What is cheap? what is expensive? Choose your camp!

So you have here two charts showing the evolution over more than 3 years of earnings, PE multiple and price for two distinct companies. One is supposedly a safe haven stock (company 1), paying a good dividend, on which losing money seems almost impossible whereas the other one (company 2) is that kind of “hype” stocks which, at some point should fall off a cliff because of overvaluation.

An equity investor must first and foremost look at the stream of earnings a company can generate in order to decide whether to buy this or that stock. Dividends are important, but come after earnings because when a corporation generates profit and does not pay a dividend, this profit goes straight up into shareholder equity, which means that in theory profits paid in dividends or retained into the company’s balance sheet should not impact the attractiveness of a listed stock.

We have seen an incredible and almost unprecedented appetite during the last 3 to 5 years for quality stocks, with predictable earnings and reasonable dividends. This seems quite logical in an unstable environment. Investors are skeptical about the economic cycle, about the financial system, about capital expenditure, and so on, therefore buying into blue chips, generally in the consumer staples sector, tends to be the only acceptable investment. And in most cases, they were right! Those large caps (Nestlé, P&G, Colgate, Unilever, Coca-Cola and others) have performed honorably, paid dividends, and were quite resilient when markets were nervous.

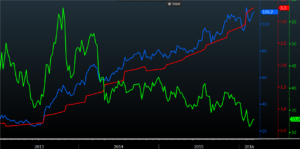

In the first chart, you can see a company which has seen its share price go from 60 to 71, its PE multiple climb from 16.5x to 20.8x, and its EPS slip from 3.65 to 3.4.

In the second chart, share price soars from 40 to 109, but EPS explodes from 0.75 to 3.3…. so mechanically the PE multiple falls from 48 to 33.

In our view, the first company does not deserve such a valuation and favorable performance if one takes out the extraordinary fall in interest rates which has magnified the stable nature of its business. There should be no other explanation because in a “normal” environment, a corporation which sees its earnings headed down should not see its share price and PE climb.

What about the second company? It was expensive when it traded at 48 times earnings, but over the considered period earnings have been multiplied by 4.4 while share price “only” rose 2.7 times. It still trades at 33 times earnings but will soon get cheaper than company 1 thanks to EPS growth.

Which one would you buy today? Indeed interest rates could still fall further and help company 1’s valuation remain at current levels (or higher), but it seems difficult to imagine that the stock can trade at a substantially higher PE as long as earnings don’t grow. We largely prefer company 2 because, as said before, the stream of earnings plays in favor of the investor. At the end of the day, the winners in equity markets are those who increase earnings, not those who benefit from external forces to drive their multiple on the upside.

By the way, company 1 is Nestlé. Company 2 is Facebook.