Chart of the Month – Something wrong? Eat chocolate.

Chart of the month

Something wrong? Eat chocolate.

Source: Bloomberg, Notz Stucki

The month of May has come with its various news, we experienced the first month in negative territory since December 2018. We had however started the year well with four consecutive positive months. May brings some questions to investors: Should I sell? Do I have to worry? … What can I do?

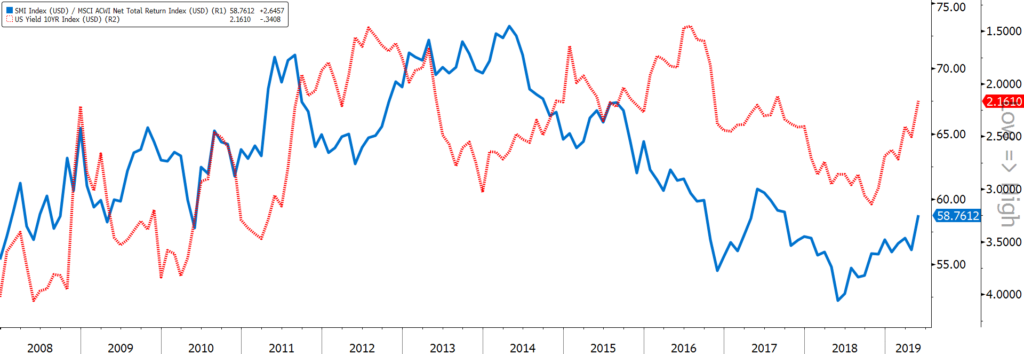

One simple action would be to increase exposure to defensive stocks. Find and invest in companies with, among others, stable earnings, low beta and constant dividend. By definition, the Swiss market has demonstrated a defensive nature over time. Links exist between movements on the US yields and world equity markets, the impact could be more or less significant. In the graph above, over an eleven-year window, we find the 10-year US yield on an inverted scale and the ratio Swiss market over the MSCI All Country World Index. The trend has been reversed since mid-2018: the Swiss market outperforms the world index. We notice that lately when yields go down in US (in our example the 10-year) Swiss market performs and since mid-2018 much better in relative terms.

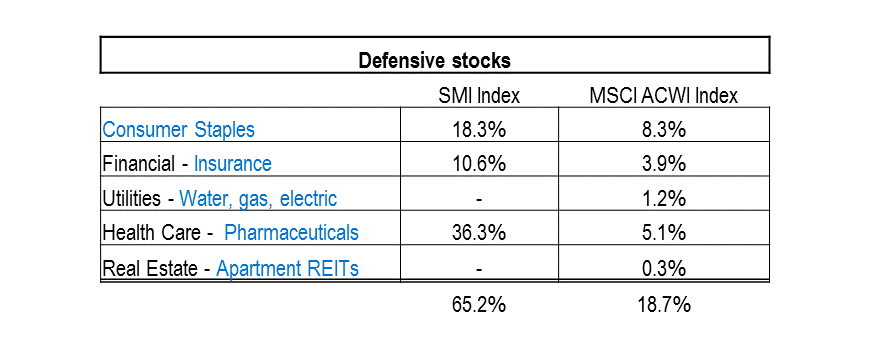

One step further, what is the actual composition of the Swiss market? Is it really defensive compared to MSCI All Country World Index? Analysis focused on the major Swiss Index: SMI Index. We selected the sectors and subsectors that have a defensive nature, this means Consumer Staples, Insurance, Water, Gas and Electric-related companies, Apartment REITS and Pharmaceuticals, excluding Biotech companies. Results are straightforward: Swiss market detains more Consumer Staples (18.3% against 8.3%), more Insurance companies (10.6% against 3.9%), more Pharma (36.3% against 5.1%) than the MSCI All Country World Index and there is no exposure to Utilities – Water, Gas and Electric-related companies or Apartment REITS. The large Swiss exposure to Staples and Pharma through Nestlé, Roche and Novartis is well known, however, the exposure to insurance and therefore the overexposure to the world index is probably not as well-known.

To conclude, more than half of the Swiss market, i.e. 65.2% is composed by defensive stocks versus 18.7% for the World Index. If we extend the analysis to the SPI Index, as the Swiss market is full of specific and niche companies, results are similar. We do not specially expect a downturn and we are not ready to sell but to add defensive in one’s portfolio can be an attractive direction. Last month, Swiss stocks demonstrated resilience with a scant negative performance of -2.52% bringing the SMI’s performance to 12.99% YTD. Last but not least, it is difficult to ignore the very good performance of the king of Swiss Staples: Nestlé, at +24.75% YTD.