Chart of the Summer – Building the perfect mousetrap for capturing alpha

Hedge fund performance overall has been disappointing this year with the HFRX Global Hedge Fund Index barely turning positive YTD as of the end of June. With your typical Balanced 60/40 portfolio up just under 10% YTD (BUT still underwater over the last 2 years!) and cash rates above 5%, hedge funds are facing a big challenge this year as the bogey has changed in the last 9 months. This year has clearly been a year for more directional equity long short managers and less so for market neutral given how narrowly led the market has been (and not only in the US with its Magnificent Seven). In addition to the lack of breadth in the market, the bi-polar factor rotation and sector re-positioning (chronic over the last few years) has caught many managers off guard (blame it on the quant funds – mostly stat arb).

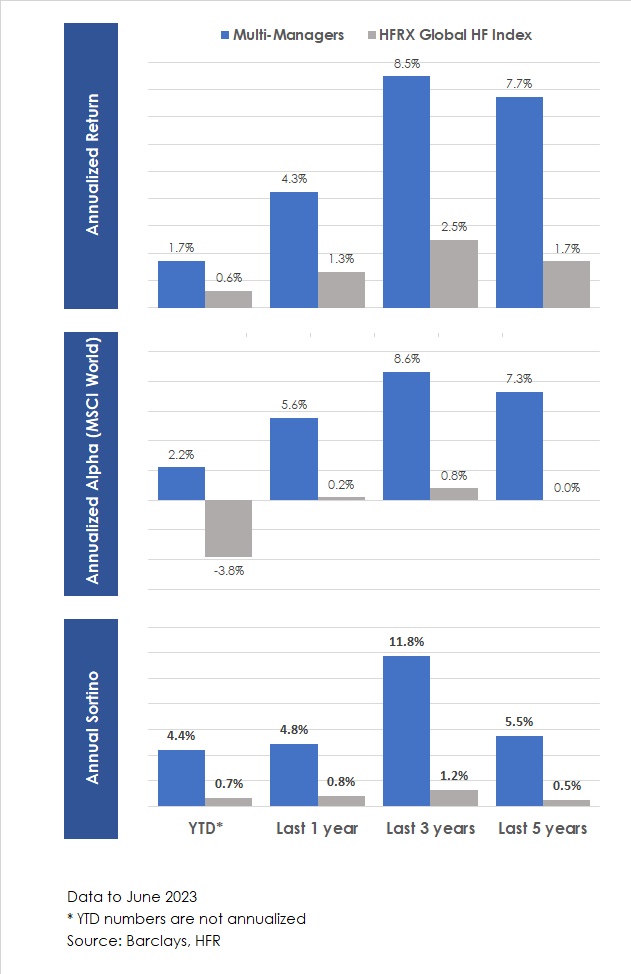

Building a longstanding legacy that is built to last with a clear succession plan to compound returns with consistency over time is more challenging for investment managers that become victims of their success than it is for consumer brands, with the inevitable style drift that comes with a successful track record, as they take in more assets than they can manage, which is the ultimate nail on the coffin. The alternative: the multi-PM model which offers decentralized portfolio management with no single risk-taker able to rock the boat, combined with centralized risk management and the ability to scale in size (to a certain point) where investment opportunities arise. This model has been around since the end of the 1980s and has proved itself over time in compounding consistent returns beyond traditional benchmark indices. This month’s chart compares the Barclays Multimanager Index of 42 multi-PM platforms versus the HFRX Global Hedge Fund Index and highlights why this model has been so successful with investors (mostly pension funds, sovereign wealth funds and private banks). It should be of no surprise that most of the growth in the $4 Trio. hedge fund industry over the last few years has been in the multi-PM space given their ability in providing consistent risk-adjusted performance and more importantly their capacity to protect capital during market drawdowns in comparison to multi-strategy funds led by a single PM that sooner or later stumble and fall before re-jigging their strategy. Their capability in identifying talent and allocating capital efficiently across various strategies has proved itself to a point where the competition for talent has reached extremes and has become a game of musical chairs. Poaching traders between multi-PM platforms has now become like paying for star football players (which does not necessarily guarantee the success of a team, but who cares, if they can score big on their own). The success of the multi-PM platform model can be further illustrated by the number of PMs that have left some of the oldest and most successful platforms over the last 25 years following a so-called stellar track record but then fail to deliver when they launch on their own. There are countless examples of these which attest to the robustness in the construct of the multi-PM platform.

The significant rise in the risk-free rate of late has somewhat challenged a platform’s ability to generate a high Sharpe ratio in addition to the subpar performance as traditional sub-strategy buckets are not working as well YTD. The most common allocations by sub-strategy within a multi-PM structure and the reason for their underperformance YTD are: Fundamental Equity Long Short (market neutral strategies are going through one of the worst years due to massive short squeezes), Discretionary Macro (tough year to call the direction of rates unless you focus on EM), Merger Arbitrage (less deals as money is no longer cheap and the regulator has taken a tougher stance), Capital Markets (the IPO/SPAC market has dried up and not many new deals) and Systematic Macro (tough year to catch trends and have completely missed the equity market rally). What has worked this year has been Global Credit, Fixed Income RV, Convertibles and unsurprisingly Commodities (where most multi-PM platforms are less exposed). Quant strategies have had mixed results but are an inherent part of the build as a diversifier of alpha sources but often plagued by “love / hate” relationships until they get thrown out and replaced down the line with a new team if they underperform over time. They are, however, better able to perform during periods of market volatility given their shorter-term time horizon.

One could say that there are way too many hedge funds today (more than the 16,041 Starbucks stores in the US alone!) fishing in the same pond for the most part i.e. the US equity market where the number of listed companies has drastically fallen from over 8,000 companies (at its peak in 1996) down to 3,700 today (thanks to private equity groups or bankruptcies). You have the same number of stocks listed in Japan today so go figure why there are barely any hedge funds left trading out of Tokyo (the capital of equity market neutral strategies)! Finding 50 of the best capacity constrained sector PMs is easy but getting 250 is more difficult with the inherent risk of diworsification. The big question today is whether the multitude of multi-PM platforms are arbitraging themselves out. The fact that they have increasing amounts of capital under management, which must be deployed across the same popular sectors and in liquid stocks, have all ended up trading the same equity names. In addition, the average holding period of a stock in the US is down to 10 months down from 5 years back in the 70s. Not surprising that we occasionally see a platform winding down a sector or sub-strategy pod which has breached its risk limits and has had to liquidate, creating a ripple effect across other multi-PM platforms which in turn are forced by their risk control teams to cut risk. The inherent leverage used within these platforms (which varies widely amongst them) to enable them to increase alpha only amplifies the ripple effect.

The big dilemma for platforms today is whether to onboard managers to have exclusivity (which comes at a price and with no performance guarantee) or work with outside independent managers and/or the sell-side. External Alpha-capture programs were first pioneered by Marshall Wace back in 2001 (initially started as a summer internship project) to enable buy-side firms to track and analyze the sell-side’s best ideas. At the time the average lifespan of a contributor was and still is around 4-5 years. Compared to the average lifespan of a PM within one of the oldest multi-pm structures today, it is now down to 17 months (Darwinism!). Perhaps the platforms concentrated down to 20-30 PMs (like the traditional fund of funds model) will do better but their capacity will be constrained. We will always be reminded that size is your biggest enemy. With at least ten new platforms slated to launch this year, the trend is far from over.

Ultimately, it is more of an art than a science and as one manager told me back in the 90s “we all use the same ingredients but it’s the recipe that makes the difference…”

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group