Breaking down your broad universe of food groups into their more basic elements and nutrients is now part of our daily habits. Checking labels for sugar, fat, carbs and protein content isn’t just the remit of Californian health freaks but something that is part of every shopper’s habit nowadays. Although worlds apart from a chef preparing a meal in a restaurant, most asset managers will look at factors in exactly the same way we look at key ingredients: factors are to assets what nutrients are to food – both cream and pork bellies contain protein and fat, just as economic risk is present in public equities, private equity, high yield and hedge funds. Understanding portfolio drivers or risk and return through factor analysis isn’t much different from understanding how food groups react with each other under hot and cold conditions to produce the perfect meal. Following the path of the food industry, the disaggregation of investment returns which began with the CAPM in the 60s and advanced by the Fama-French three factor analysis in the 90’s has now moved from theory to the real world.

Many active managers have therefore used factor based models quite extensively with the building blocks of their factor analysis revolving mainly (for equity managers anyway) around value, small caps, low volatility, high yield, quality and momentum. A few years back when I worked for a large Swiss group, risk management would sit down with PMs and look at their portfolio based on the factors above as well as sensitivity to rates, oil and other more macro elements. If the PM claimed his or her main source of return was based on fundamental work and stock picking, the factor chart would have to reflect that, essentially showing very little exposure to any given one. If the factor study showed strong correlation to one or two factors, then performance (and risk) was driven by something outside their remit and we were confronted with a binary choice: either accept we’re paying fees for something that was a static bet (more often than not coming from the PMs style) or simply redeem. There was very little else we could do.

‘Today there’s a wide range of factors through smart beta ETFs that are available to investors which give a new range of options’ states Angel Sanz, Notz Stucki’s Chief Economist who analyses manager talent (or lack thereof) on a daily basis for the firm. ‘When a team comes by our office to see us, first thing I’ll do is look at regressing their performance on my Bloomberg terminal against several factors and try to understand what types of exposure they’re offering on a factorial basis. If they’re unaware of how their return stream looks through a factor model or can’t address the differences between their portfolio’s characteristics and those of the closest factor index, it will make for a very short meeting. In the past, I may still have invested’ opines Sanz ‘if I felt this type of factor exposure made sense (i.e. I was underexposed to this factor) even though I felt fees were egregious for something that didn’t require much talent. Today though, why would we want to pay fees to an active manager when ETFs are readily available that can give me the same kind of exposure?’

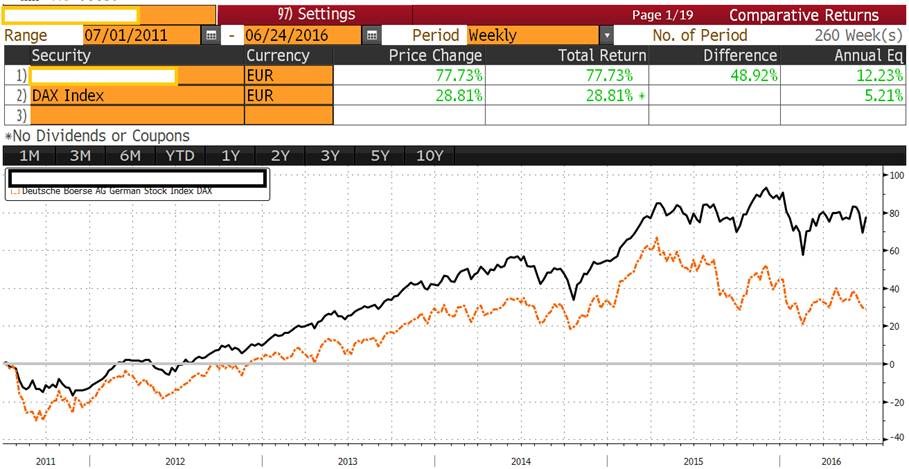

Graph 1 above looks compelling right? At first glance, this manager investing in German equities (black line) looks like they’re adding quite a bit of value (or alpha) vs the DAX (yellow line).

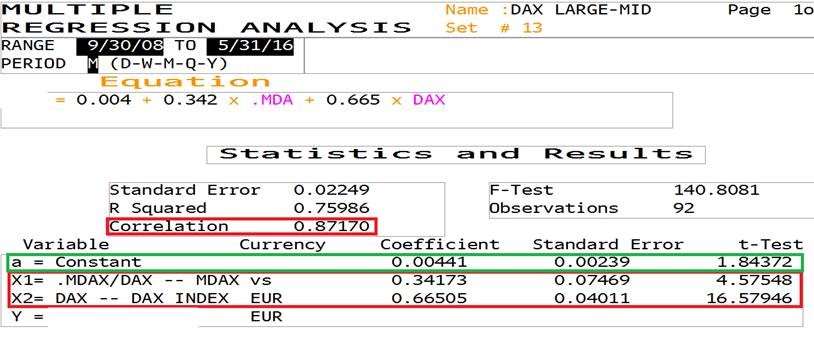

But a closer look at a regression analysis on Bloomberg, trying to explain his or her returns shows a different picture. In table 2, it becomes clear that almost 100% of the performance can be explained by 2 factors, the DAX and the MDAX (the German mid cap index). The constant or alpha is low and not even statistically significant (i.e. t-test below 2)… a different proposition altogether.

To get back to basics, an active manager’s return in excess of the benchmark can be broken down into three components (1) returns to static factor premia, such as tilt to value or momentum stocks (2) manager skill coming from factor timing and (3) manager skill coming from security selection. Points 2 and 3 are the only things we’re willing to pay for and now we can do something about it.

It can also help assessing what kind of risks we have in our overall portfolio. Factor based studies also help us better understand, on a look through basis, what kind of risks we’re taking for our overall portfolio. Norges, the (very) large Norwegian wealth fund and government pension plan, were instrumental in addressing this. In late ’08, they were surprised at how their investments, which had supposed independent bets and offered adequate levels of diversification, all collapsed in tandem. It was their drive in trying to understand what they had exposed themselves to that led to this development, ultimately pushing most institutions to look at factors in a more granular way.

‘I’m looking to pay active managers who generate genuine alpha through either tactical timing around markets and factors or through security selection. Static factor tilts can be replicated more cost efficiently with smart beta strategies’ opines Sanz and goes on to conclude ‘the availability of smart beta ETFs helps me improve portfolio outcomes, reduce costs and more importantly increase performance transparency’.