Chart of the Month – Time to invest in midcaps in the us equity market

Chart of the Month – Time to invest in midcaps in the us equity market

The investment landscape in the United States is often dominated by the allure of large-cap stocks, as evidenced by the S&P 500’s remarkable 26.3% rise in 2023. However, a closer examination of the market reveals an intriguing opportunity in mid-cap stocks. Despite the S&P 400 (Mid Caps) experiencing a lower rise of 16.4% in the same year, there’s a compelling case for why now might be the ideal time to partially pivot towards midcaps.

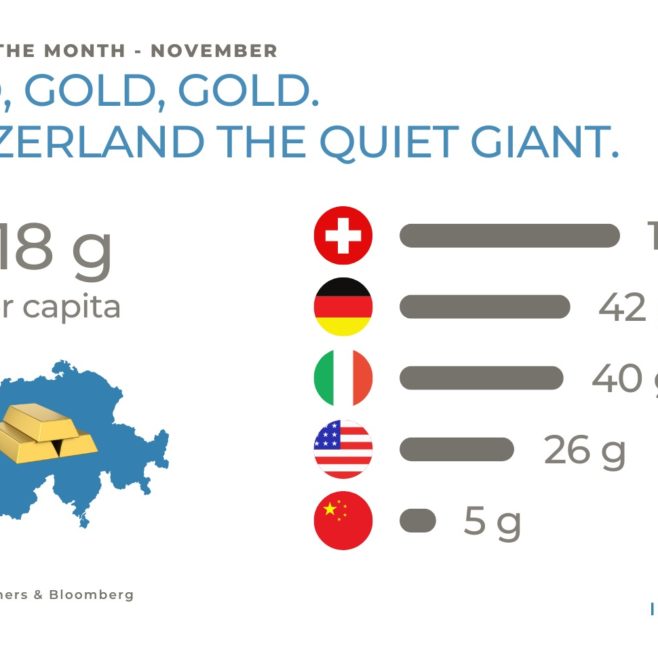

Over the last decade, the cumulative performance of the S&P 500, inclusive of dividends, stands at 212%, surpassing the S&P 400’s 143%. This disparity, however, opens a window into an underexplored investment avenue. According to Ibbotson data, smaller companies tend to outperform larger ones over the long term, primarily due to their faster profit growth. This trend is highlighted by Chart 1, which shows a 150% increase in Next 12 Month (NTM) profits for the S&P 400 over the last decade, compared to a 99% increase for the S&P 500.

A further analysis of market valuations and expectations reveals a striking disparity in Chart 2. The S&P 400 is currently trading at a Price-to-Earnings (PE) ratio of 14.8x NTM, a significant discount compared to the S&P 500’s 19.4x. Moreover, while the S&P 500 is expected to see a profit growth of 9.3% from year 1 to year 3, the S&P 400 anticipates a slightly higher growth rate of 10%. Thus, the market presents an opportunity to invest in an asset class with similar growth prospects to the S&P 500 but at a 24% discount.

Several factors contribute to this valuation gap. Firstly, the S&P 500’s higher exposure to the Information Technology sector (28% vs. 10%), boosted by advancements in Artificial Intelligence, skews its valuation upwards. Secondly, there have been significant inflows into ETFs linked to the S&P 500, particularly in the last three years. Lastly, midcaps are generally perceived as riskier than large caps, with a beta of 1.10 over the past decade.

Conclusion

The market, in its complex dynamics, often aligns closely with underlying economic realities. The current undervaluation of the S&P 400, when juxtaposed against its large-cap counterparts, seems excessive. For investors looking to adopt a defensive strategy, reallocating some investments from large caps to midcaps could be a prudent move. This shift not only leverages the historical trend of smaller companies outperforming larger ones but also takes advantage of the current market anomalies in valuation.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group