A shock of volatility to raise the right questions

A shock of volatility to raise the right questions

While the consequences of the mini-crash at the beginning of August were not too serious, it should serve as a wake-up call.

Signs of tension

During the first week of August, the financial markets experienced an episode of unprecedented volatility, reminding everyone that investors were no longer necessarily in a serene mood. During this episode, the VIX index, which measures volatility and hence tension in the S&P 500 index, reached a level of over 65, which is quite simply the 3rd highest peak in its history. For he record, the two most severe peaks before that were the collapse of Lehman Brothers in 2008 and the materialisation of the scale of the COVID pandemic in 2020. I’m sure you’ll agree that this beginning of August had nothing in common with those two historic moments. So what happened?

Some complacency on the markets

As with any phenomenon of exceptional magnitude, there is never just one factor that explains it. The first phase of the crisis corresponded to the announcement of worse-than-expected US employment results. Fears of a marked slowdown in US growth were suddenly reawakened. As a result, the equity markets reacted negatively and the VIX rose, although nothing really dramatic until then. However, at the same time, the Japanese central bank announced that it was raising its key rates by 15bps, 5bps more than the market was expecting. The almost simultaneous combination of the two pieces of news had a scissor effect, with many JPY/USD carry trade positions being sold off in a hurry. It became clear that many speculators were borrowing in JPY at rates close to 0% in order to invest in USD assets, in the knowledge that short-term ‘risk-free’ US rates were in excess of 5%. This is an unfortunate reminder of the trend in the 2000s to borrow CHF mortgages to invest in EUR property, with the result that we are all familiar with.

The snowball effect

It’s at times like these that a good understanding of market structure can be essential. Many players, notably investment banks but also funds, are once again shorting volatility. After the VIX surged, they had to react quickly to cover their positions and rebalance their books. And they did so simultaneously, because they were all moving in the same direction, against a backdrop of low liquidity for the beginning of August. You know the rest of the story: the VIX reached these particularly high levels. Fortunately for these traders, the markets came to their senses and things normalised quickly enough not to trigger any a priori disasters. To date, the JPY/USD carry trade positions have largely been sold off.

What lessons can we learn from this?

This episode highlights the way in which events can unfold in some market configurations. Technical factors can run ahead of fundamentals, which is why good risk management is more essential than ever when it comes to investing. Another consequence is that the market looks more ‘fragile’ than it did at the beginning of the year. Clearly, central banks are not going to hesitate to cut rates to counter a more marked economic slowdown, while hoping that inflation is at an acceptable level, but the depth of the market has been reduced. Yes, NVIDIA can continue its meteoric rise by trying to meet the huge CAPEX requirements of the US tech giants, but the market is likely to be disappointed. Yes, India is seeing its promising growth confirmed, but it is also reasonable to think that the valuation of Indian small/mid-caps has become excessive. Yes, geopolitical risks may diminish in intensity in the near future, but unfortunately nothing is less certain and the associated risk premium does not seem particularly high to me.

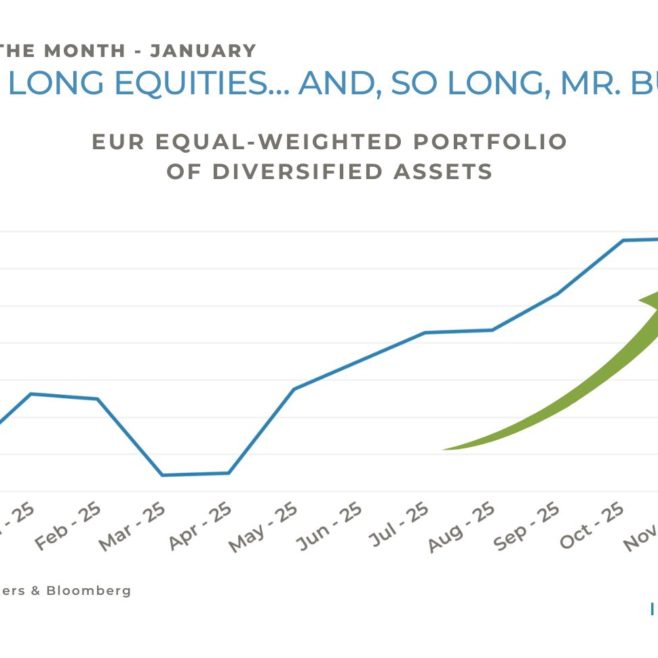

To sum up, this end of summer seems to be a good time to ask ourselves what type of risk we want in our portfolios and to favour a diversified approach in terms of asset allocation.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of the date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instruments referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the Finma cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request. © NS Partners Group