What’s going on?

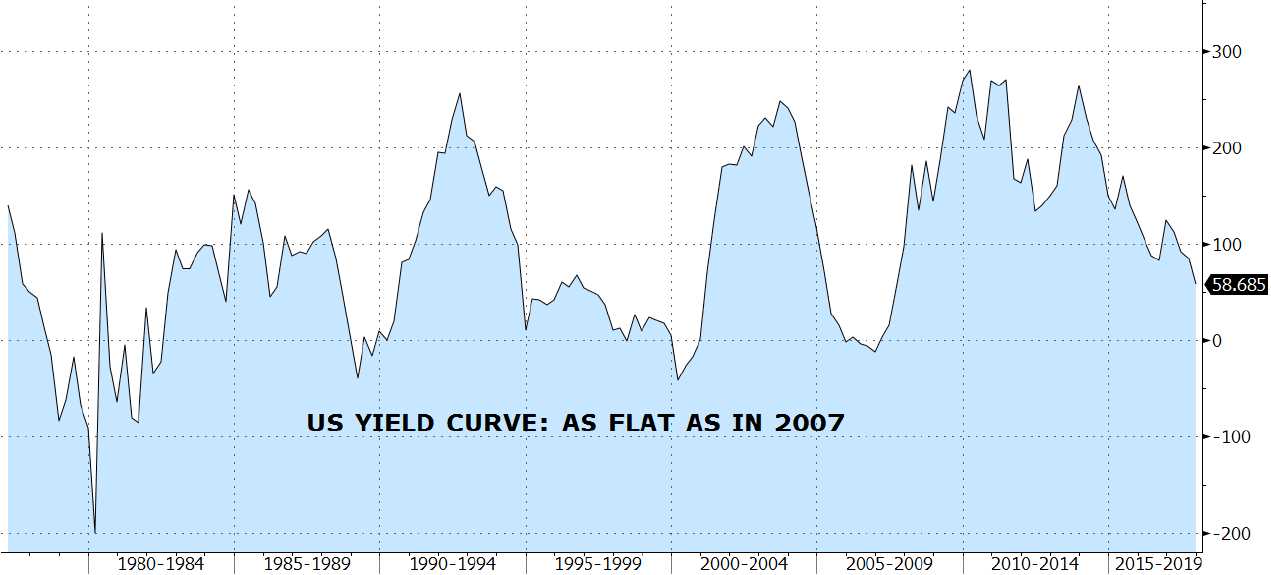

The US yield curve is flattening at a steady pace. One of the most followed indicators, the 2-10 year differential, has more than halved since the beginning of the year, from 125 basis points to less than 60 bps today.

Traditionally, a flattening yield curve is a warning signal for lower economic growth, and in some cases, notably when it gets into negative territory – i.e. an inverted yield curve – for a recession. Although we’re not in that situation, this rapid flattening of the 2-10 year slope raises questions, especially when all lights seem to be flashing green: global economic growth is strong, Europe and Japan show at last real improvements, Emerging Markets and China are roaring ahead, US employment is extremely steady, and the list goes on.

Besides all these positive indicators, it is also noteworthy that, apart from Venezuela or Turkey, there is no imminent catastrophe looming, at least apparently.

So what is the US yield curve telling us or, in other words, is there something we should really worry about?

First of all there are technical reasons for this flattening: the Fed has announced it will raise interest rates as soon as December this year, with further hikes planned next year, which exerts upside pressure on 2 years yield, while at the same time, tame inflation figures tend to put opposite pressure on longer term yields. The fact that the Fed has also declared that QE was now behind us should eventually have increased prospects for higher long term yields, but the Fed was and is not – by far – the only buyer of long dated Treasuries and strong hands have been on a buying spree of late: foreign holdings of US Treasuries have increased by more than $ 300 billion this year, led by China in particular.

Then, in a world craving for yield, getting 2.5% on one of the safest and most liquid assets in the world (the US 10 year T-notes) is clearly attractive. There is almost no equivalent in the developed world, and perhaps the most strikingly comparable comes with Portuguese 10 year yields which barely reach 1.9%!

But let’s not be complacent; most US recessions were preceded by a yield curve inversion with a negative 2-10 year slope. As we get closer to zero, more and more investors will start fretting about a possible recession and become more cautious. Although we’re not in the recession camp as we see no signs of it in today’s markets and economy, we’ll keep on closely following any deterioration in what could be qualified as a Goldilocks environment. For the time being, enjoy strong equity markets, but don’t overlook the possibility that something bad and unpredictable happens….