Angel Sanz

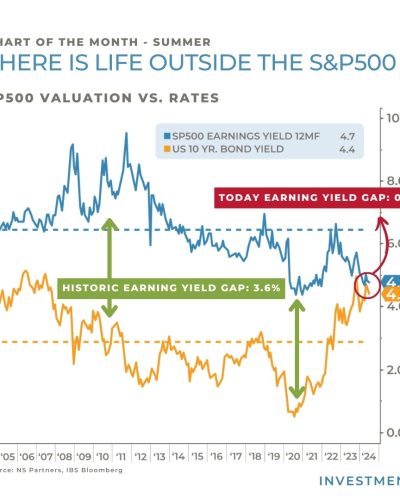

Chart of the Month – There is life outside the S&P500

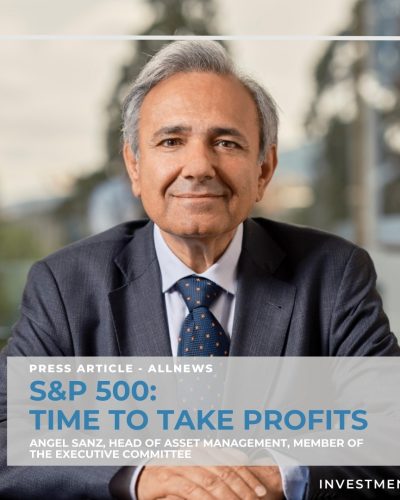

Time to Take Profits in the S&P 500

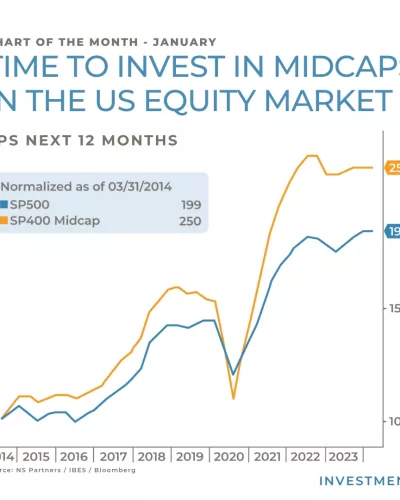

Chart of the Month – Time to invest in midcaps in the us equity market

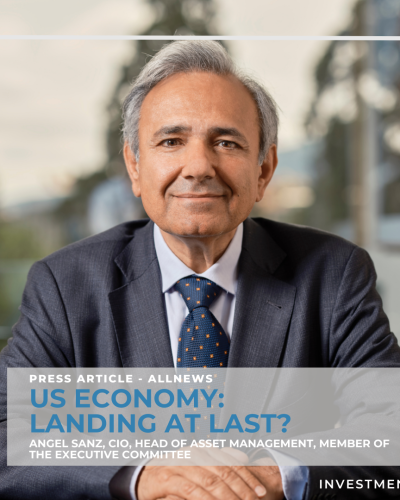

US economy: landing at last?

Towards a slowdown in the US economy at the end of the year

What can you do during this particularly hot summer?

Que faire durant cet été particulièrement torride ?

Gráfico del verano – Una oportunidad de inversión de 3 billones de dólares para la transición energética

Graphique de l’été- Une opportunité d’investissement de 3 000 milliards de dollars pour la transition énergétique