Energy transition from the hedge funds point of view

Source: NS Partners

As part of our quest for alpha vectors, the research work of the past recent months has led us to identify energy transition as an obvious theme.

The generalized trend around that theme channels a massive investment momentum by following measures and objectives that are for some, already obsolete. In other words, many are rushing-in… but for the wrong reasons.

It is from this first observation that the opportunity emerges. Unbridled enthusiasm is a source of both value creation and value destruction. It is from this imbalance that we can generate a stable and consistent alpha.

The investment universe within this theme unsurprisingly extends from commodities to consumer goods (EVs, storage, transport, batteries, materials, etc.). This offers us a broad investment spectrum of about 5 vertical sub-themes that we can diversify through a selection of managers that we compiled on a matrix intended to ensure optimal granularity, articulated around the trading style, the sub-sectors biases and market capitalization segments. (see the risk-return profile Chart)

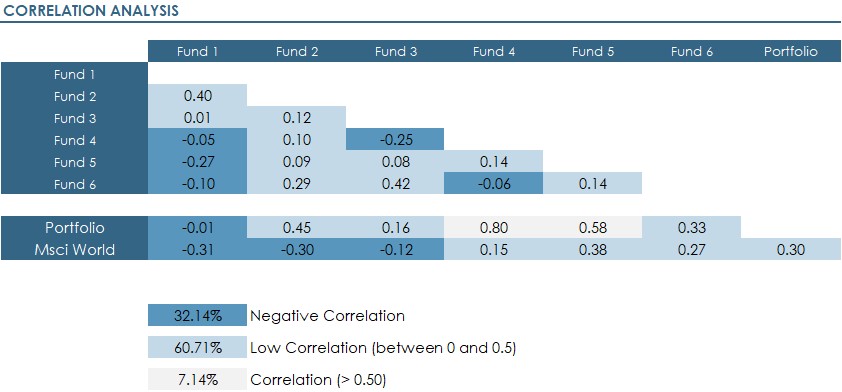

In addition, due to the relative exuberance that reigns in this universe, the ability to generate trading profit is accessible with less leverage (between 130 to 180) and less directionality (neutral to +30 net). Offering a favorable risk profile. Moreover, one of the dominant vectors of this investment strategy lies in the dynamic of innovation, which opposes the hopeless obsolescence of certain players or even certain sectors. Long-short strategies have fertile ground here for alpha generation, and low correlation to traditional markets. (see the correlation table of our selected managers)

Our selected investment universe to-date is composed of six managers in our “focus-list”, of which 2 can constitute already an energy transition position within a client portfolio, with a view to representing approximately 10-15% of the portfolio to start with, or up to 40% should the allocation be made of the 6 managers.

In conclusion of this overview, it is important to keep in mind that this opportunity is in front of us for a period of about 3 to 4 years before Governments come out of their moment of laxity if not of denial. From then, what is at stakes will be unavoidable and strategies will impose themselves. Approaching this phase, it will be wise to measure the risks associated with forced regulation of certain sectors, among few other challenges.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group