Time to invest in European banks equities

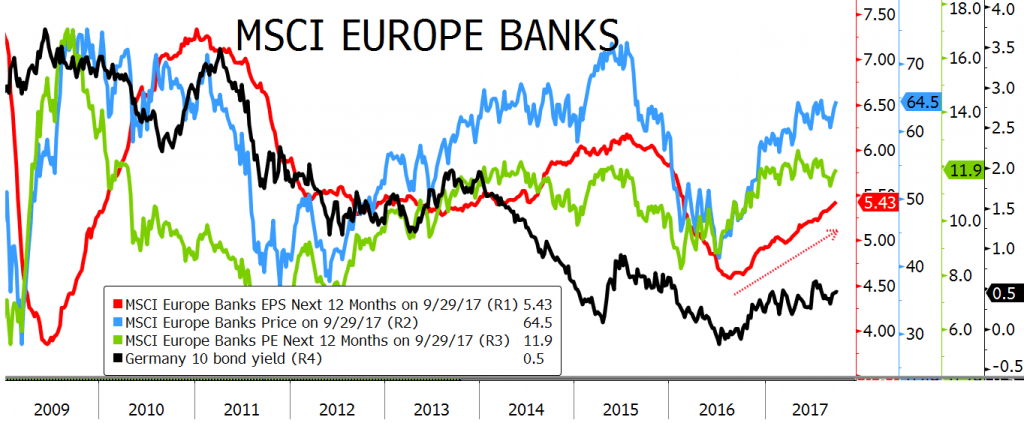

Banks have been underperforming dramatically since the burst of the bubbles in 2008, especially in the European market, but since the middle of 2016 the trend has been reversed. The graph shows the following information:

- Blue line: Price evolution. Minimum was touched in July-2016

- Red line: Earnings Per Share expectations (IBES) for the next 12 months. After a long period where profits were consistently going down, in August-2016, expected profits improved 20% until today.

- Black line: 10 year German bond rate. Rates were negative (-0.2%) in July16 and since then the yield has increased to 0.5% today.

- Green line: Price/Earnings (PE) ratio for the next 12 months. In January, PE was 8.2x (40% discount to the whole European equity market) and today we have reached 11.9x (20% discount to the European equity market). In relative terms, this valuation is in line with the one of the last 10 years. The sector trades at a discount to the total market due to the perceived higher risk.

WHAT HAS HAPPENED TO EXPLAIN THE RECENT RERATING?

Many planets aligned during the last 15 months:

- The economy has been growing at 2%.

- Banks have decreased their provisions for Non Performing Loans.

- Banks have increased their loan activity to both household and non-financial corporations.

- Financial costs have decreased after the huge monetary stimuli of the ECB.

- Net Interest Margin have started to increase.

- Weak banks have finally raised enough capital (Deutsche Bank, Unicredit, etc.) or have been sold out (Popular, small Italian banks, etc). Now, the Core Capital (CET1) of the European banks is twice as much as what it was in 2007.

…AND, MORE IMPORTANT, WHAT CAN BE EXPECTED IN THE NEAR FUTURE?

All the factors described above are still in place to help the banks. Furthermore, in 2018 it is expected that the ECB will start unwinding some of the extraordinary measures they put in place to stimulate the economic expansion. Somehow, this unwinding process will cause interest rates to “normalize”, namely to go higher. In that scenario, the Net Interest Margin of the banks will improve, whereas NPL provisions will decrease and contribute positively to the bottom line.

We would expect the red line (EPS) to continue the uptrend, and probably a PE rerating also. The combination of these two factors will make the European banking sector more attractive than the overall equity market. Both trends will even be more positive in the Eurozone banks.