Chart of the Month – To be or not to be in a bull market

Source: NS Partners, Bloomberg

Following sharp negative performances in 2022, global stock markets are nicely up since the beginning of the year. The only exception is China, where the macroeconomic recovery continues to disappoint investors. But if we consider developed markets, the S&P 500 index is up +8.9% YTD as of the end of May, the MSCI Europe index +6.6% and the Topix index +12.6%.

Despite more uncertainties on the macroeconomic front (economic slowdown, Germany in technical recession, inflation declining but still at high levels, continued geopolitical tensions) market volatility has weakened significantly (VIX index and VStoxx recent marks are closed to 15 when they were respectively above 20 and 25 most of the time during recent months). The situation is not as worse as people thought initially, in particular if we look at corporate earnings, but it is still really surprising to see the S&P 500 index completely immune to the bankruptcy of large US banks in March when at the same time the US 2Y Government bond yield went down from 5.2% to 3.9% in 2 days, an amplitude not seen since October 1987!

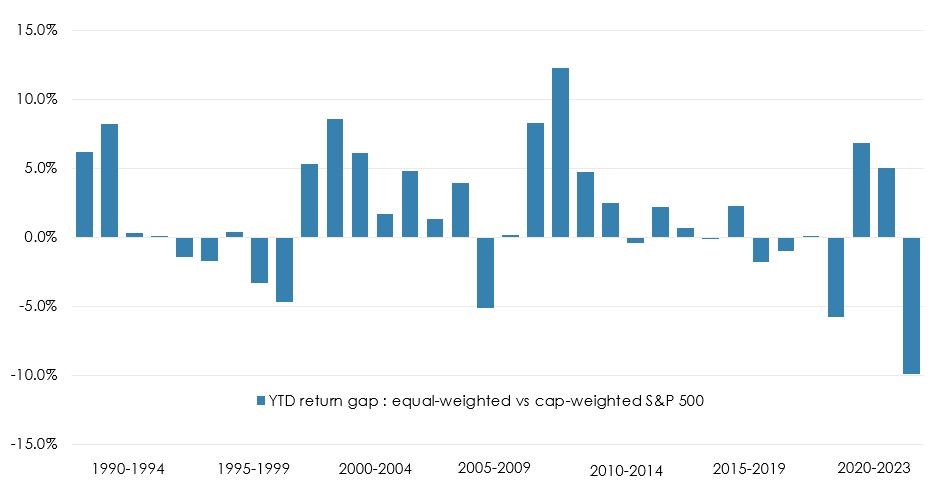

In fact, there is a lot happening behind the scenes and the overall market has been driven by only a very few large US mega-cap AI-related Tech stocks this year. The chart shows the YTD return differential between the S&P 500 equal-weighted and the S&P 500 market-cap weighted. The gap has actually never been so large since 1990!

How do active managers perform in this current market environment? Without surprise, we witness a very high dispersion between managers, depending on their sector positioning, small or large-cap bias, growth or value orientation, concentration and finally stock picking. What is reassuring is the fact that our selection of stock pickers where we have high conviction and who suffered last year are strongly back: Blackrock Global Unconstrained is up +20.5% YTD & -25.5% in 2022, Cantillon +10.7% & -23.4% in 2022, and AKO +16.8% & -18.5% in 2022. A significant proportion of 2022 losses have already been recouped whereas the MSCI World index is up +7.6% YTD after losing -19.5% in 2022, which represents only 39%!

With regards to long/short equity managers, they are back in positive territory in terms of alpha generation. In Asia and China, most of them have been able to protect efficiently on the downside and our diversification approach has helped. In DM, as central banks’ hiking rate cycle seems to be closer to the end in the US and shows a more visible path in Europe, fundamentals make the difference again. Our European long/short mandate is up +9% YTD, which is a good result considering that managers are well diversified in terms of sectors and rather cautious in terms of market exposure.

Having equity risk-managed portfolios in this context makes sense.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group