Exploring luxury through a new lens of growth: sustainability

Luxury is Flourishing

Recent financial reports from companies like Hermès, LVMH, Compagnie Financière Richemont, and Ferrari have impressed investors, showcasing their dedication and ongoing pursuit of profitability. According to Bain & Company, the global luxury market reached EUR 1.5 trillion in 2023, marking a robust growth of +8%-+10% compared to 2022 and setting a new industry record. Forecasts indicate continued growth, potentially reaching EUR 2.5 trillion by 2030. Investing in these assets has generated a return on investment in euros over the past five years of +424% for Hermès, +285% for Ferrari, +244% for LVMH, and +101% for Compagnie Financière Richemont, compared to a market increase of “only” +77% over the same period (MSCI World index). The strengths of these players, such as high entry barriers, effective margin management, strong balance sheets, pricing power, adaptability, and the rise of the emerging middle class, are unequivocally evident.

A Polluting Industry

After examining the financial potential of these investments, it’s crucial to also consider sustainability. How can the luxury sector position itself in this revolution? Can we truly envision a luxury sector that is more sustainable? Luxury, almost by definition, stands apart from highly polluting industries such as energy, mining, or heavy industry. However, some aspects of the luxury industry have poor environmental records. Focusing on personal luxury goods globally, which represent 24% of global spending on luxury items, it’s evident that the accessories and apparel industry performs poorly in this regard. For instance, over 8% of human-induced greenhouse gas emissions stem from the production and transportation of clothing and shoes (Quantis). However, it’s important not to equate luxury with fast fashion. Luxury purchases are inherently more considered in terms of sustainability, with each piece often holding sentimental value and encouraging intergenerational transmission, thereby reducing environmental impact.

Sustainability Embedded in the Consumer’s Consciousness

Today, sustainability plays a pivotal role in consumer purchasing decisions, especially among younger generations. Bain & Company predicts that by 2030, Generations Y and Z will represent between 75% and 85% of luxury market purchases. Generation Z undeniably places a high value on human connection, demonstrating a strong desire for meaningful interactions during their purchases. They also show a clear preference for products that are produced ethically and with consideration for the environment.

What Solutions Exist?

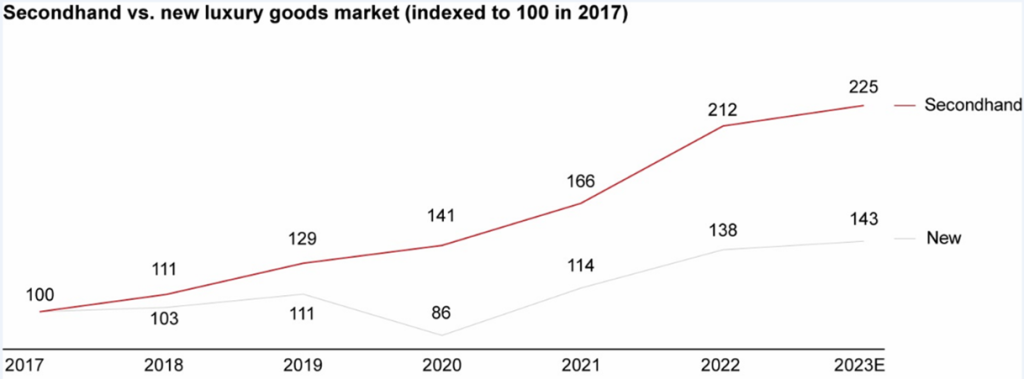

Aside from its participation in COP28, the luxury industry is increasingly demonstrating a commitment to social and environmental sustainability. Some major brands have already taken significant steps, such as discontinuing the use of fur and providing transparency regarding the origin of exotic skins. They are also exploring alternatives to traditional leather, such as vegan leather, mushroom leather, or cactus leather. These initiatives, integrated into a circular economy, include fabric resale platforms. Additionally, the second-hand market, favoured by younger generations, is expected to experience an annual growth rate of +7.2% between 2024 and 2032 (IMARC Group). Over the last three years, the market has experienced accelerated expansion, with Europe maintaining its position as the largest market and hard luxury accounting for over 80% of the total market share. This approach offers consumers the opportunity to acquire authentic luxury products at affordable prices while extending the lifecycle of these products within a circular economy.

The primary challenge lies in production and distribution chains. In this regard, initiatives such as the Aura Blockchain Consortium, launched nearly three years ago, aim to enhance traceability and transparency in these chains. Similarly, in the cosmetics industry, initiatives like TRASCE (Traceability Alliance for Sustainable Cosmetics) monitor the entire production process, from beauty product formulas to packaging, to support sectors in their ecological transition. Today, brands struggle to progress if they do not reduce their carbon footprint, both in packaging and production chains.

Engagement, transparency, traceability, and innovation in seeking alternatives are now crucial. By adopting these practices, the luxury industry can not only maintain its status but also shape a sustainable future. This enhances brand reputation, long-term resilience, and competitive advantage. Luxury is and will remain an attractive investment.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group