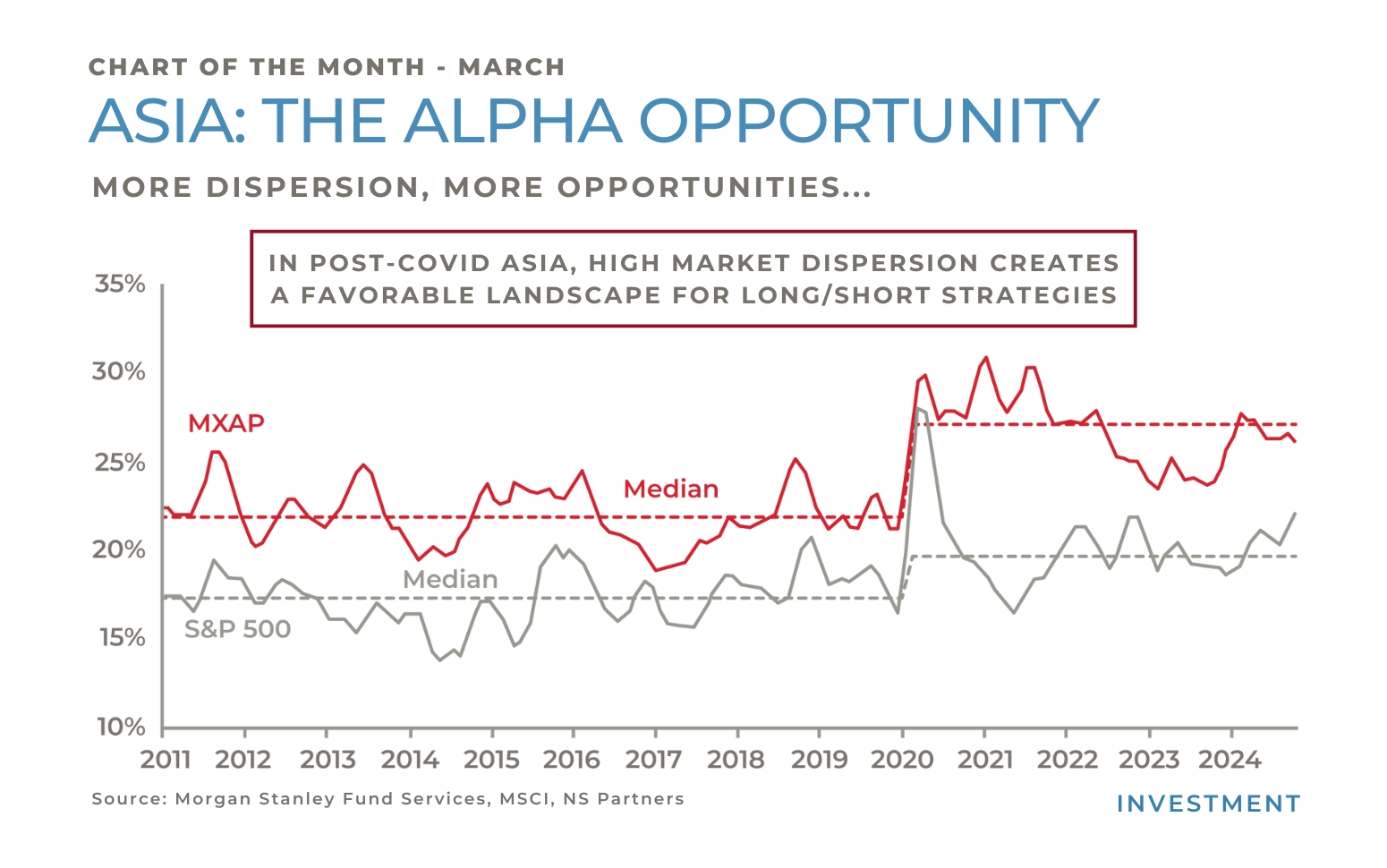

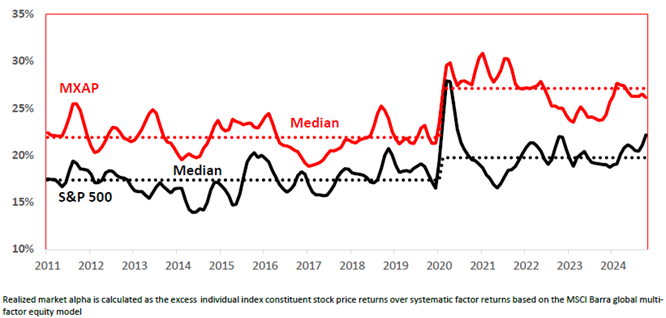

Chart of the month: Asia, the alpha opportunity

Asia: the alpha opportunity

Since the onset of COVID-19, dispersion in the US and Asia has significantly increased, with Asia continuing to show higher levels. This accounts for the superior performance of Long/Short strategies in recent years, especially in Asia, where there are more opportunities to go long on high performers and short underperformers, allowing these strategies materialize in stock returns.

Over the past decade, Asia’s expanding market size, liquidity, and sector depth have led to a greater diversity in returns, providing an often-overlooked source of alpha opportunities. Many stocks remain under-researched or misunderstood due to local barriers such as language, culture, and regulations. Historically, Asia was seen as a growth market, with cyclical foreign investor flows mainly chasing market beta. However, Asian markets are now evolving into a diverse investment landscape, where fundamental stock selection is becoming increasingly rewarding.

The return composition of Asian equities is becoming more alpha-driven, with stock selection playing an increasing critical role. This is essential in an environment where performance bifurcation within industries has become more pronounced. Following a period of systematic beta decline, markets are now finding strong support levels. Concurrently, improved policy clarity and stability in the economy are boosting confidence in stock selection, allowing investors to focus more on fundamentals rather than tail-end events.

Our strategy: the equity Long/Short multi-manager approach offers the right diversification for investors looking to reallocate capital to the region. Managers have been performing well this year. Since we began investing in the region, we’ve had the opportunity to allocate capital to managers who have successfully protected capital during downturns while generating strong returns in rising markets, benefiting from good asymmetric returns.

The regional market structure is shifting from beta-driven to alpha-driven opportunities. To capitalize on this, we must quickly adapt to the new investment environment with an agile approach. Managers using a Variable Net hedge fund approach provide the necessary flexibility. Overall, we favor active investments over passive ones. Passive investments, such as ETFs, fail to capture the new economic trends, while active long-only funds are less dynamic in adjusting exposure to the right sectors to seize market opportunities.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group