Chart of the month: inflation and yield curve April 2025

Inflation and the yield curve

Is the inflation transitory this time?

At the press conference after the last FED meeting on Wednesday 19th of March, FED chairman Jerome Powell, used the infamous T word to describe the impact that tariff would have on inflation in the short term. While he could well be right, the use of the term “transitory” for describing inflation was very bold as it revives fresh memories of what is probably the worst monetary policy mistake of this decade.

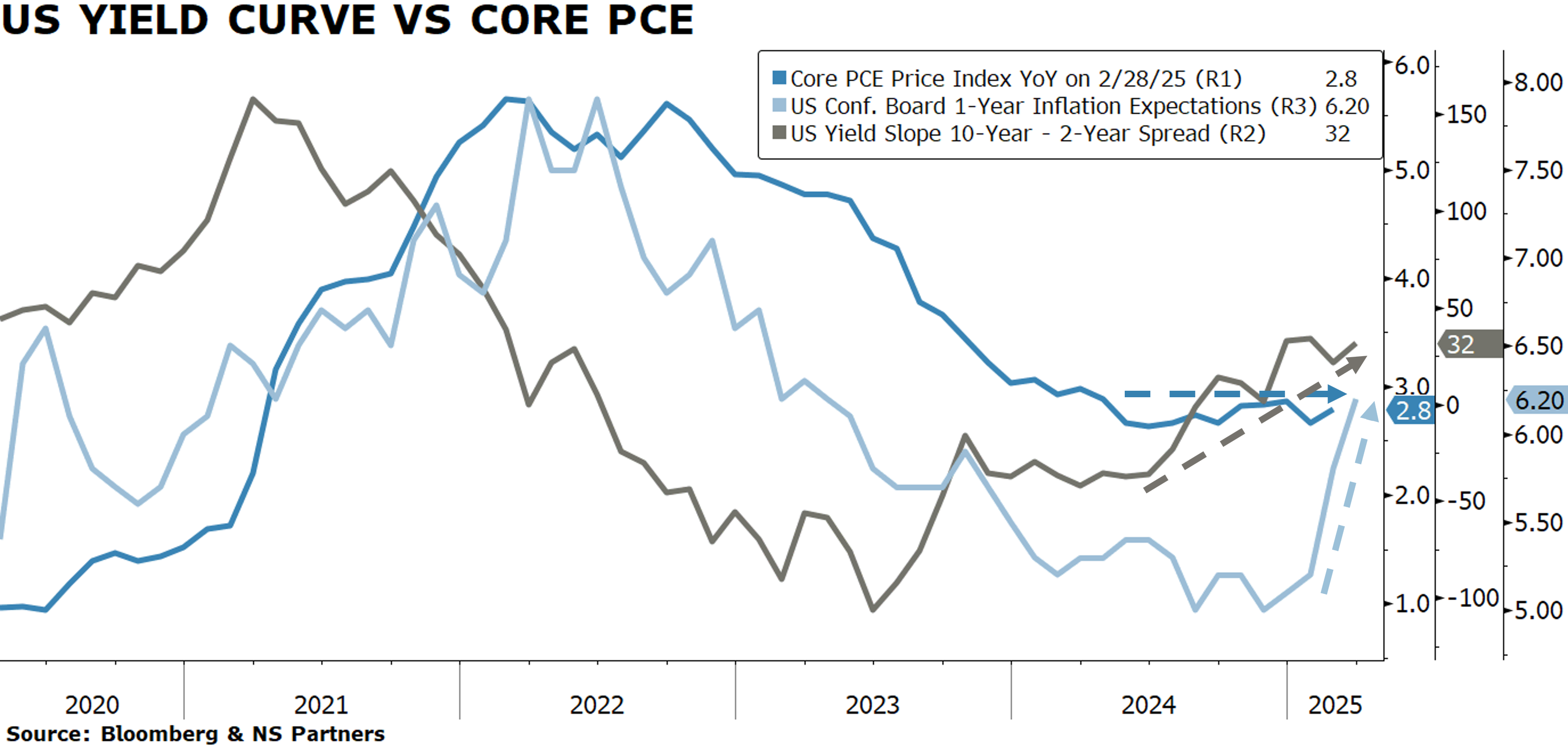

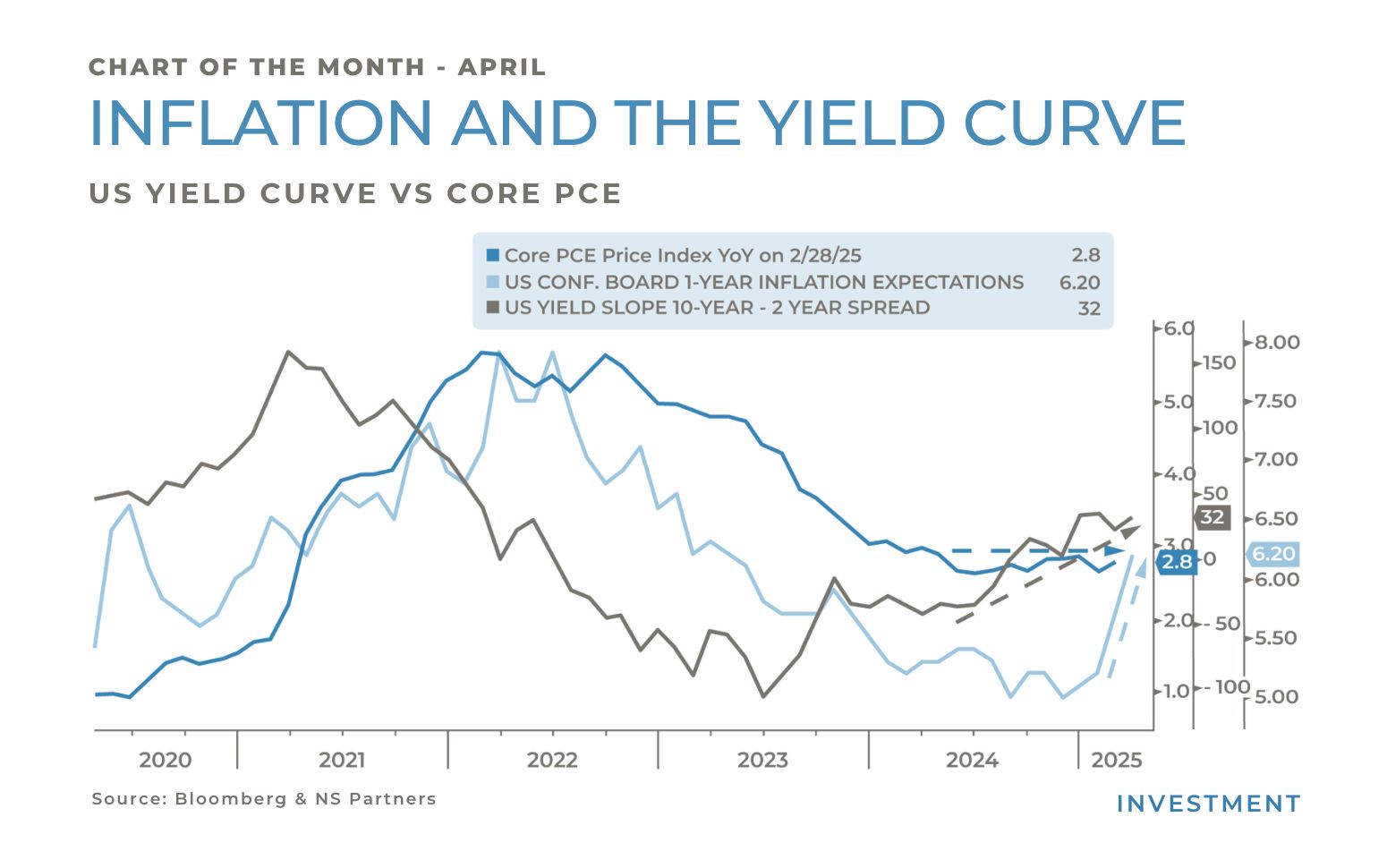

The FED preferred measure for inflation, the core PCE price index (the dark blue line in the chart) was at 2.8% in February on a year over year basis. This level is not alarming in itself. What is more concerning however is that the inflation has not made further progress since May last year (as reflected by the dark blue arrow on the chart) while still being above the 2% FED target.

As the US growth is showing some signs of weakness and the FED made it clear that they view the recent elevated inflation numbers as only a short-term impact from tariffs, the bond market is pricing 3 FED cuts for the year, which would take the FED fund rate at 3.75% in December.

What does it mean for future inflation and the yield curve? Since the start of the year, the inflation expectations one year from now (the light blue line in the chart) has rebounded from 5% to 6.2% as consumers are getting worried of price hikes. Since inflations expectations tend to be self-fulfilling prophecies, this could trigger an upshot in the core PCE price index.

The yield curve can be approximated by the difference between the 10-year nominal yield and the 2-year nominal yield (the dark grey line in the chart). This measure has gone from -36 bps to +32 bps since last May when disinflation progresses stalled (as shown by the dark grey arrow). And as one of the major drivers for its slope is the inflation uncertainty, we could be witnessing the start of a bear steepening, where the 10-year nominal yield rises faster than the 2-year yield.

This is very important because we have seen previously that a steepening yield curve tend to lead to credit spreads widening (which started this year) and ultimately recessions. While we are not calling for a recession in the US just yet, it is becoming a greater risk amid political uncertainty.

Therefore, stay careful with your credit exposure and watch out for the curve steepening!

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group