“Audentes fortuna iuvat”, Virgil

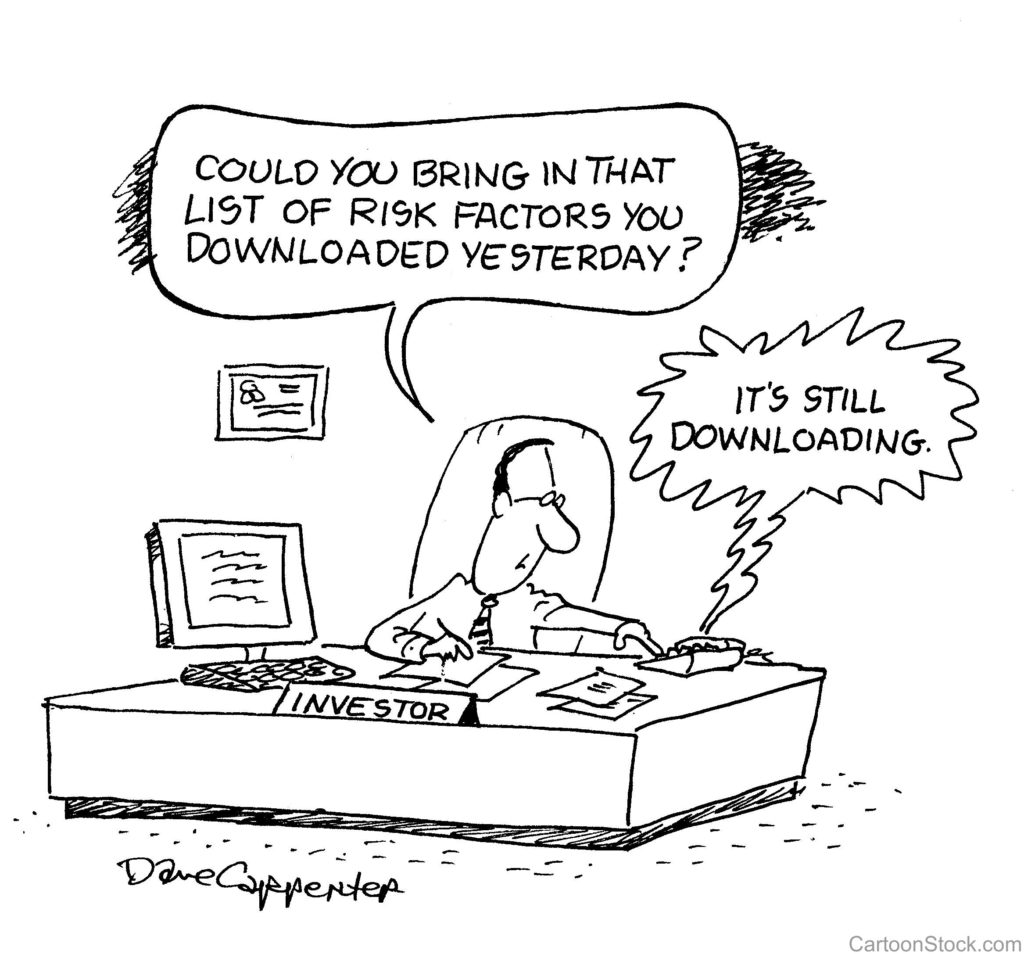

Currency risk, volatility risk, downside risk, credit risk, liquidity risk, concentration risk, equity risk, key man risk, governance risk, geopolitical risk, duration risk, counterparty risk, disruption risk, opportunity risk, macro risk, regulatory risk, reputational risk, competitive risk …. And the list goes on….

Risk is inherent to investment. There’s nothing like focusing on the list of potential threats to your investment rationale and decisions to prevent you from doing anything and finally make you miss opportunities and, very frequently, pushes you to end up acting in opposition to your principles. Panic buying or panic selling, in general, are done by risk-adverse investors buying at the top and risk-prone investors throwing the towel at the worst time (read: at the bottom).

It is quite common to hear that equities are risky while high grade/Government bonds represent safety. This is true, to a certain extent; it has been true in the past; it will be true again in the future. But not systematically, and in particular today, as safety is more expensive than ever, and in some cases investors are willing to literally pay for safety (German or Swiss Government bonds, among others, are a blatant illustration as they carry negative yields).

Buying safe havens like high quality Government bonds can be good or bad investment decisions on a relative or an absolute basis; still, in the past it has always been a good decision for risk-adverse investors who, at least, got some return from their bullet proof assets and slept well (the counterparty being eventually an opportunity cost compared to riskier assets which would have returned more).

Is this still the case today? Will a price sensitive investor sleep well if interest rates rise and trigger a capital loss on an already negative yielding security with no income? The 0% coupon German 10 year Bund benchmark issued this month at 102.50 will fall by 9% if yields rise from -0.38% to +0.50%; this can’t be qualified as safe and cash deposits at a solid bank would, from our point of view, be a better alternative.

And for those who can bear volatility and have a mid to long term view, equities are certainly the best choice.

As an example to comfort those afraid of a correction, buying the S&P500 at the peak of October 2007 would have generated a 174% total return until today or 8.5% annually, by coincidence very close to the long term return of the US market, and buying the US 20 year Treasury benchmark at the same time would have provided the investor with a still good 98% total return (5.7% annually). But at that time the 20 year was yielding 4.75%. Today it is a meagre 1.6%. Very risky, indeed….