Beyond the wall: transforming China’s inefficiencies into alpha opportunities through equity long short investing

Beyond the wall: transforming China’s inefficiencies into alpha opportunities through equity long short investing

China continues to offer one of the richest, and most misunderstood, equity opportunity sets in global markets. Macro uncertainty, regulatory interventions, shifting policy priorities and persistent market inefficiencies have created an environment where traditional long-only investing often struggles to capture value. However, these very complexities make China a highly attractive market for long/short strategies, where differentiated insights, disciplined risk management, and active exposure adjustment can extract meaningful alpha from both winners and losers.

A macro landscape that rewards selectivity

China’s macro landscape is still in transition. Policymakers are steering the economy away from overcapacity, speculative excess, and the so-called involution dynamic, where firms compete aggressively without generating real productivity gains. Recent measures targeting property developers, exporters with razor-thin margins, and manufacturers benefiting from subsidies highlight a clear policy direction: quality over quantity.

At the same time, China is fostering strategic sectors such as AI, semiconductors, renewables, healthcare technology and high-end industrial automation. These policy signals generate strong divergence across industries. In such an environment, long/short investors can go long companies aligned with policy tailwinds while shorting those facing structural or regulatory headwinds, turning macro uncertainty into an alpha source rather than a risk.

Market inefficiencies: a structural advantage

China remains one of the world’s most inefficient major equity markets. Retail investors still account for a large portion of daily trading volumes, contributing to:

- High levels of sentiment-driven volatility

- Momentum overshoots

- Rapid rotation between themes

- Behavioral biases such as herd behavior and panic selling

These characteristics create mispricing on both sides of the market. While long-only investors suffer from these swings, long/short managers can systematically exploit them, building long positions in oversold quality names and short positions in speculative or structurally challenged companies.

A market of leaders and laggards

Despite the headlines, many Chinese companies are not only thriving, they are becoming global leaders. In advanced manufacturing, robotics, EV supply chains, battery technologies and digital services, China has produced companies with accelerating earnings, strong balance sheets and expanding competitive advantages. These belong on the long side of a portfolio.

Conversely, firms trapped in industries targeted by the government’s overcapacity crackdown, traditional manufacturing, low-margin exporters, uncompetitive commodity producers, face structural pressure. These make compelling short candidates, especially when valuations remain disconnected from fundamentals.

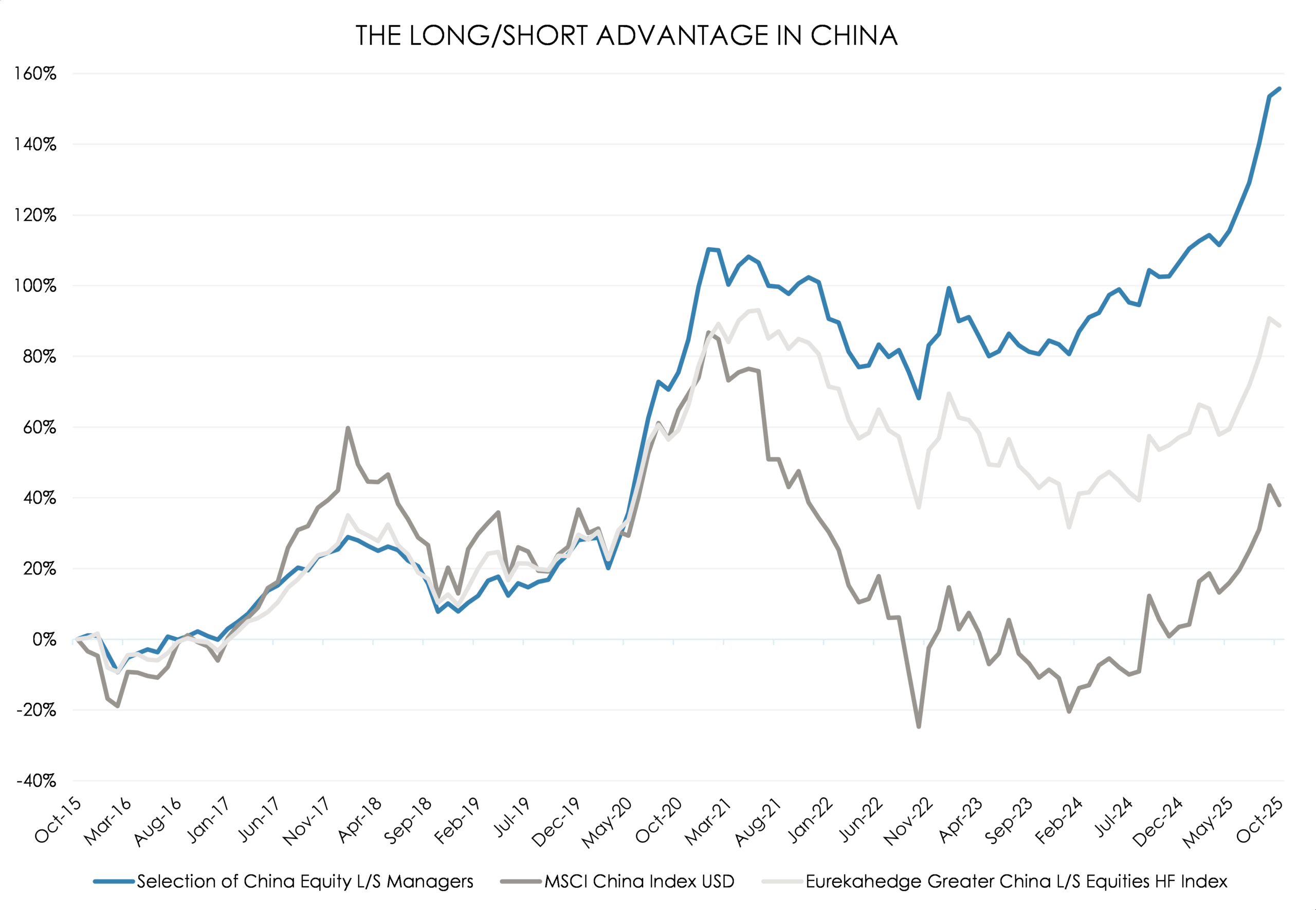

Strong alpha generation: what the chart shows

The attached Chart of the Month illustrates precisely this dynamic.

Over the past decade, the Chinese equity market, represented by the MSCI China Index, has delivered only modest performance. In contrast, Chinese long/short equity managers, as measured by the Eurekahedge Index, have achieved returns approximately twice as high. Moreover, through disciplined manager selection, it has been possible to enhance results even further, generating performance levels that exceed the Eurekahedge Index by a substantial margin.

Conclusion: the right strategy for the right market

China is a market where macro shifts are decisive, policy direction matters, and inefficiencies are abundant. This environment naturally favors investors who can go long the future winners and short the inevitable losers, a capability that long-only strategies simply do not possess.

As the Chinese economy continues to evolve, so too will its equity markets. The long/short approach offers a disciplined, opportunity-driven way to harness China’s growth potential while managing risks in a market that rewards agility, research depth and selective exposure. For investors seeking to participate in China’s next chapter, long/short is not only a smart approach, it is the most adaptive one.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group