Soooo long equities… and, So long, Mr. Buffett.

Soooo long equities… and, So long, Mr. Buffett.

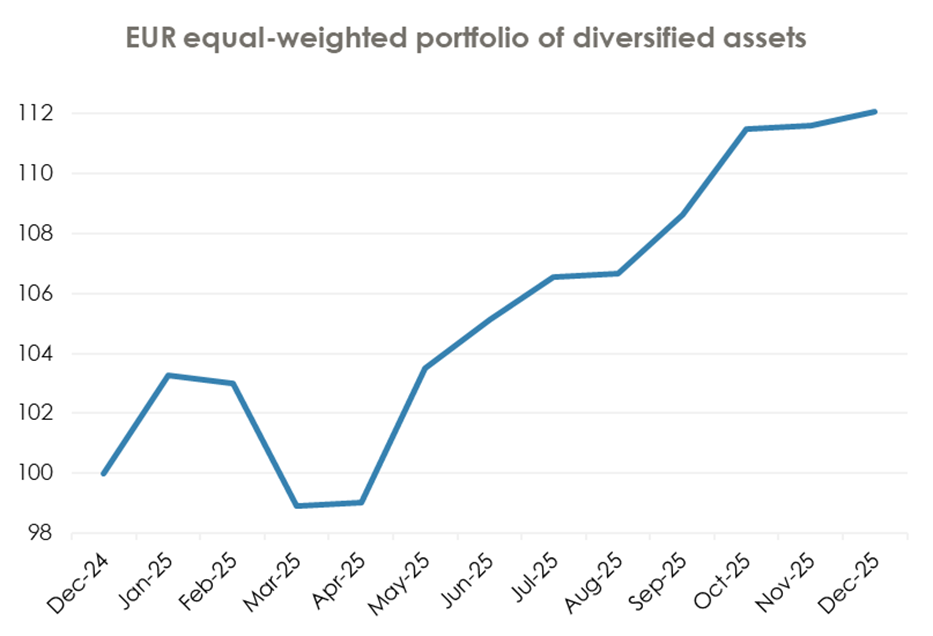

Sources: NS Partners, Bloomberg

As shown on the chart of the month, 2025 has been a positive year for investors; this chart simply illustrates the performance of the euro share classes of an equal-weighted portfolio composed by all the products we manage at NS Partners with AuM above € 100 million equivalent. The return of this theoretical portfolio would have been above 12%. It includes alternatives (Haussmann, Lynx, Pendulum), Asset Allocation (Horizonte, NS Balanced), Equities (Stock Selection, Cleaner Energy, Swiss Excellence, Quality Trends) and Convertibles. The beta of this portfolio would have hovered around 0.6, hence a “balanced plus” profile.

It was almost impossible to lose money in 2025 despite multiple perils. Investors embraced the positive mood; institutional cash levels stand at 3.3%, a record low, while positioning is soooo long equities, with exposure close to record high. As the adage goes, markets “climbed the wall of worries”.

Speaking of adages, 2025 has been marked by an important event for all equity markets; Warren Buffett finally decided to retire. Beyond his formidable track record as an investor, Mr Buffett was also a never-ending source of inspiration with his famous quotes. Let us pay tribute to him and review some of the most emblematic, and how they applied to markets in 2025:

“In the business world, the rearview mirror is always clearer than the windshield”. So true as the AI capex-related equity boom after the tariffs mess looks logical today, but was hard to bet on in April.

“Be fearful when others are greedy, and greedy when others are fearful”. A very famous one, but a mixed picture in 2025 as it indeed paid off to be greedy among fear in April, but it did not pay off to be fearful among greed in H2.

“Never ask a barber if you need a haircut”. Always true; don’t listen to self-declared experts on the internet telling you to go long or short the dollar, or Bitcoin, Gold, Nvidia or Silver or whatever. Make your own research and assess the risks you’re ready to take.

And my two favourites:

A rising tide lifts all boats.

This has been very accurate in 2025, with many unprofitable businesses posting spectacular returns on the back of global enthusiasm around AI.

Only when the tide goes out do you discover who’s been swimming naked.

One of his most repeated warnings, which resonates strongly with the turmoil surrounding Oracle or Coreweave on the credit market, both companies running negative free cash-flow and deploying massive capex, while no real pain was felt by the Mag-7.

The last one could be considered as an advice for the year to come.

“Predicting rain doesn’t count. Building arks does”. No one knows what happens next; but good portfolio management consists in investing in a range of asset classes that do not correlate too much with each other. In the long run, the management of risks is paramount. Another great thinker, the late baseball star Yogi Berra, confirmed this relentlessly, stating that: “It’s very difficult to make predictions, especially about the future”.

Happy New Year!

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group