Chart of the Month – Something hits the Faanmg?

Something hits the Faanmg*?

In the recent market correction, the famous Faanmg have, on average, been hit quite hard, especially when taking into consideration the intrinsic quality of these stocks.

Remember, many observers pointed out that these stocks were the main driving force behind the good performance of the US equity markets until recently, and if this was the case, the Faanmg must also bear some responsibility in the October weakness. There must be some symmetry there…

Source: Bloomberg, Notz Stucki

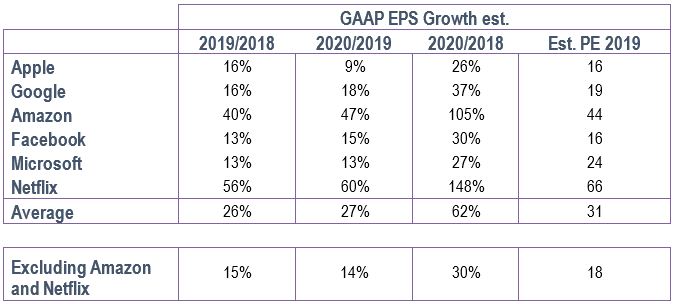

Leaving aside momentum and flows, it is worth looking at the numbers after large moves like this. What do you get at the end of the day, as an investor, with these companies? The table above simply summarizes estimated EPS growth for 2019 and 2020 for each component of the Faanmg, with their respective valuation. It is striking to see that the numbers look pretty appealing on average (26 and 27% EPS growth for 2019 and 2020 respectively with a 31x PE). But there are two very fast-growing companies in the group (Amazon and Netflix) which distort the numbers; it is then interesting to look at the panel without these two stocks, and here again a good investment case can be made.

Where do you get 30% total earnings growth for the next two years, which you only pay 18 times? Furthermore, if we aggregate some balance sheet items for Facebook, Apple, Microsoft and Google you end up with staggering numbers:

Total Cash (2017): $ 548 bln

Total Debt (2017): $ 204 bln

Total Pension Liabilities (2017): 0

Total Free Cash Flow (2018 est.): $ 174 bln

What would you do if you’re not invested yet? We believe at Notz Stucki that it’s an attractive entry point especially that these companies hold dominant market share and still have numerous growth drivers. There will be more regulation and scrutiny, but does it really change the picture and reverse the tailwinds?

Are you invested already? Don’t throw the towel. Market corrections are part of the investment cycle, and are sometimes good opportunities to add to your existing positions.

*Facebook, Apple, Amazon, Netflix, Microsoft, Google (Alphabet)