Emerging Markets FX Feels Woes From Trade

The FED and the ECB have both recently turned more dovish, US 10Y yield is lower compared to the beginning of the year and is also well off its 2018 peak, China is expected to stabilise growth thanks to recently announced fiscal and monetary stimulus measures and credit spread have compressed aggressively year to date. Market expects that current trade negotiations between the US and China could at least deliver a short-term truce and potentially less tariffs.

All these factors should have been very supportive to Emerging Market (EM) currencies. So why are they lagging other asset classes in 2019 so far?

One of the reasons that could explain this underperformance is the fact that EM central banks have themselves turned dovish after the FED announced the end of Quantitative tightening. Central Banks of Brazil, Mexico, Indonesia, India, Chile, etc… have all either turned dovish or reduced their tightening bias. The only exception is central bank of Turkey which is maintaining discipline to regain credibility but even there it hasn’t paid off as the Turkish Lira performance is negative year to date.

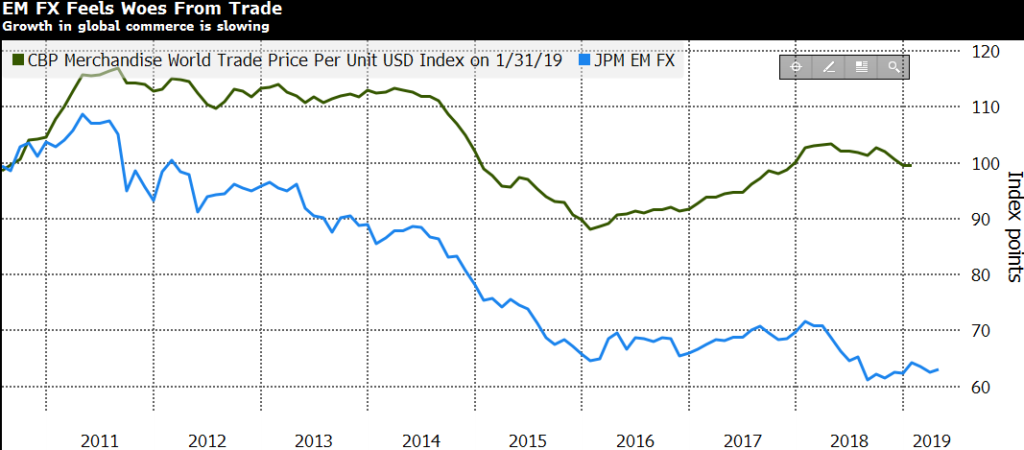

Others possible reasons are not encouraging. As we see in our chart of the month above, there is a long-term correlation between global trade growth and the performance of EM currencies. It could be that EM currencies are telling us that we are in a persistent trend of lower trade or lower trade growth and a short-term deal between the US and China would not be a long-term game changer. EM needs a proper and long-term resolution of trade dispute which clear the outlook for global trade to resume growth.