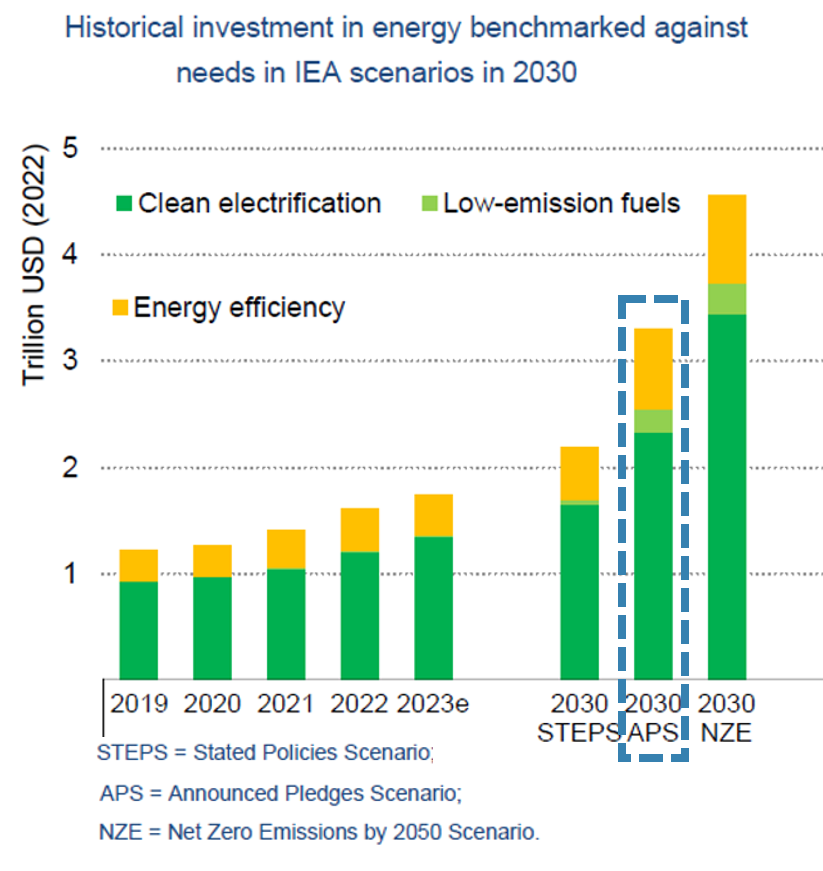

Chart of the Summer – A USD3 trillion investment opportunity for the energy transition

This economic shift is being referred to by many economists as “The New Industrial Revolution”. A glance at the chart presented by the International Energy Agency (IEA) clearly highlights the massive investment effort needed worldwide to decarbonize the economy. To visualize this investment opportunity, we embark on an imaginary journey where our guest will discover an array of interesting ideas and companies to invest in.

Mary turned on her Tesla, a marvel of electric car technology known for its eco-friendly design. The digital dashboard lit up, indicating a battery power level of seventy-five percent. Mary admired her vehicle, not just for its quick, quiet ride but also for what it symbolized – a step towards environmental stewardship.

She was accompanied by her co-pilot, a recent chemistry graduate. Together, they admired the sight of towering windmills dotting the landscape. These were Vestas windmills, renowned for their effectiveness in transforming wind power into clean electricity. The co-pilot noted that the motors and rotors of these windmills, much like those of their Tesla, relied on rare earth elements due to their unique magnetic properties.

Their journey took them past fields glittering with solar panels from First Solar, Canadian Solar and other manufacturers. These solar farms, managed by Iberdrola, captured sunlight and transformed it into energy. Amidst these farms were electrolysers, which used electricity to separate water into hydrogen and oxygen. This hydrogen was stored and later used to create ammonia, a clean and potent fuel. Some of this hydrogen was sent to a steel manufacturing company that use it to produce clean steel.

Nearby was a plant that used the ammonia to manufacture fertilizers, enriching soil to produce good crops. The ammonia was also loaded into ships, fueling their voyages across the globe without leaving behind a trail of pollution.

As the Tesla signaled the need for a recharge, Mary pulled into a nearby charging station. The station derived its power from a compact yet potent 200 MW mini-reactor nuclear power plant. The co-pilot explained how uranium, despite its contentious history, was critical for these nuclear reactors due to its immense energy-producing capability.

Upon reaching her modern, eco-conscious house in the countryside, Mary could see the solar panels adorning the roof. Connected to efficient Enphase inverters, these panels harnessed sunlight and converted it into electricity. Excess energy was stored in reliable Samsung SDI batteries, a crucial component requiring significant amounts of lithium, a light, yet energy-dense metal.

The house was also equipped with a state-of-the-art Johnson Controls heat pump system and a Schneider smart home system, providing not only comfort but also efficient energy usage.

This journey demonstrated several ideas to profit from this USD3 trillion investment opportunity. These opportunities will appeal to ESG investors, non-ESG investors, growth investors and value investors. Both developed and emerging countries are investing in these technologies, and current valuations do not yet reflect the expected growth.

Embark on a USD3 trillion investment journey, happy investing!

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group