Conversation with an energy L/S portfolio manager

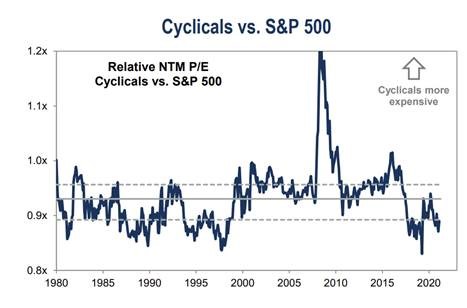

The Global Energy Sector is still very cheap vs history – which differs from the broader market (charts below which compare relative valuations between different sectors and the broader market, Energy is still trading at 11.8x P/E, a discount to historical averages vs. the broader market trading at ~20x, a premium).

So potentially plenty of room for relative multiples to normalize value vs. growth, especially given the focus from energy management teams on return on and return of capital (the space is set to see >20% ROCE over the coming years, which competes with any market sector, as well as in some cases double digit return of capital yields). This compares to other ‘stimulus driven’ sectors where there is a pull forward of demand – ie, cons discretionary and info tech which are still elevated vs. historical valuations.

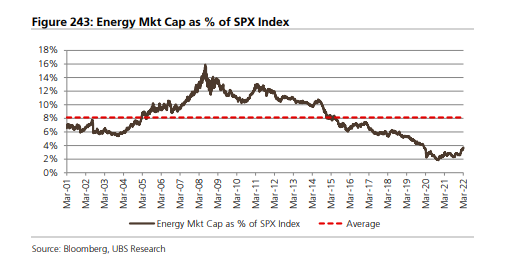

The chart below illustrates Energy Market Cap as percent of S&P, still close to the lows: 4% vs. 20 year average of 8%. This shows the degree of valuation disconnect vs. both historical measures and the broader market.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group