Chart of the month: Gold, Gold, Gold. Switzerland the quiet giant.

Gold, Gold, Gold. Switzerland the quiet giant.

Source: World Gold Council, Swiss Federal Statistical Office, Bloomberg, NS Partners. Image generated by artificial intelligence based on author-provided content.

The gold rush is back. Gold has climbed to new record highs, emerging as the top-performing asset class year-to-date, with gains above +50% in USD. From private investors to central banks, demand has surged across the board.

Gold remains an ultimate hedge against inflation, currency debasement and uncertainty, a safe harbor when markets tremble. Amid the global search for safety, Switzerland stands out as a quiet pillar of strength.

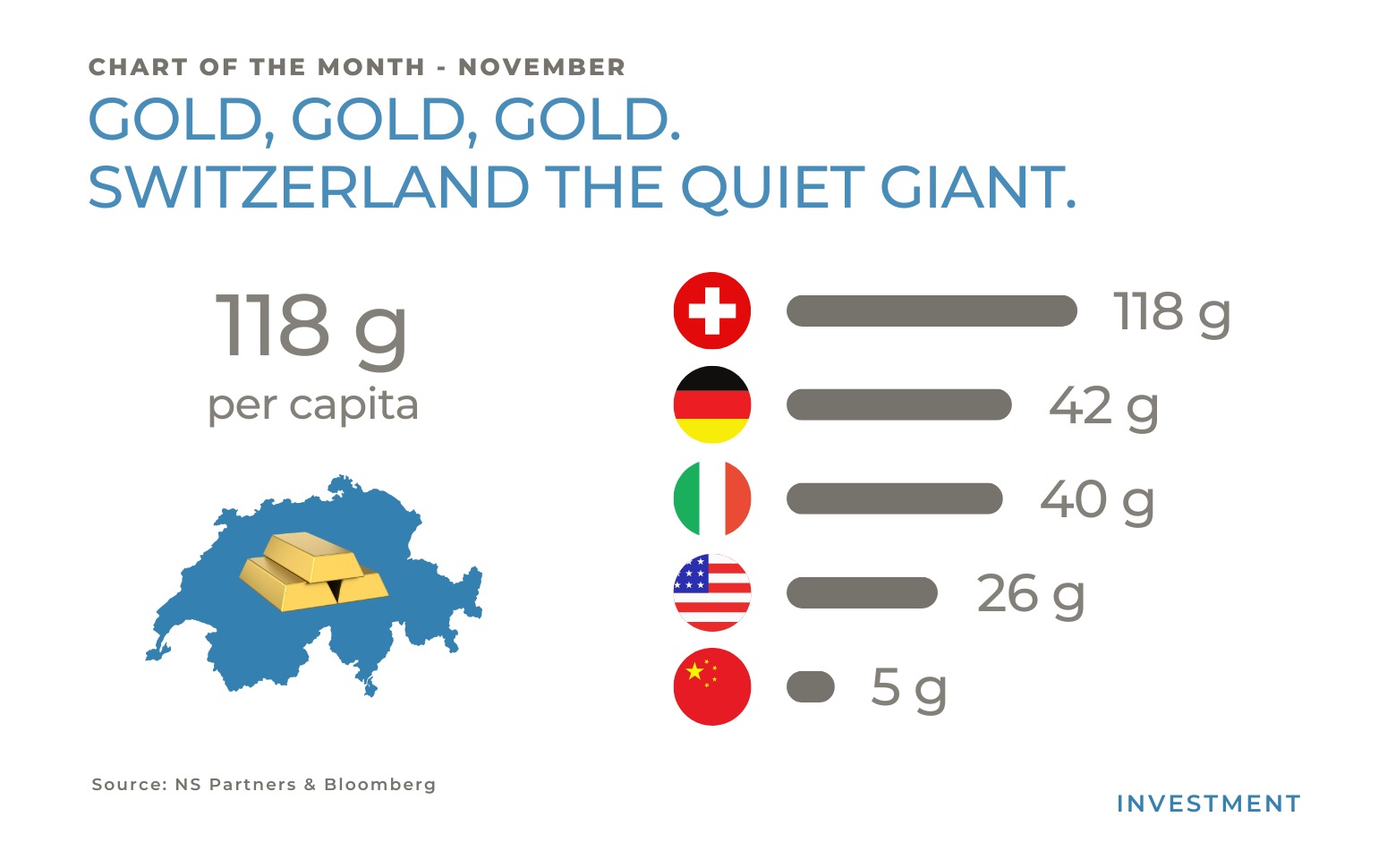

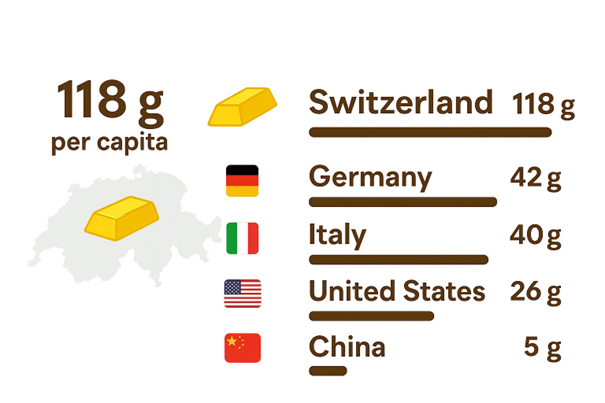

Did you know that Switzerland holds more gold per capita than any other country in the world?

The Swiss National Bank currently holds around 1,040 tonnes of gold, equivalent to roughly 100 billion Swiss francs in value, placing Switzerland seventh worldwide in total holdings. On a per capita basis, this corresponds to about 118 grams of gold per Swiss resident, which is the highest ratio in the world. Although the Swiss franc has not been backed by gold since 1999, the Swiss National Bank continues to maintain substantial reserves. This reflects Switzerland’s enduring tradition of financial prudence, stability and independence.

This impressive reserve position has a measurable impact. In 2024, the rise in gold prices generated an unrealized gain of CHF 21.2 billion, contributing significantly to the Swiss National Bank’s record profit of around CHF 80 billion. In early 2025, gold prices surged further, adding CHF 12.8 billion in valuation gains in the first quarter, partially offsetting foreign currency headwinds. By mid-2025, after a moderate correction in gold prices, unrealized gains stood at CHF 8.6 billion, confirming gold’s role as a key stabilizing factor in the Swiss National Bank’s balance sheet.

Switzerland’s strength extends well beyond its reserves. The same principles that underpin its monetary discipline are visible across the real economy. A focus on high value-added sectors such as pharmaceuticals, chemicals, machinery and precision engineering has built a foundation of sustainable growth and innovation, rather than reliance on low-margin industries such as automotive.

Resilience is not only an economic story; it is also a market story. Switzerland is a strong economy, with a resilient industry and a robust financial market. Over the past decade, Swiss small and mid-caps have shown consistent outperformance. While this momentum has moderated over the past five years, performance has reaccelerated over the most recent twelve months. Still, it is precisely within Swiss small and mid-caps that the most attractive opportunities reside, featuring hidden champions and niche innovators offering long-term value potential.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group