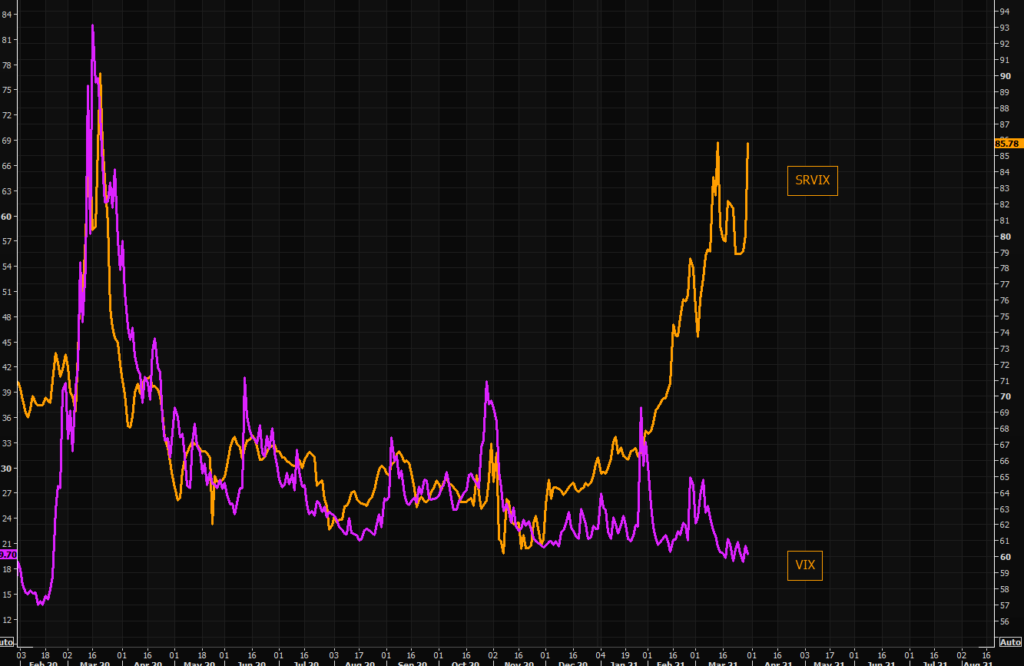

Interest Rate vs Equity “Fear”: Two different worlds

SRVIX vs VIX “gap” is once again getting very extreme.

The current gap has been mentioned during multiple conversations with HF managers recently. They also confirmed that equities are not realizing much volatility nor is much “exogenous” risk being priced in for now, as suspicious as it may sound….

The latest turbulence further to the implosion of Archegos is so far just an isolated event, but there is a general trend pushing risk managers to look through the portfolios and the average order book, simulating scenarios in a new way.

Yields have put in a “big shooting star candle”.

Will we get a pause in yields and rates vol?… Most believe that SRVIX vs VIX gap isn’t sustainable.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Notz, Stucki provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document.

This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the Notz Stucki Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer.

Additional information is available on request.

© Notz Stucki Group