Rotations

I personally love skiing.

Like all ski addicts, I know what rotation means:

- Feet and knees trigger a change in orientation.

- Edge grip

- The upper body stays in front of the slope and does not rotate.

- The turn is controlled and mastered.

- Conclusion: rotation is necessary, good and helps

Like all equity portfolio managers, I know what rotation means:

- Growth outperforms Value, or Value outperforms Growth, in this secular opposition between styles.

- This happens whatever the direction of the market.

- A portfolio can suffer or profit from rotations.

- It is awfully difficult to time the market, and, on top of that, to time rotations.

- Conclusion: rotation is potentially dangerous

It’s easy to see that in skiing you are the source of the rotation, whereas in equity investing you are subject to it.

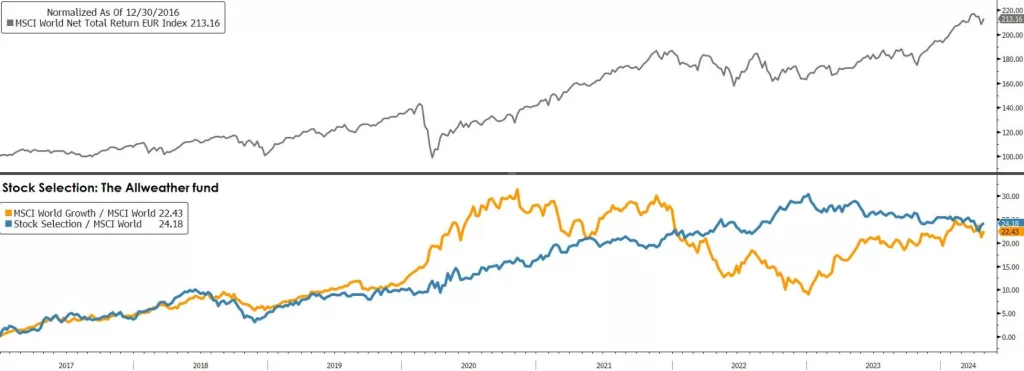

The Chart of the Month is divided in two parts:

- The upper part shows the performance of the MSCI World Net Total Return in euros since 2017. It has more than doubled.

- The orange line in the lower part displays the relative performance of the MSCI World Growth versus the rest of the market. It has bettered the MSCI World by more than 20%, but how volatile this has been! And the blue line represents the relative performance of our equity flagship DGC Stock Selection, which has done better than both the MSCI World and the MSCI World Growth over the period.

Investors have a natural tendency to try to time the market; this is very frequently a failure. Looking at all the rotations highlighted in the Chart of the Month, they also have to cope with styles, adding another risk of failure.

We believe at NS Partners that we offer a comprehensive and reasonable equity exposure with a blended global equity fund with no style bias, as shown by the blue line in the chart of the month. As you can see, our DGC Stock Selection fund has been able to deliver an appreciable outperformance, without having been biased towards Growth or Value, but by applying a disciplined approach in terms of valuations and quality.

History tells us that long periods of outperformance from one style versus another tend to correct, but the timing is uncertain. We expect many more rotations in the future.

Like an advanced skier who will always keep his shoulders in front of the slope to make sure he controls his trajectory while rotating his feet and knees, our fund will continue to focus on quality and valuations, whatever the sector, in order to smooth out style rotations and, hopefully, deliver superior performance for investors going forward.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group