Active Management is back!

During March, the Covid-19 pandemic has forced authorities of a vast majority of countries to implement lockdowns and impose physical distancing measures to contain the spread of the virus. Almost all economic sectors have been literally shut down overnight. This unprecedented situation resulted in some of the most volatile financial markets on record and one of the fastest deleveraging event across all asset classes in history. From the peak of 12 February to the lows of 23 March global equity markets declined approximately 34% showing their worst quarterly performance since 1987.

Contrary to what happened during the financial crisis in 2008, central banks took actions very quickly through massive liquidity injections and governments put huge fiscal stimulus on the table. These measures helped stabilize financial markets but let equity investors with huge uncertainty to navigate markets going forward.

We believe that stock picking, a long/short approach and active exposure management should be favored with a focus on:

- Countries which are able to manage both the health and economic crises better.

- Sectors which will not be too much impacted by the economic crisis and become impaired.

- Companies with high quality earnings and cash flows, strong balance sheets and low debt.

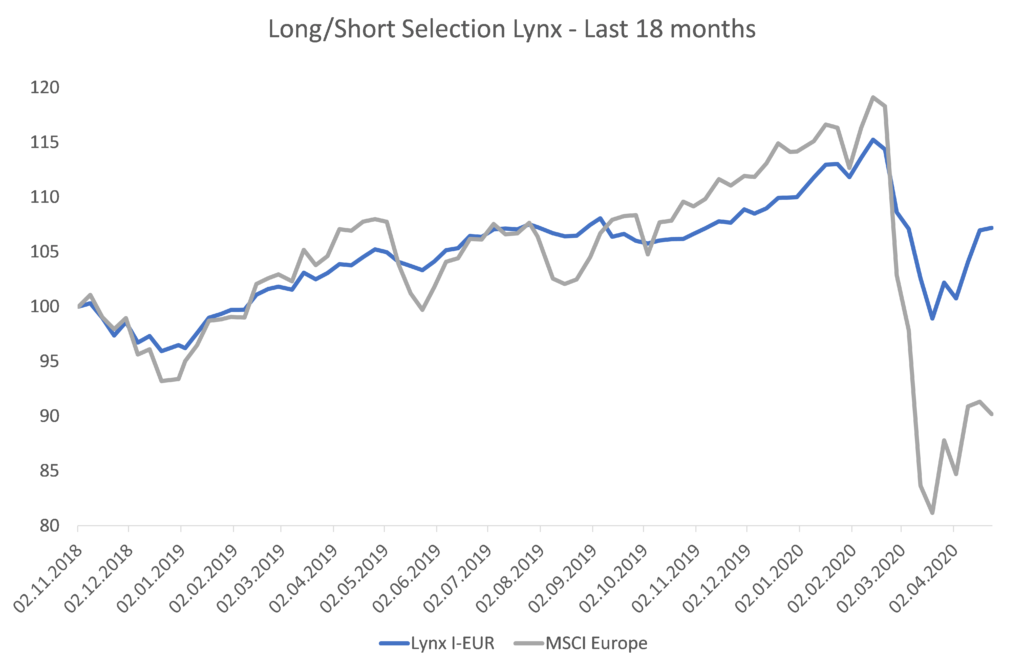

In this difficult environment, Lynx’s strategy to diversify assets across a limited range of independent, absolute return oriented money managers with interests aligned with their investors, worked well as the fund’s NAV declined only -6.9% compared to the equity market which lost -24.3% since the peak in February. This capital protection on the downside is even more remarkable considering that fact that Lynx captured almost 2/3 of the market upside with 40% of the market volatility in 2019. A good way to sleep well while remaining invested in markets?