Daniel Kahneman, the Nobel Prize in Economic Sciences in 2002, wrote a best-selling book entitled “Thinking, Fast and Slow”. The central thesis of the book is that human beings have two modes of thought: System 1: Fast, instinctive and emotional; System 2: Slow, deliberative and logical. We can say that System 1 resembles the PERCEPTION, whereas, System 2 is closer to the REALITY. Being so fast and so emotional, sometimes the PERCEPTIONS may distort or exaggerate the news delivered by the market, whereas REALITY gives the investor a medium-long term framework to better assess the market situation.

Discover our monthly series “Perception vs. Reality”!

PERCEPTION

Americans prefered Trump to Clinton.

The polls were totally wrong.

REALITY

Although Trump was elected president because of the peculiarities of the US electoral system, Clinton had more votes than Trump.

Clinton: 47.7% Vs. Trump: 47.1%

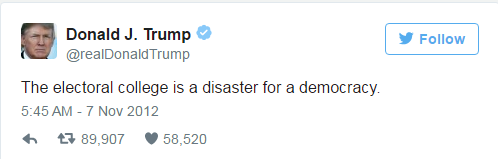

In fact what Trump called “the electoral college disaster” in 2012 was making him president, despite having had less votes.

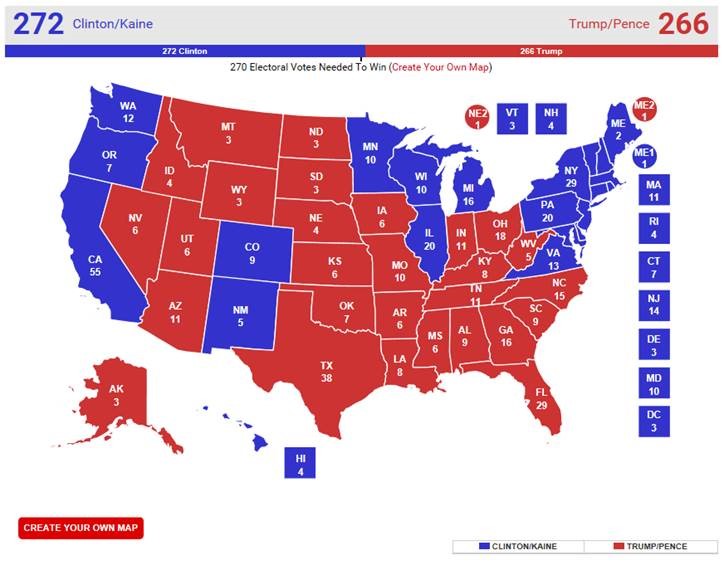

Was the election outcome a surprise?

Only to certain extend. This chart was the best estimation the day before the election. Trump won PA (+20), WI (+10), MI (+16) and lost NV(-6), and he went from 266 to 306 electors. In PA, WI and MI the difference was only +1% and that made the difference.

CONCLUSION

The polls, were not that bad, but the media and investors were the ones who did not properly read that beforehand was already a very closed call.