Tag: hedge funds

Les stratégies hedge funds gagnantes pour 2023

Winning hedge fund strategies for 2023

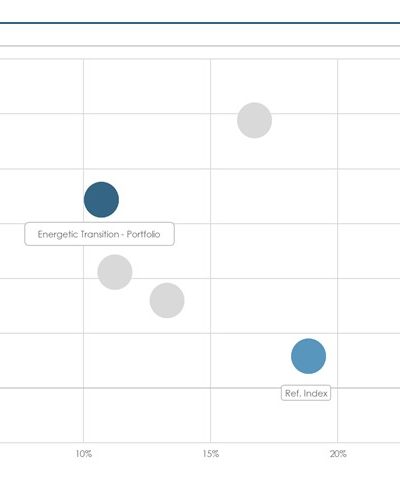

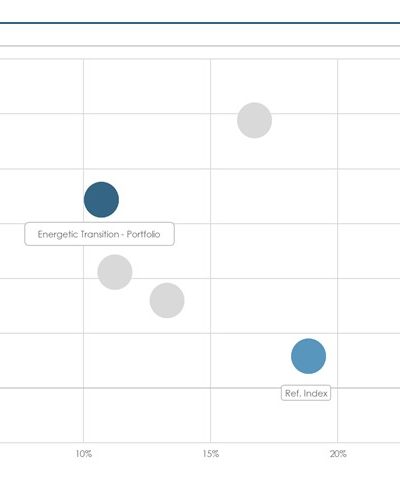

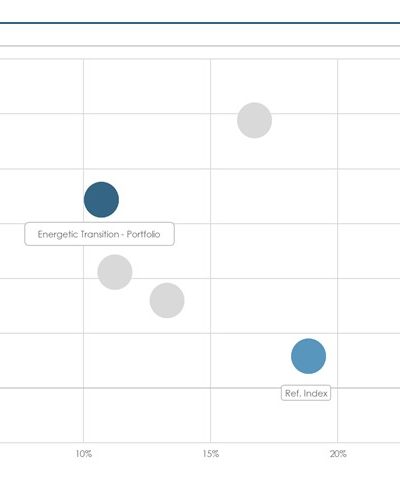

Graphique du mois – La transition énergétique du point de vue des hedge funds

Gráfico del mes – La transición energética desde el punto de vista de los hedge funds

Chart of the Month – Energy transition from the hedge funds point of view

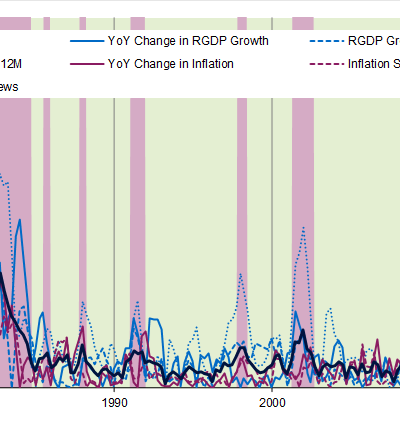

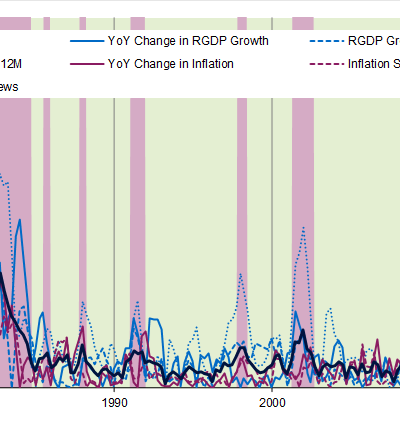

Gráfico del mes – Los gestores hedge funds global macro estan de vuelta

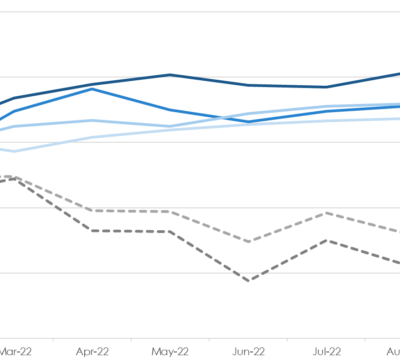

Chart of the Month – Global macro hedge fund managers are back in the game

Les gérants alternatifs savent profiter des crises

Hedge fund managers know how to profit from crises