Chart of the Month – Survival of the Fittest: a Darwinian Approach to Hedge Funds

Survival of the Fittest: a Darwinian Approach to Hedge Funds

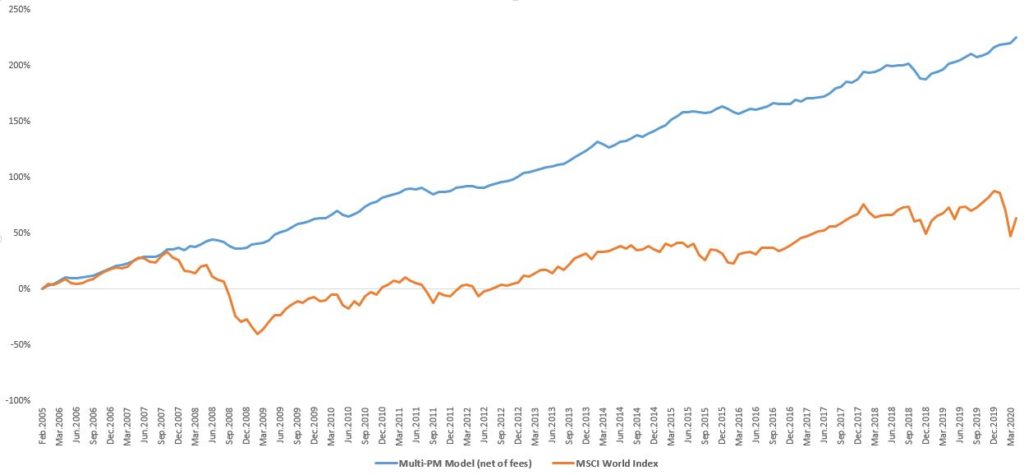

Source: Notz Stucki

If there ever was to be a defining moment for hedge funds in recent history, this was it! The month of March witnessed mass destruction across global markets as almost all hedge fund strategies, with the exception of tail risk hedging and market neutral equity long short, seemed to have failed miserably under the stress of an unprecedented black swan event. This provided another opportunity for the press to bash on the dismal performance of hedge funds. The reality is that some of the biggest names in the industry failed to protect capital during the market meltdown and missed the rebound. The privilege of being part of the largest and most renowned multi-billion dollar hedge funds with minimum entry tickets of up to USD 50 mio. has faded over the last few years and the latest events may be the final nail in the coffin (we shall refrain from mentioning any names).

So what has survived in this recent turmoil? One can observe that the most successful hedge funds that have stood the test of time are the multi-PM models that have been around since the 1990s for the most successful ones and have been closed to new investors for some time and for which investors crave for a piece of the action. Based on the “eat what you kill” approach, each PM is given an allocation within their core competence to manage with a market neutral approach and a tight stop loss, which if breached, terminates their career at the firm almost instantly. As the risk is diversified across multiple PMs each with a limited pool of capital together with the diversification across multiple asset classes and strategies, the result is a stable stream of returns with very limited drawdowns in times of stress. One of the most successful models in this category is Millennium with an annualized rate of return of 13.65% since 1990. It should be of no surprise that this type of product is in high demand from investors however it has been hard closed to new investments for the last five years (until recently, if you agree to be locked up for eternity – almost!). These type of models have limited capacity and are not scalable, however there have been an increasing number of platforms trying to replicate the Millennium model on a smaller scale. That’s where it become interesting, as in order to maintain a high Sharpe ratio, size is the limiting factor. A back of the envelope exercise of combining existing 11 multi-PM platforms each with a proven track record into one portfolio, equally weighted and rebalanced every month, would result in the historical track record illustrated above (ARR of 8.57% net of fees with a Sharpe above 2). So unless you think you are good at timing the market with ETFs in this current TINA* market environment, why not play safe with a stable return and low volatility portfolio that will compound over time and let you sleep peacefully at night.

Stay tuned, as we are working on a new project in this direction…

*There Is No Alternative

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Notz, Stucki provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document.

This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the Notz Stucki Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer.

Additional information is available on request.

© Notz Stucki Group