Green? Supergreen!

For the past three years, we generally haven’t gone a week without a mention of responsible investment. There is a real awareness of the situation in which we find ourselves, particularly from the point of view of climate change. We have to align our thoughts and our investments: from exclusion of companies to real impact, the range of sustainable investments is wide. Sustainable investments, either directly or through funds or ETFs, are expected to represent between $15 and $20 trillion of all assets under management over the next two to three decades. Since 2016, this approach has grown by 25% in Europe. In all industries, at corporate level, the notion of energy efficiency is increasing; all companies have to cut their carbon emissions. A large number of the world’s biggest companies have improved their energy consumption over the last five years. But there is still a long way to go!

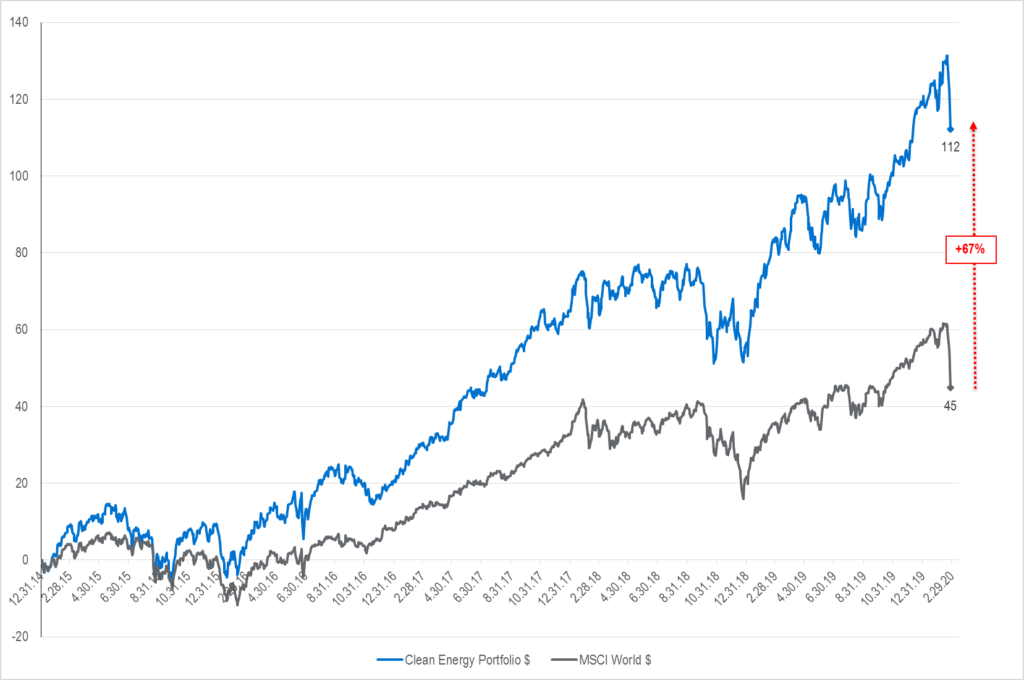

Performance is also a very important factor when deciding to invest in this trend. We are now aware that sustainable investment is not detrimental to returns, and it has been shown that a company’s successful implementation of sustainability enhances its financial performance.

We did the exercise with a Clean Energy portfolio. A global dollar equity portfolio composed of 42 equally-weighted companies in Power, Energy Efficiency and Transport, (automotive, industrial, semiconductors, software, hardware, materials…). We selected the most popular stocks and excluded extreme points from our analysis. Over the last 5 years, the portfolio’s performance is 112% vs 44% for the MSCI World. We clearly notice an outperformance and an explosion in the portfolio’s performance over the last 3 years. The performance differential is mainly due to the stock selection and to the theme. The portfolio offers a dividend yield of 1.87% and is trading at 24.1x next year earnings (PE: 19.1x for the MSCI World) with a correlation of 0.89 to its benchmark. On a YTD basis, the portfolio has demonstrated better resilience than the market.

Where do we stand at Notz Stucki? In Geneva, at corporate level, we launched in December 2017 our philanthropic initiative NS Impact, which supports local and concrete projects involving our employees. In the Asset Management department, we have gradually increased our exposure to sustainable funds in our three asset allocation funds. This ESG-SRI allocation represents between 14.4% and 24.6% of our current exposure, and was built up by investing directly in funds that focus on this specific theme or by switching to sustainable class of the funds we hold if the latter perform better. For our Long Only equity funds, we are in the process of integrating ESG analysis and rating in our stock selection process and are already compliant with the Norges Bank’s exclusion list. From traditional investing to philanthropy, the scope is huge, but taking a few steps in this direction seems to be standard in finance nowadays.

As Korben Dallas asked Ruby Rhod in the 1997 film the 5th element “Green?”, “Supergreen!.”