Equities: focus on sectors & themes

In the early days of Notz Stucki, the country was an important factor to cherry pick the best companies for an equity portfolio. Capital markets were more isolated, trade flows were smaller, interest rates differed among countries, and some countries had specific political risks. As a consequence of that, the top-down investment process started with the country view and, after that, sector view and stock picking.

As the economies became more integrated from the trade point of view and from the capital market point of view, the country notion became less important. The birth of the euro for instance, changed the nature of equity investments and many investors started to consider the Eurozone or Europe as one region to invest, and not specific countries.

Time went by and when we look at the market today, we notice that sectors have become the dominant factor to explain performances:

- US energy companies lost 37.6% in 2020 and European energy companies lost 37.2%.

- Information Technology in the US gained 44.5% and the Asian IT companies gained 51%.

- Companies linked to “cleaner energy” have performed very well regardless of their geographical exposure.

Why have sector/themes become a dominant factor rather than countries/regions?

- Trade flows for goods have increased over the last decades.

- Flow of services has increased over the last decades.

- Capital markets are more integrated.

- Big multinational companies are dominating the market so the domicile of the company may differ from the origin of its revenues. For instance, Roche (Swiss company) has 50% of its sales in the USA, 21% in Asia, and 22% in Europe.

- The asset management industry has recently focused more and more on investment themes like Digitalisation, Circular economy, Health, Wellness, Water, Artificial Intelligence, Cloud, etc, and those investments are free to select companies from all the regions.

IMPLICATIONS FOR NOTZ STUCKI INVESTMENT PROCESS AND MARKET VIEWS

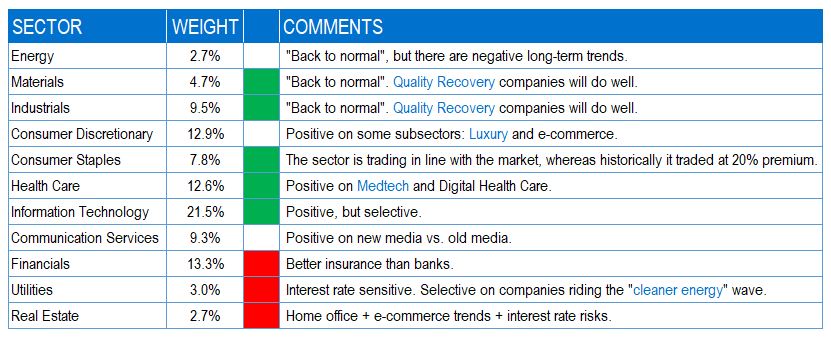

With this more explicit focus on sectors and themes, we have modified our recommendations accordingly, so we have the following expectations at the beginning of the year:

- Positive view on Materials and Industrials to play the theme: “Back to normal”. With 3 vaccines already approved for emergency use, we expect the economies to recover by the 2H21, so we have this positive view on these cyclical sectors.

- Positive view also on Consumer Staples, MedTech and Information Technology. They have attractive PEG ratios versus the world equity index, and they enjoy positive trends for the next decades.

- We still hold a negative view on Financials, a sector that is negatively affected by low rates and that is being attacked by many new Fintech companies who would like to “eat” the profits of, specially, the banks.

- We also like the theme of Cleaner Energy, a cross-sector theme that takes companies from Information Technology, Industrials, Utilities and Materials.

After the good rally in equities in 2019 and 2020, the focus on sectors and themes will help investors navigate a challenging period with demanding valuations in many companies.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Notz, Stucki provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document.

This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the Notz Stucki Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer.

Additional information is available on request.

© Notz Stucki Group