The mystery of stock prices falling despite earnings increasing

“Millions saw the apple fall, but Newton asked why.”

Bernard Baruch

Apple and Nestlé, among many popular large-cap stocks did not perform well since September 2020, despite a rising broad market and favorable earnings releases. Between September 2020 and February 2021, Apple fell close to 10% and Nestlé 12%. Although the most important thing for a stock to perform well over the long term is by far its earnings growth, sometimes, shorter term, this isn’t sufficient to compensate for the other most important factor when it comes to asset prices in general: interest rates. This love and hate relationship between equities and interest rates should, in theory, be very simple to assess: falling interest rates are good for equities as it magnifies future flows, while rising interest rates do the opposite. But this has not been the case all the time; popular “risk-parity” strategies were playing against the maths logic as they were long fixed-income and equities in order to have a protection on possible equity downside thanks to supposedly good returns from bonds when it happens. But this is not what the maths tell you: if the discounting factor (i.e. interest rates) moves higher, then the price of your asset, all else things equal, falls.

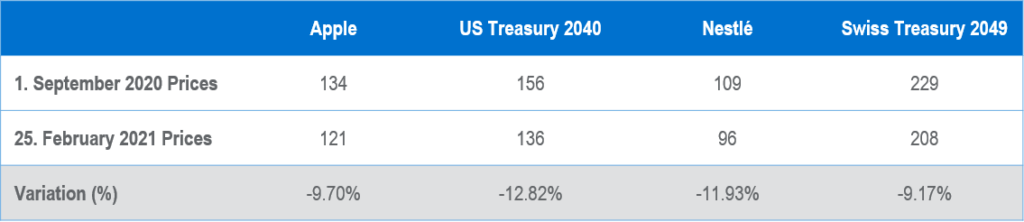

And this is precisely what happened during the last 6 months (for some listed companies), as the discounting factor rose quite sharply (US 10 year yield went from 0.7% to 1.47%, 20 year yield from 1.24% to 2.15%). Guess what, maths worked perfectly well this time as long duration equities fell, almost in line with the fall in bond prices like the table above highlights. Apple’s Price Earnings Ratio went from 34 to 27 times 2021 estimated earnings, for Nestlé it moved from 26 times to less than 23. Here’s the proof that although higher yields do not really affect the business of these companies, it definitely has an influence on their valuations. But there are equity sectors which show an inverted correlation compared to what the maths say. First and foremost, financials, the most hatred sector of the last decade. Rising interest rates is good for banks and insurance companies. More broadly, cyclical sectors tend to be shorter duration assets than growth and defensive sectors and logically outperform when yields move to the upside. The very good performance from cyclical sectors since interest rates started to move up was the reason why indices were able to grind higher. This is why a balanced approach in terms of sectors is important. We don’t know if yields will keep on rising, stall or fall; but we do know that building a portfolio of good companies, whatever their sectors, with a nice equilibrium between Value/Growth and Cyclicals/Defensives is the surest way to deliver appreciable returns over the long term.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Notz, Stucki provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document.

This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the Notz Stucki Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer.

Additional information is available on request.

© Notz Stucki Group