Alpha generation is back!

Equity markets have entered into a new volatility regime since February 2018. This could have been expected with the beginning of the end of QE decided by all major central banks since almost 10 years following the global financial crisis.

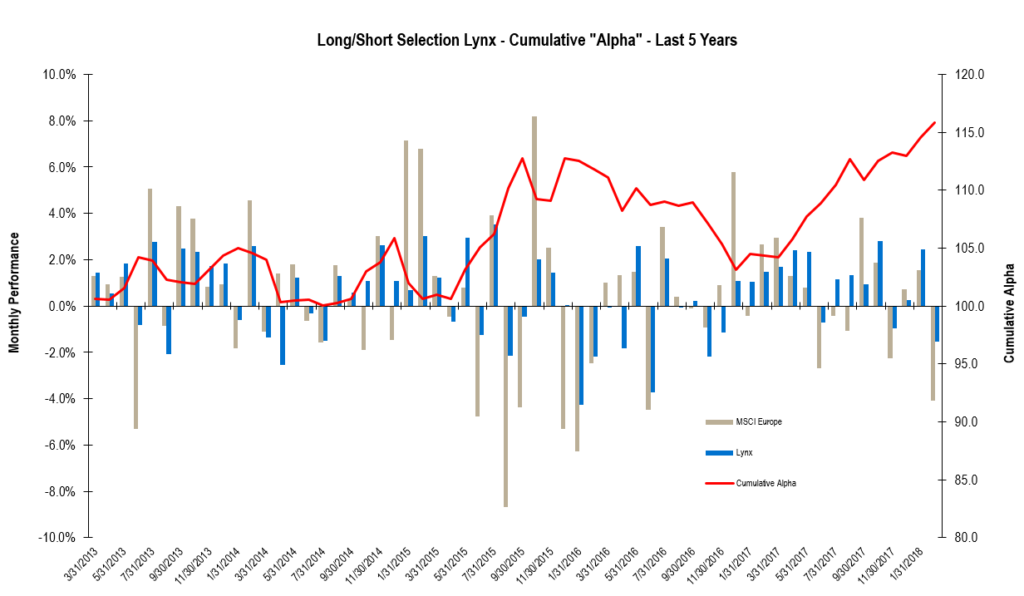

During this period of massive liquidity injections in markets, equities have performed well, especially in the US, particularly in the healthcare and technology sectors. The European economic recovery has been slower to materialize than in the US and the MSCI Europe Index was up +28.5% over the last 5 years.

Active managers like fundamental stock pickers or equity long/short managers have struggled to deliver alpha in a context of risk on/risk off mode driven by macro factors. The scenario has started to change over the last 12 to 18 months as can be shown on the cumulative alpha generated the managers selected in Lynx compared to European equities. Since February 2017, Lynx has generated more than 10% of alpha compared to the MSCI Europe Index.

With a lower correlation between stocks and sectors and a slow normalization of interest rates, we think that active managers should continue to deliver alpha and should be the approach to favor when investing in equities.