From carbon to silicon. The case to invest in semiconductors.

With the climate change, there is a huge trend to decrease the use of fossil fuels, whose main component is carbon. By chance, in the famous periodic table, silicon is just below carbon, and silicon is the main component of the semiconductor chips, which are the foundations of the digital economy. These small chips are the essential technology that makes anything computerised or digital work.

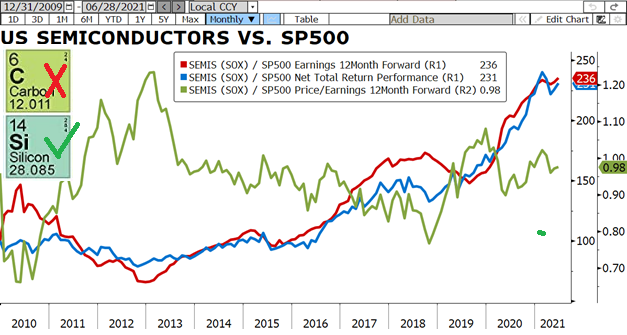

The chart above (blue line) shows the relative performance of the Philadelphia Semiconductor Index (SOX) compared to the performance of the SP500. During the last 11.5 years, this index has outperformed the SP500 by 7.8% per year!!!

What a coincidence that the profits (red line) of semiconductors have also been 7.8% higher per year!!! Once in a while the market seems to be efficient.

Where did the growth come from?

- Communications (33% of demand), which had a phenomenal growth

- Computers (29%). Growth has decreased but it is a main component of all computers.

- Consumer (13%). Consumer electronic products rely on semiconductors

- Automotive (12%). Cars are increasingly using semiconductors for many functions

- Industrial (12%). Microcontrollers, power devices, sensors, etc, all need semiconductors

The important question is: Where will the future demand come from?

- OLD: Communications, computers, consumers, industrials will continue to use more and more chips as the economy continues to “digitalise”.

- NEW: Electric and Hybrid vehicles need between 3.0 and 3.3 times more chips than a traditional vehicle, and the new economy is going to migrate at an accelerated rate to electric vehicles.

- NEW: 5G will enable the wide use of the Internet of Things and self-driven cars, which are going to be reliant on chips.

- NEW: Artificial Intelligence, gaming devices, quantum computers, will all use powerful microprocessors to fulfill their requirements.

With all this use of chips, the demand of semiconductors has outstripped supply to a level such that auto makers cannot deliver enough cars due to chip shortages. Video cards are not fully available either nor video game consoles.

How much do we have to pay to get exposure to semiconductors? the green line in the chart shows the relative PE of semis at 0.98 versus the SP500, more or less in line with the average since 2009. Today, the investor pays the same earnings multiple for semis as he does for the SP500!!!

CONCLUSION

Interesting sector: it grows faster than the market; it is highly exposed to the “digital” economy; it will profit from the migration to electric vehicles; it will profit from the 5G deployment… and all of these without paying a premium!!

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Notz, Stucki provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document.

This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the Notz Stucki Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer.

Additional information is available on request.

© Notz Stucki Group