Daniel Kahneman, the Nobel Prize in Economic Sciences in 2002, wrote a best-selling book entitled “Thinking, Fast and Slow”. The central thesis of the book is that human beings have two modes of thought: System 1: Fast, instinctive and emotional; System 2: Slow, deliberative and logical. We can say that System 1 resembles the PERCEPTION, whereas, System 2 is closer to the REALITY. Being so fast and so emotional, sometimes the PERCEPTIONS may distort or exaggerate the news delivered by the market, whereas REALITY gives the investor a medium-long term framework to better assess the market situation.

Discover our monthly series “Perception vs. Reality”!

PERCEPTION

Warren Buffett, probably the best investor ever, made a bet in 2008 against Protégé Partners that its strategy that invests in hedge funds couldn’t beat a Vanguard mutual fund that tracks the S&P 500 Index. This weekend, during the annual gathering in Omaha, Buffett announced the returns after 8 years: The S&P500 index climbed 65.7% vs. 21.9% returned by the bundle of hedge funds selected by Protégé. The S&P500 index has been 3 times more profitable than investing in in hedge funds.

With headlines in all newspapers across the world, we can imagine that the perception is that hedge funds “get unbelievable fess for bad results” (Bloomberg). Besides, if Warren Buffett says this during his annual meeting, the perception gets into every investor’s mind.

REALITY

In 1990, Harry Markowitz and William Sharpe were awarded a Nobel Prize in Economic Sciences mainly because they were the pioneers in developing a theory about investments where returns and VOLATILITY must both be taking into account, and not only returns. This is quite a simple principle that we all were taught as the basic topic in Finance, but surprisingly, many times smart people forget it.

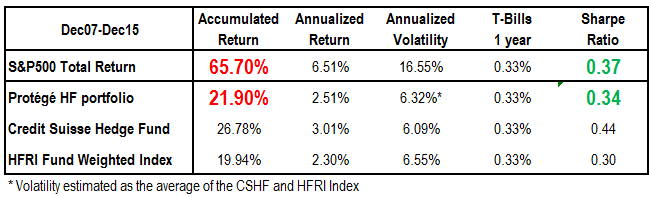

In the previous table, there is a comparison on a RISK-ADJUSTED RETURNS between the S&P500 and the Protégé HF portfolio. As we do not have information about the volatility of this portfolio, an estimation was made using the average volatility of the 2 best known hedge fund indexes.

[stop-align] The reality is quite different, as the Sharpe ratio of the hedge fund industry, the S&P500 and the Protégé HF portfolio are more or less in line, as can be seen in the table above.

It is important to consider also that hedge funds invest on a worldwide basis, and this comparison is made with the S&P500, which has been the best regional index in the world.

CONCLUSION

- Although the absolute returns of the HF industry have not been good, on a risk adjusted basis they have been in line with the performance of the S&P500 during the last 8 years. Better if we were to compare them with the MSCI World.

- Protégé forgot to make the bet not on absolute returns, but on a Sharpe ratio basis.

- This comparison does not take into account the liquidity risk: Whereas you can trade the S&P500 on a daily basis, hedge funds can be traded on a monthly or quarterly basis, so the performance of hedge funds should have been better to justify the lower liquidity.