Chart of the month: Time to perform differently – Global Macro

Time to perform differently: Global macro

Source: NS Partners, Bloomberg

In our previous “Chart of the Month” from September 2024, titled “Time to Reassess Market Risks,” we noted early signs of fragility in global market structures. Since then, markets have trended lower and become more volatile, driven primarily by Trump’s trade war and persistent geopolitical tensions.

By late 2024, one of our strongest convictions was the growing attractiveness of global macro strategies. These managers generate returns by identifying broad economic and political trends, such as shifts in interest rates, inflation, currency dynamics or global risk factors, and positioning portfolios accordingly across a diverse set of asset classes, including equities, bonds, currencies and commodities.

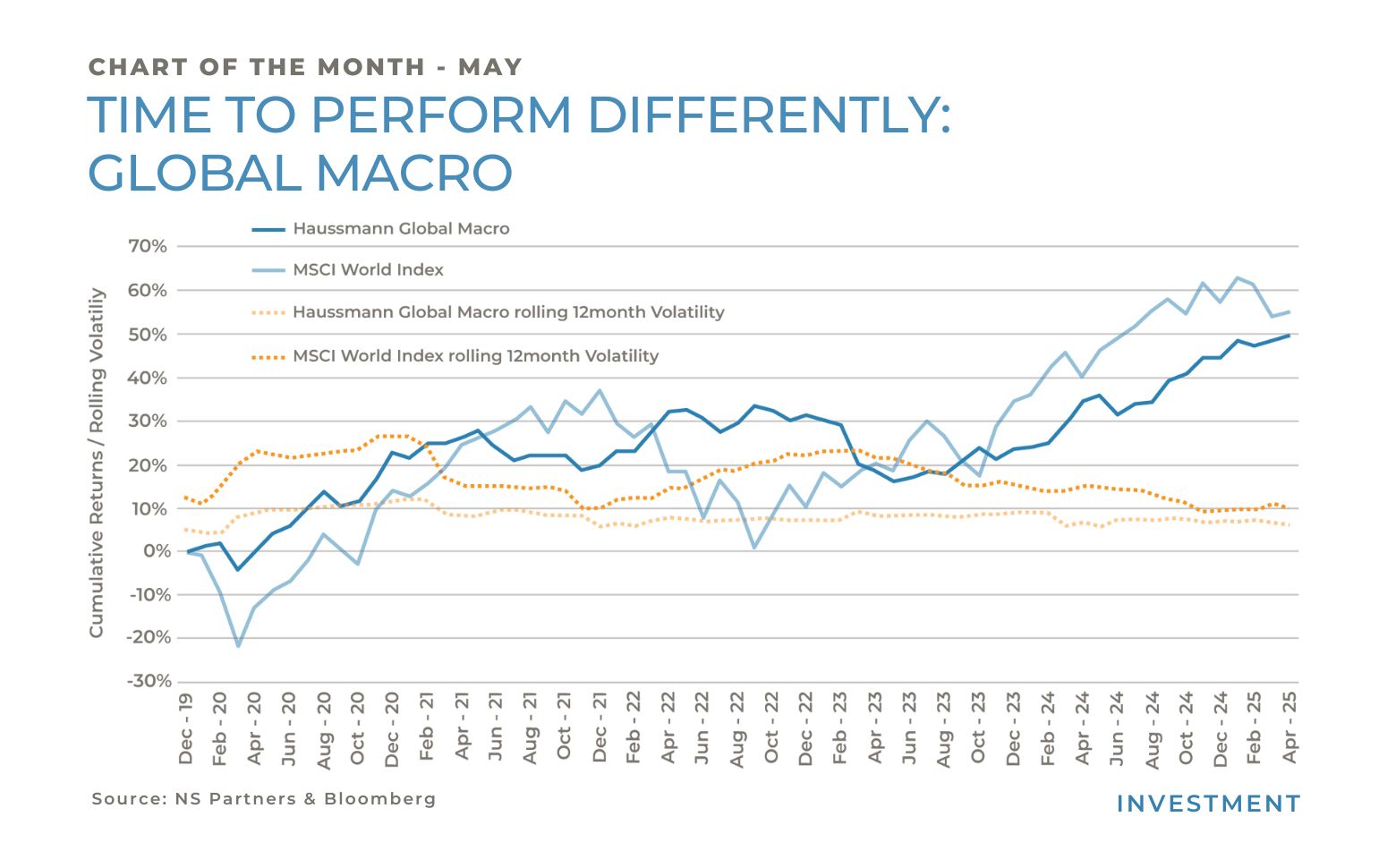

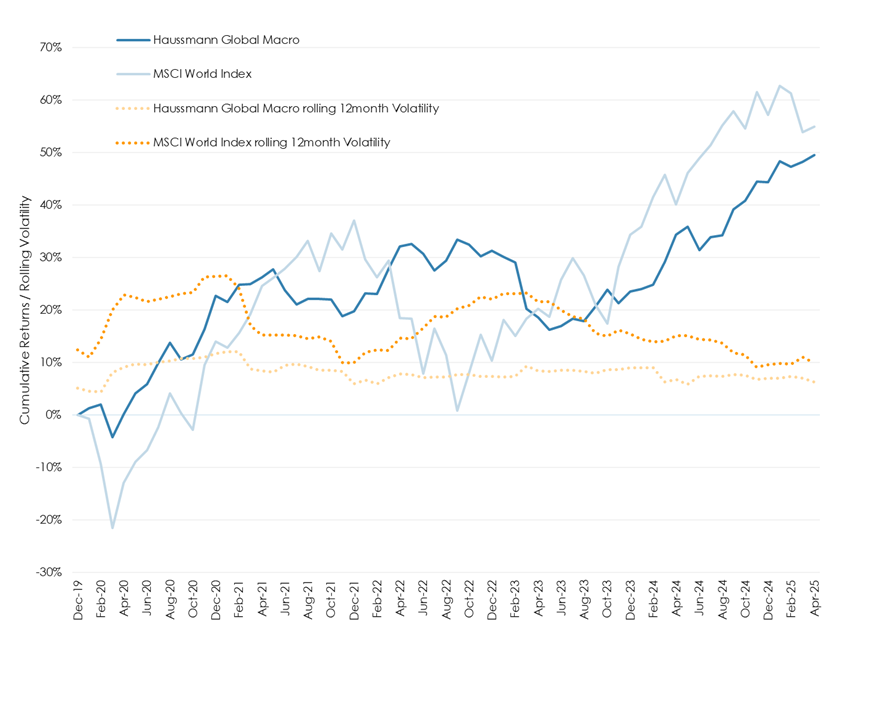

The accompanying chart highlights the performance and volatility of our global macro managers in Haussmann versus the MSCI World Index since 2020. While the equity market returned an impressive +55% over that period, our macro managers delivered comparable performance, with far greater resilience.

Crucially, the rolling volatility of the global macro strategy was roughly half that of equity markets and significantly more stable. Whereas market volatility peaked near 30%, macro volatility rarely exceeded 10%. From a portfolio construction standpoint, this is compelling: the strategy’s correlation to equities was only 0.18 and its downside capture was -7%, meaning it generally performed positively during equity market drawdowns.

Today, global macro represents more than 25% of Haussmann’s capital allocation. We take confidence in the long-standing strength of our top three macro allocations: Caxton, Castle Hook and Gemsstock which have been part of our portfolio for many years.

We are now operating in a market environment that is increasingly macro-driven. Trade tensions and tariff-related uncertainty continue to suppress risk appetite and heighten volatility. While we are not advocating an exit from equities, positive surprises remain possible, we strongly believe this is the time to complement portfolios with strategies that offer greater resilience and positive convexity.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group