Swiss equity market: a good growth/value investment idea

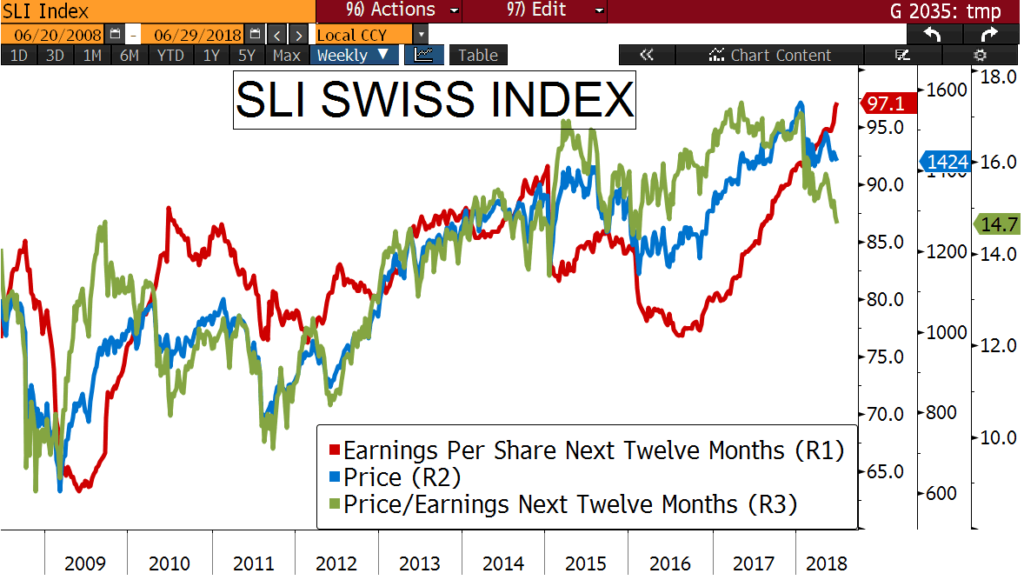

The chart shows some interesting characteristics of the Swiss Equity Market. The Swiss Leader Index (SLI) includes the 30 most liquid shares traded in the Swiss equity market, market cap weighted, but with a 10% cap, so the Swiss giant companies like Roche, Novartis and Nestlé are not overrepresented.

The red line shows the expected profits of the companies included in the index. We can see a strong momentum in earnings which is one of the main drivers of performance.

The blue line shows the price which has fallen 6% during 2018, and leaves the index almost at the same level that it had by the end of 2014.

The green line shows the valuation at 14.7x profits (Next Twelve Months). This valuation is similar to the one it had in 2013-2014. Put in another way, if one investor buys this index today for 100 CHF, the expected profits in 12 months of the underlying companies would be 6.8% (Earnings Yield), which is very attractive especially when compared with all CHF fixed income securities yielding negative returns.

WHAT IS INSIDE THE SLI INDEX?

At the sector level, 30% are Financials (UBS, Zurich Insurance, Credit Suisse), 24% are Health Care companies (Roche, Novartis), 14% are industrial companies (ABB, Geberit), 11% are materials (Lafarge, Givaudan), 10% are Consumer Staples (Nestlé), and 7% Consumer Discretionary (Richemont, Swatch).

Many of those companies are Leaders in their fields with good financial ratios. The index has only 2% exposure to Information Technology, which makes this index very complementary to other widely popular investments.

In the middle of a possible trade war, the main components of this index are lightly exposed to the so far announced tariffs.

WHY HAS NOT THE INDEX PERFORMED WELL RECENTLY?

On one hand, the trio made up by Roche, Novartis and Nestlé, do not perform well when rates rise. Also, the “Italian crisis” has negatively impacted all the financial sector (Zurich Insurance, Credit Suisse, UBS, Swiss Re).

OUR CONCLUSIONS

- Switzerland has one of the best macro statistics in the world, with reasonable growth, low inflation, positive current account balance and 0% budget deficit.

- We find now an excellent combination of good profits momentum + good value.

- It is quite complementary to other funds or investments that are highly exposed to information technology, whose valuations are more demanding than before.

- It is not very sensitive to a possible trade war.

- It is quite defensive if the world experiences an economic slowdown.

All these factors make us believe that it is a very interesting entry point to make money in an uncertain economic and political environment.