The contribution of alternative investments to asset allocation

The debate around inflation is raging these days. While the arguments in favor of temporary inflation clash with those advocating the return of higher structural inflation, it is clear that the narrative of the US central bank has considerably evolved in recent months. To the point that some analysts are now wondering if the Fed simply made a major error of judgment that could lead to serious corrections in financial markets. In the short term the Fed is so “behind the curve” that it has no other choice but to start raising its key rates in March. It is also surprising to see such divergence between DM and EM central banks which already started their rate hike cycle for months. As we are writing these lines, the Fed is still injecting liquidity into markets! However, inflation is mainly a US problem today (with the exception of specific cases such as Turkey and its unorthodox monetary policy, or significant increase in European energy prices) with the combination of several factors: ultra-accommodative monetary policy, unprecedented fiscal stimulus, strong economic growth, excess household savings and record low unemployment rate leading to upward pressure on wages. On top of that, we have the China factor. Indeed, the “zero COVID” policy pursued by the Chinese authorities, coupled with relatively low herd immunity and a less effective vaccine, are causing repeated partial shutdowns of the Chinese economy. The impact on supply chains, particularly for the production of consumer goods for Western countries, is being felt. While headline inflation is quite low in China, inflation on production costs is up more than 10% year-on-year.

This situation will push the central banks of developed countries, and first and foremost the Fed, to raise rates very quickly. The rate and amplitude are difficult to predict, but the direction is clear. There are several consequences in terms of asset allocation and portfolio managers can’t remain insensitive to this change in the macroeconomic environment.

- Regarding equities, value sectors are now significantly outperforming growth sectors, which had been the big winners of the pandemic and the last decade. Sector exposures will be key in such a macro-driven market environment going forward. With more than 10 rotations in 2021, equity markets have not been so easy to navigate. The performance of the indices can mask certain realities and the Nasdaq, which gained 22% in 2021, would only be up 9% in its 5 largest capitalizations. It seems to us that a “blended” approach with a selection of good quality companies is the right approach at this stage.

- Regarding bonds, it seems almost impossible to expect a decent return without taking risks for which we are not paid for. The period of free money has lasted so long that certain economic realities will resurface with the end of this era and we don’t see why private debt markets would be immune to the rise in rates.

Over the past 10 years, the classic 60/40 portfolio model, i.e. 60% allocation in equities and 40% in bonds, has generated satisfactory risk-adjusted performance, but we can legitimately doubt that it will be the case for the coming months. In this context, “relative value” strategies seem particularly interesting to consider. Their objective is to deliver consistent performances, decorrelated from markets, with low volatility. There are 2 main relative value strategies:

- Multi-strategy multi-PM platforms, which tend to be large by assets and able to attract the best traders in the world and

- Smaller managers who implement niche strategies on specific market segments. With an in-depth knowledge of this investment universe, an efficient selection process and capacity to invest with the best managers, NS Partners has been able to build robust portfolios, which have delivered “all weather” returns for more than 20 years.

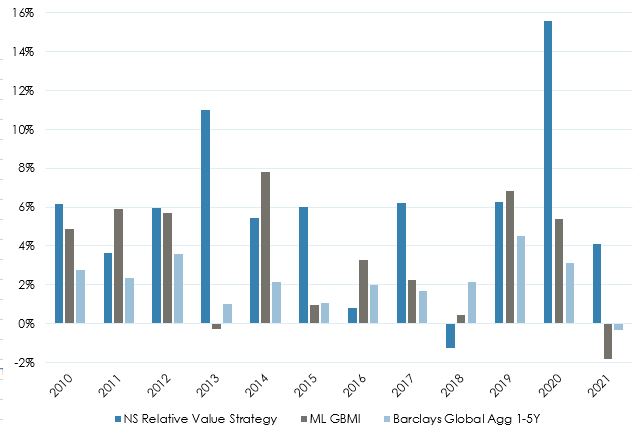

The chart above shows annual performances of the NS “relative value” strategy compared to the BoA-ML Global Bond and Barclays Global Aggregate 1-5Y bond indices:

- Over the past 12 years, the strategy has posted a net average annual performance of +5.8%, compared to +3.4% and +2.2% for the two indices.

- The annualized volatility of the strategy is only 3.1% and shows no correlation with bond markets.

- Even more interesting, when we consider the 10 months when the US 10-year interest rate increased the most, the strategy posted an average performance of +0.96% while the BoA-ML Global Bond index posted exactly the same average performance in absolute value but with a negative sign, -0.96%!

And if you are not convinced by the past, consider the present. The Bloomberg 60/40 index lost 4.2% in January 2022 whereas the NS RV strategy is estimated to be slightly down for the month.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group