Daniel Kahneman, the Nobel Prize in Economic Sciences in 2002, wrote a best-selling book entitled “Thinking, Fast and Slow”. The central thesis of the book is that human beings have two modes of thought: System 1: Fast, instinctive and emotional; System 2: Slow, deliberative and logical. We can say that System 1 resembles the PERCEPTION, whereas, System 2 is closer to the REALITY. Being so fast and so emotional, sometimes the PERCEPTIONS may distort or exaggerate the news delivered by the market, whereas REALITY gives the investor a medium-long term framework to better assess the market situation.

Discover our monthly series “Perception vs. Reality”!

PERCEPTION

Republican led administrations in the US are typically more business friendly than Democrat ones. Republicans are more likely to decrease taxes, to deregulate markets, to better control the budget deficit, to decrease the Government size and generally speaking to create a better environment for companies. Looking at history, Republican Presidents have had in their cabinet more business people to lead the country. As a dramatic example, Trump’s cabinet has about 50% of its members with a business background, the highest proportion since WWII, whereas Obama’s administration had only 10% on a comparable basis, which was the lowest proportion since WWII. With these hard data, investors can infer that US stock markets should have performed better while a Republican President was in office, and also will expect a good equity market during Trump’s government.

REALITY

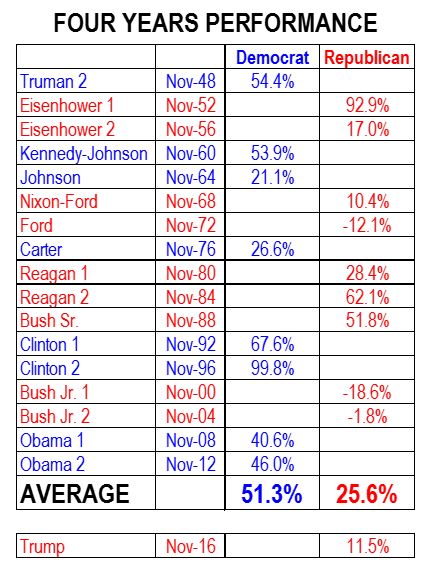

The table shows the performances of the S&P500 (price only) since WWII, and… surprise, surprise! the S&P500 has performed much better when a Democrat was in the White House. The 4 year average mandate of a Democrat presidency has seen a 51.3% performance whereas a Republic presidency has delivered only 25.6%, just half of the performance of a Democrat administration. We are counting only 17 periods with 8 Democrats and 9 Republicans, but in any case, it sounds quite counterintuitive.“It is the economy stupid”, was the sentence used by Bill Clinton to explain why he beat Bush Sr. in the Nov-92 elections. We may also say that the economy, market valuation, luck and other factors may explain this reality. For instance:

- Clinton took office after the 1991 US recession, so his first mandate took place during an economic recovery that was due after the recession, and so the market made 67.6% in 4 years.

- The second Clinton administration enjoyed the technology bubble, so the market gained 99.8%

- Bush Jr. was elected President when the S&P500 was quoted at 19.5 times 12M forward earnings, so his first mandate was overseeing the burst of the TMT bubble and the market fell 18.6%

- Ford was unlucky to be President when the OPEC started to push oil prices up.

- Obama was lucky to start his presidency when the SP500 had just collapsed and was quoted at 11.8 times 12M forward earnings.

Besides all these specific situations, it is very important to remember that the US is a very strong democracy with many checks and balances, with powerful House, Senate and Governors who have a big influence in politics and in the economy. Likewise, US corporates are very strong and well managed and have a profit cycle that might be independent of the political party of the President.

CONCLUSION

In the US (and in most developed economies), politics are much less influential on the performance of equity market than what people think, whereas the most typical financial and economic factors remain the best indicators for expected equity performance: FED hiking rates is not good news; lower corporate taxes will be good news; deregulation will be good news; a high PE ratio (17.9 today) is not good news, etc. The market will switch from a Trump led market to an economic led market.