EURO DOLLAR PARITY: THE LOGICAL SONG

This recurrent question which always comes from the audience when a financial presentation is held (outside of the US of course): “and, what do you think of the dollar?”…… and it very often embarrasses the speakers because you normally can illustrate a bearish or a bullish scenario with numerous different reasons:

- Commodities are down, so the dollar goes up

- Risk-off environment, the dollar falls

- Foreign Central Banks build up their USD reserves, so the Greenback rises

- Sovereign Wealth Funds liquidate positions, the dollar is headed down

- Forget about any short term move, the dollar is the reserve currency of the world and, as such, must fall

- US corporates hold trillions of dollars offshore and will repatriate them…the dollar will rise…

This non-exhaustive list just show how easy it is to find a rationale for supporting a bearish or a bullish view on the dollar, and there are probably times when one or two or all these explanations are perfectly valid…. But what about a simple, verifiable and proven reason like….interest rates differential?

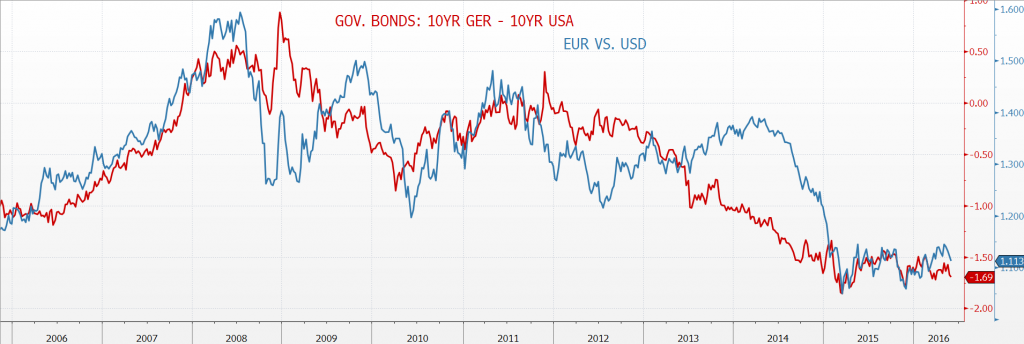

Yes, this sounds logical, and can be checked over a long period of time as the chart above shows when it comes to find a trustful cause for the euro-dollar parity movements: the interest rates differential between the US 10 year Treasury and the German 10 year Bund seem to be a good proxy for explaining the long term trend for the EUR/USD. To make it simple, when the red line falls the gap between the yield of a US 10 year Treasury and the 10 year Bund widens, so you are better remunerated for holding dollars than euros, and conversely when the red line rises. And the blue line is the euro-dollar parity.

Furthermore this comparison offers you nice positioning opportunities if you have a long term view. Just to illustrate, look at the wonderful recurrent buying opportunities you had on the dollar versus the euro from mid-2013 until mid-2014. The euro was on the rise while the interest rates differential was telling you that the opposite should have occurred.

So today what should be the answer when this terrible question arises: “and, what do you think of the dollar?”? The easiest answer is that the dollar is supported by a better remuneration, not by a wide margin though, but the speeches from the ECB and the Fed tell us that this yield differential should last for a while, so holding some dollars in a euro account makes sense today.