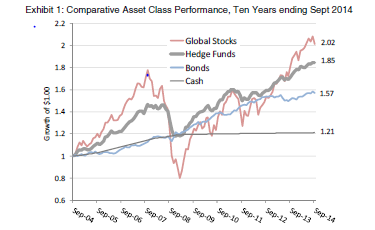

The news that Calpers in the States and PFZW in Europe were pulling out of hedge funds did not come too much as a surprise considering how their portfolios fared. There were clearly specific issues regarding these two investors but as large allocators and opinion leaders in the market, there was a risk that this move would impact the whole industry, especially large pension plans who have always been dedicated to this space. 2 years later, it appears appetite for hedge funds has remained robust as per Towers Watson and Prequins latest studies. Although the industry has clearly had better times, the value proposition is intact and at Notz Stucki, where we run several fund of hedge funds and use hedge funds actively in our allocation process, they have contributed positively to the return and risk profile of diversified stock and bond portfolios. We expect that they will continue to do so, particularly given the low returns (and negative rates) projected for traditional fixed income as well as other asset that have done well in the past 5 years but now appear toppish.

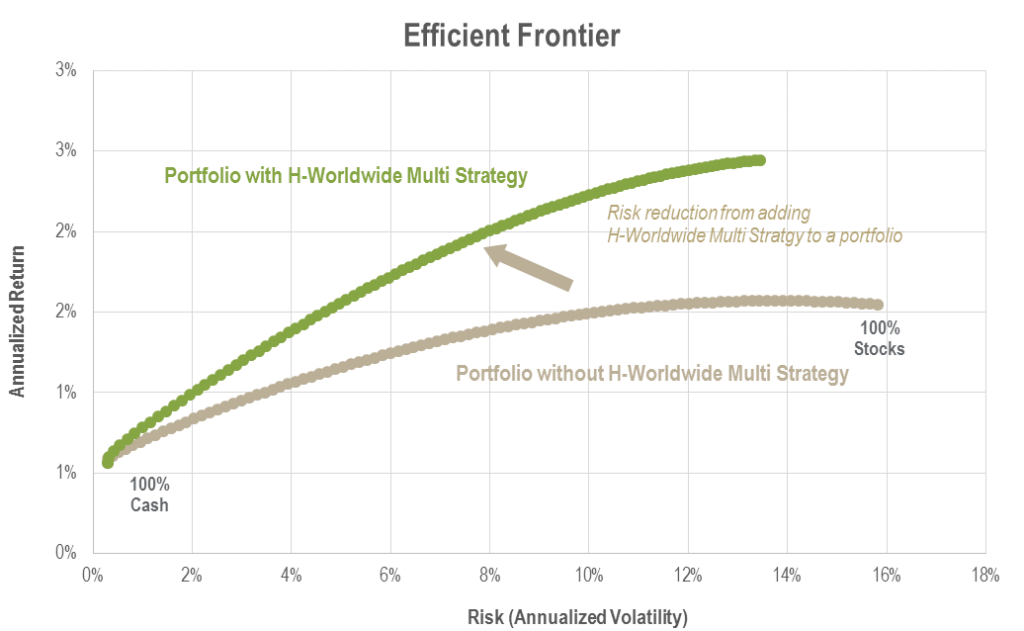

The H-Worldwide – Multi Strategy fund is a good case in point. In the last 10 years, it ranks #1 amongst its low volatility multi strategy peers. Structured as a Luxembourg Alternative Investment Fund, it invests globally in some of the best hedge funds in the world in various strategies, ranging from global macro, to RV, US, Europe and Global Equity hedge. It’s up over 130% in USD terms since inception in 2005 (the MSCI world was up 32% during that period) but what’s been most value add is the downside protection it offers investors: in 2008 H-Worldwide Multi Strategy was down only 8.39% (and bounced back by over 26% the following year) and, since inception, has only captured 0.5% of the equity market’s drawdowns during losing months. Volatility stands at 5.9% since inception, much lower than the equity the MSCI world’s 15.8% annualized for the period. By offering equity like returns with bond like volatility over the past 10 years, even a small allocation to H-Worldwide Multi Strategy during that period has helped our clients maintain their expected returns whilst meaningfully reducing their risk. A winning proposition all around.

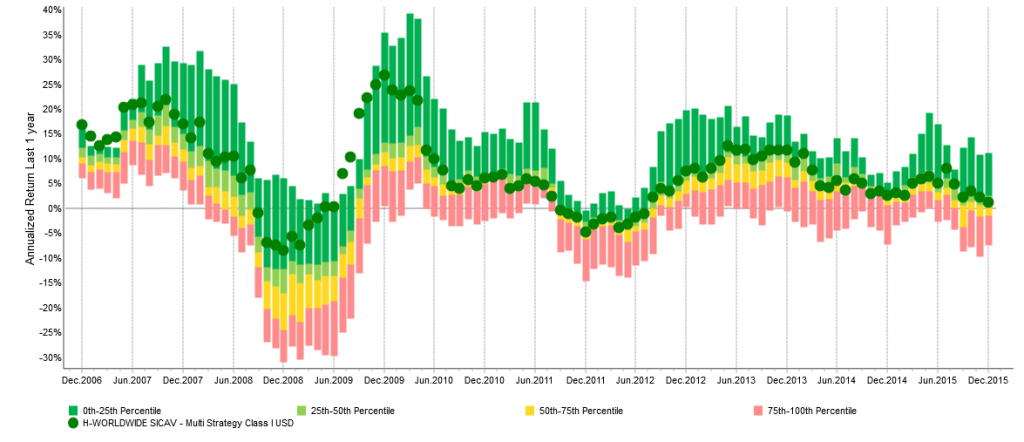

H-Worldwide vs. Global Fund of Funds (‘GFF’) – 30 Funds of Funds (data from Jan 2006 to Dec 2015)

In a supportive market environment as the MSCI World, which was up 32% over the past 10 years, the average performance of GFF was the same (32%). The HFRX Global fund of fund index was flat. The Sharpe and Sortino ratio of the MSCI World was 0.16 and 0.64 respectively, while the average GFF was 0.45 and 0.83 respectively. H-Worldwide Multi Strategy has made nearly more than 2 times the money the average GFF made since inception:

- # 1 in cumulative performance since inception vs its peer group. 10 year annualized returns stand at 7.2% well above the average fund of fund returns for the period of 2.8%. H Worldwide Multi Strategy had annualized volatility of 5.8%, slightly below the volatility of its peer group during the same period

- On a rolling 12 month basis H-Worldwide Multi Strategy consistently ranks in the top quartile of the universe with relative and absolute gains for both 2008 and 2009 (see chart below).

- Alpha generation of 6.38% (against the MSCI World) vs. 1.96% (on an annualized basis) for the average GFF. A more than 4 point spread every year.

Past performance is not indicative of future results. This article does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. This funds is registered for distribution in Switzerland to qualified investors only. The documentation may be obtained free of charge from the Representative in Switzerland, Acolin Fund Services Limited, Stadelhoferstrasse 18, 8001 Zurich. Paying Agent in Switzerland is the Neue Helvetische Bank AG, Seefeldstrasse 215, 8008 Zurich.