An interesting way to play China.

Since the emergence of the COVID-19 we are talking less about yellow fever. But during July, Chinese markets were at the epicenter of the attention of investors. Because of the Chinese government’s regulation crackdown, the MSCI China Index lost -14.3%. Some sectors were materially negatively impacted whereas others were almost immune, depending on the regulatory overhang: on a pick to through stock performance basis, new energy lost 1%, semiconductors 2%, healthcare 24%, consumer 27% and internet 52%. When looking at the 12-month trailing returns, the underperformance of China Internet versus the Nasdaq has reached unprecedented levels, closed to -65%.

The main objective of the Chinese Government is to have a stable society and this goes with wealth creation being relatively well distributed amongst people. This is why they target industries that are adding significant burden to ordinary people’s life, such as privatized education, property or online gaming. However, wealth creation is being driven by innovation lead by the private sector and the authorities will continue to support technology development such as artificial intelligence, semiconductors, automation and new energy.

Such a market move is not without consequences on investor sentiment. It will take time for some investors to regain confidence to invest in certain sectors but the Chinese economy remains vibrant with growth in many different sectors.

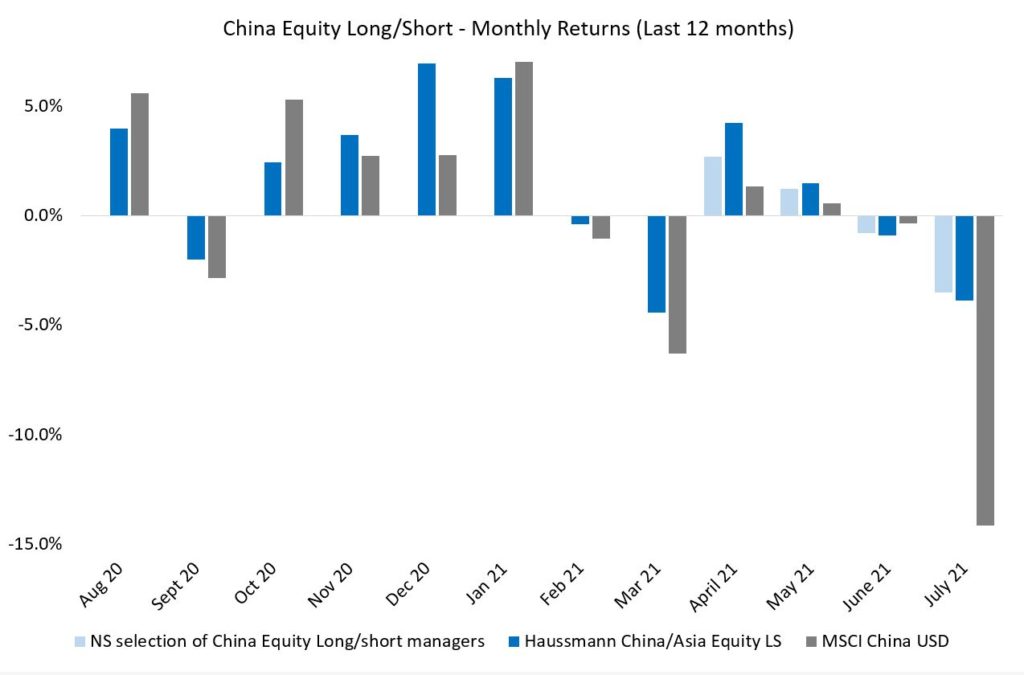

According to us, an interesting way to benefit from investment opportunities in Chinese equity markets is through experienced equity long/short managers able to understand and adapt to the dynamics of the markets, and with the ability to seize investment opportunities both on the long and short side which arise in the current environment. July was a real stress test and our selection of managers managed to limit the downside to one third of the market drawdown. Over the last 12 months, our selection of managers have captured 123% of the market upside and 42% of the market downside. More importantly our strategy delivered a cumulative return of 25.0% when the market lost 1.1% over the period, with a volatility of only 13.8% vs 20.4% for the Index.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Notz, Stucki provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document.

This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the Notz Stucki Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer.

Additional information is available on request.

© Notz Stucki Group