1986 – 2016. « LIVE TO TELL » (MADONNA)

In 1986 Madonna was singing a very nice song titled « Live to Tell » which rapidly became a hit.

Although the song was by no means a reference to financial markets, it’s easy to extrapolate with the title and imagine the great singer wondering what would be the best way to invest the revenues generated by the huge sales of her record over a 30 years horizon. Now that this 30 years’ time period comes to an end, she has lived to tell the right choice that was to be made in terms of investment in 1986.

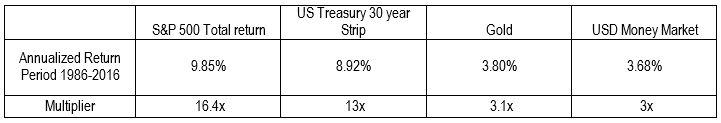

Here below is a simple table of the annualized returns of the S&P 500 with dividends, a 30 year Treasury Strip, Money Market (less than 12 month T-bills) and Gold:

As a reminder, inflation (CPI USA) has run at a 2.62% annualized pace over this period, so one 2016 dollar is worth 2.2 times less than a 1986 dollar.

It appears clearly, with hindsight, that in terms of absolute performance nothing compares to equities, but the 8.92% annualized return on the US 30 year Treasury Strip is unbelievable (for a liquid Aaa fixed income instrument). Otherwise, for those who wanted to avoid risk, money market has done its job by providing investors with a decent return, well ahead of inflation. And finally, Gold has done barely better than money market (but with much higher volatility).

Are there lessons to be drawn from this quick summary? Yes, certainly: over an extended period of time, equities are unsurprisingly the best investment, especially in the US where there is extremely low influence of the State on the stock market (as opposed to Europe and Japan where some companies are deemed strategic and are under pressure from their respective Governments). In the considered period, there were not less than 6 episodes of severe drawdowns (1987, 1990, 1998, 2000-2002, 2007-2009, 2011) and despite that the overall performance of the stock market remains more than compelling.

Another lesson is that the incredible performance of the bond market can’t be repeated with current yields at 3.1% on 30 years Treasury Strips. We have enjoyed an unprecedented bull market on bonds, and even if it can eventually deliver decent returns, they will by no means get close to those of the last 30 years.

At last, history seems to favor short term US T-bills over Gold for safety. The volatility attached to Gold makes it difficult to call the shiny stuff a safe investment.

As a conclusion, looking at past returns does not make sense for fixed income or money market because future returns will very largely depend on interest rates at entry levels. What is really interesting is that US Equities have the good habit of returning close to 10% annualized over the long term, whatever the start date. And the odds are pretty favorable for this to last!