Tag: graphique du mois

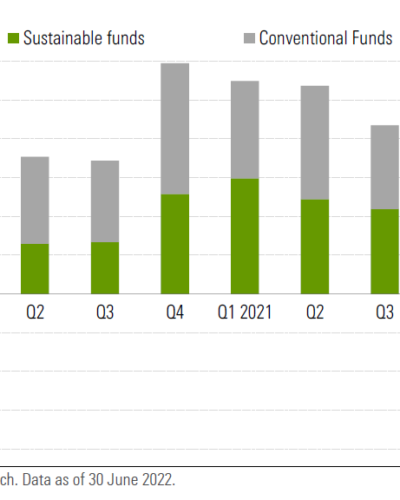

Graphique du mois – Attention au greenwashing

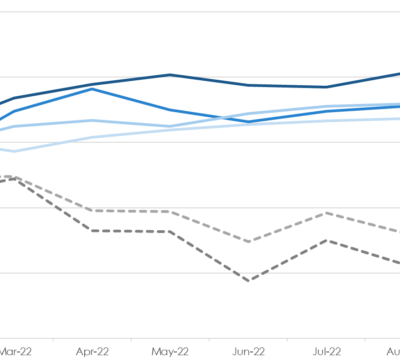

Graphique du mois – Intelligence Artificielle et fonds alternatifs

Graphique du mois – Face aux turbulences, attachez votre ceinture!

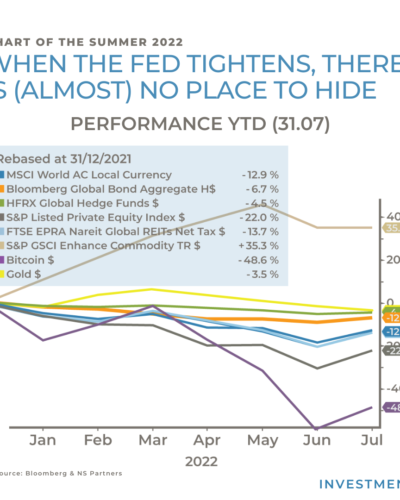

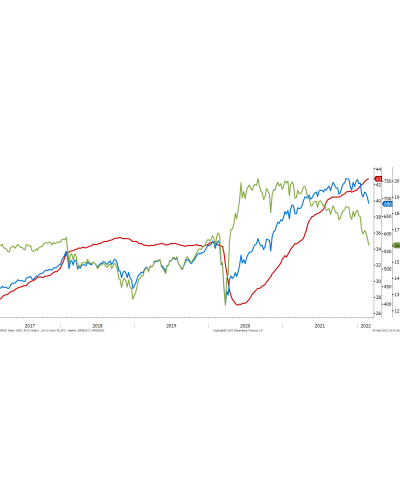

Graphique de l’été – Quand la FED durcit le ton, aucun refuge ne subsiste (ou presque)

Graphique du mois – Nulle part où fuir, Nulle part où se cacher

Graphique du mois – Accroître l’allocation aux secteurs défensifs lors des périodes de ralentissement économique

Graphique du Mois – Comment devenir l’ami de Monsieur Marché?

Graphique du mois – Les marchés actions changent de braquet

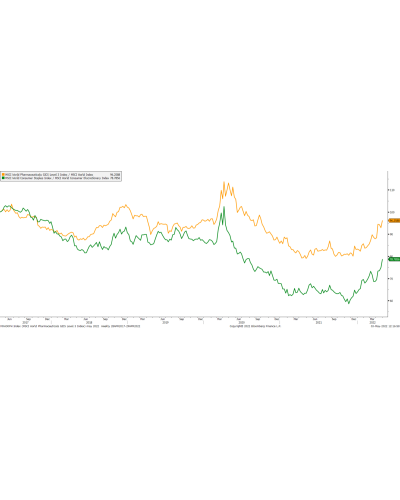

Graphique du mois – Spacaphobie