US Budget Deficit

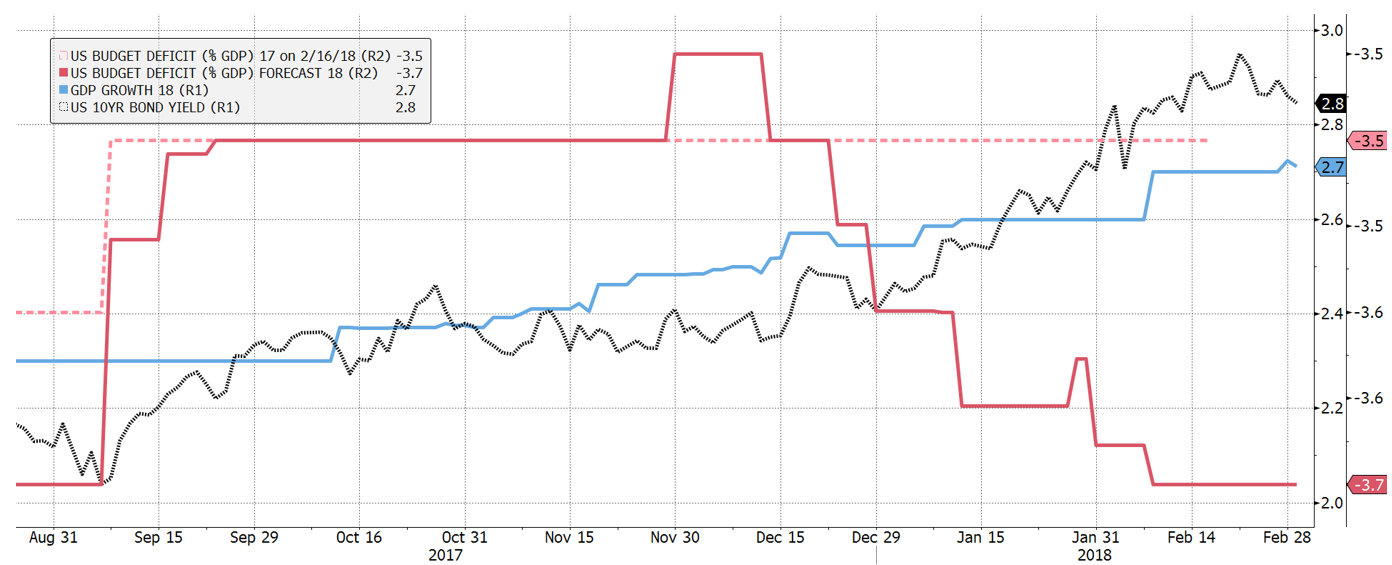

The chart above shows the 2018 U.S. Budget Deficit reflected as a percentage of GDP. U.S. Budget has been negative for several years; compared to history this level is not so surprising but the economic context today is quite different. We are now in the ninth consecutive year of economic recovery. It is hard to consider the U.S. budget without analyzing some elements which are: 10 Year U.S. Bond yield, inflation and unemployment rates.

What is the situation today? And in which direction will this budget go?

We can easily answer that the annual deficit will widen in the years to come.

If we try to make a brief picture, let’s look at the U.S. figures more closely.

• The Real GDP year over year was 2.3% for 2017. The economy is showing good shape with a higher forecasted GDP for 2018 (2.7%).

• The core CPI rate is expected to reach 1.8% this year. Near the 2% level historically targeted by the FED.

• When it comes to financial markets, the reference index for U.S. had a tremendous 2017 year with a performance of 19.42%. Year to date the index is up 1.50% (as of 28.02.2018) after having encountered turbulence in early February. On average, corporate results have been impressive and tax cuts will drive future results.

• The year 2017 ended with an unemployment rate at 4.4%. Compared to the past, we are at the lowest level since 2007.

Those good numbers are a sign of a good economy. In the illustrated chart, the U.S. Budget Deficit reflected as a percentage of GDP is ballooning. With a larger deficit, interest rates could rise.

We should also consider the future increase in the costs of social security and medical care. As a matter of fact, in 6 years, the last baby boomers will approach retirement age and there will be large demands on Social Security. In that sense, the Congressional Budget Office announced in June 2017 that its projection for 2018 should be a deficit that would exceed $689 billion. Which is high for a period of economic recovery.

We should not forget the Tax cut and the recent new spending program (2-year budget that would raise spending). The tax cut in December had several effects and especially large on US 10 year Government Bond Yield. We observe a huge move between December 2017 (2.4%) and today (2.9%) (See the chart above). We do not normally observe this level of volatility for such a short period of time.

Then, the question on everyone’s lips is what will happen with the FED interest rate hikes?

First, interest rates could increase as a result of large CPI rates or this larger 2018 expected deficit. National debt is composed by short but also long term bonds. Studies show that the impact on budget will not be that high in the short term. The national debt permits the Fed to raise interest rates, the effect will come in the 5 years horizon, high interest rates come at a very high cost. Nevertheless, this will be an extraordinary impact in the decade. Fed might increase rates more than the three times currently anticipated. Then, we should expect 3 to 4 gradual increases in interest rates. As investors, even if rates increase, we should remain positive and confident, companies are showing good signs and some of them will be helped by the tax cut.

The conclusion is not straightforward. This year will not be as easy as 2017. To the tailwinds we had in 2017 like profits and good economy (9th year of recovery) we will add and face this year headwinds with short term interest rates hikes and FED gradual increases.