US economy: landing at last?

At the beginning of the year, there were fears of a sharp slowdown, but the US economy has proved surprisingly resilient.

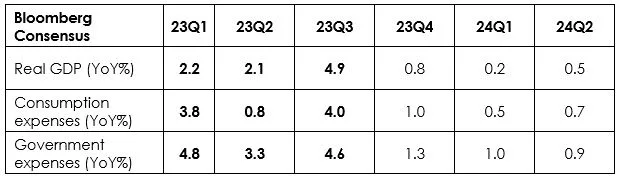

At the beginning of the year, US GDP growth for 2023 was forecast at 0.3% according to the Bloomberg consensus. The question was not whether the US economy would slow down, but rather whether its landing would be soft or hard. Interest rates had risen sharply and the yield curve had inverted. But the US economy proved these pessimistic forecasts wrong, surprising everyone with its robustness (see table below). Today, the consensus forecast is for GDP growth of 2.2% in 2023.

How could the market have been so wrong? Firstly, because consumption has remained very strong, thanks to additional post-Covid household savings and an unemployment rate that has remained very low. In addition, the US government stimulated the economy thanks to the various programs approved by the Biden administration in 2022, such as “The Chip Act” and “The Inflation Reduction Act”. These two major forces offset the negative impact of rising interest rates. Indeed, the FED cited the strength of the US economy as one of the reasons for persistently high interest rates.

And what happens now?

But that’s in the past. Let’s look to the future. On the consumption side, households have used up all the extra savings accumulated during the Covid. What’s more, students began repaying their loans in October, which could further reduce their purchasing power. Lastly, rising interest rates are likely to have an impact on purchases of durable goods. As for the Government, the situation has also changed. The House of Representatives is now controlled by the Republicans, who are seeking to force the Biden administration to cut spending. We may also see government shutdowns if Congress and the White House fail to pass the legislation needed to raise the debt ceiling. According to Goldman Sachs, each week of government shutdown could reduce GDP growth by 0.2%. Finally, the “bond vigilantes” continue to put pressure on the government to spend less.

In view of these factors, our outlook for US GDP growth over the next three quarters could be similar, if not a little more pessimistic. In fact, we expect a significant slowdown over the next few quarters. But this time, we think the US economy is ready for a landing, probably a soft one.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of the date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instruments referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the Finma cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group